The global corporate credit markets are among the largest capital markets in the world and growing at a rapid pace: the market was valued at $17.6 trillion in 2021, and is projected to reach $47.2 trillion by 2031, growing at a CAGR of 10.7%. Yet despite the market size and speed of growth, corporate lending and borrowing terms housed in ultra-complicated transactional documentation remain increasingly complex, non-standard, and difficult to benchmark.

The current benchmarking and negotiation process for corporate debt terms requires countless professionals on both sides of any deal manually searching for comparable deals on which to base new terms. These deal professionals (advisors, borrowers, lenders, financial sponsors, etc.) spend hundreds of manual hours cross referencing comps to understand market terms, leaving room for significant risk, missed negotiation opportunities, and improper protections on all sides.

Noetica is here to change that.

Founded in 2022, Noetica is a New York based AI powered software platform for deal professionals to benchmark corporate debt transactions and determine whether capital markets deal terms are on or off market. Today, there are multiple stakeholders involved in these transactions across legal and financial institutions. These teams spend weeks reviewing historical transactions and provisions in order to benchmark and structure borrowing terms, and frequently miss key comparables that lead to better term negotiation.

With Noetica, users can upload any credit or bond document and compare all terms to tens of thousands of comparable public and private deals in under a minute. Their platform enables deal professionals to find and incorporate market terms in the best interest of their clients by scanning the largest knowledge graph of corporate debt terms in the industry. Their technology has been fully built and fine-tuned in-house and does not utilize third-party LLMs to power its software.

In just over a year of operating, the company has already made a name for itself in the credit space among legal and financial deal professionals. They have several of the largest and most profitable law firms in the world as customers and their product has been instrumental in many multi-billion dollar debt transactions. We couldn’t be more excited to announce today that we’re leading the $6M Seed round in Noetica.

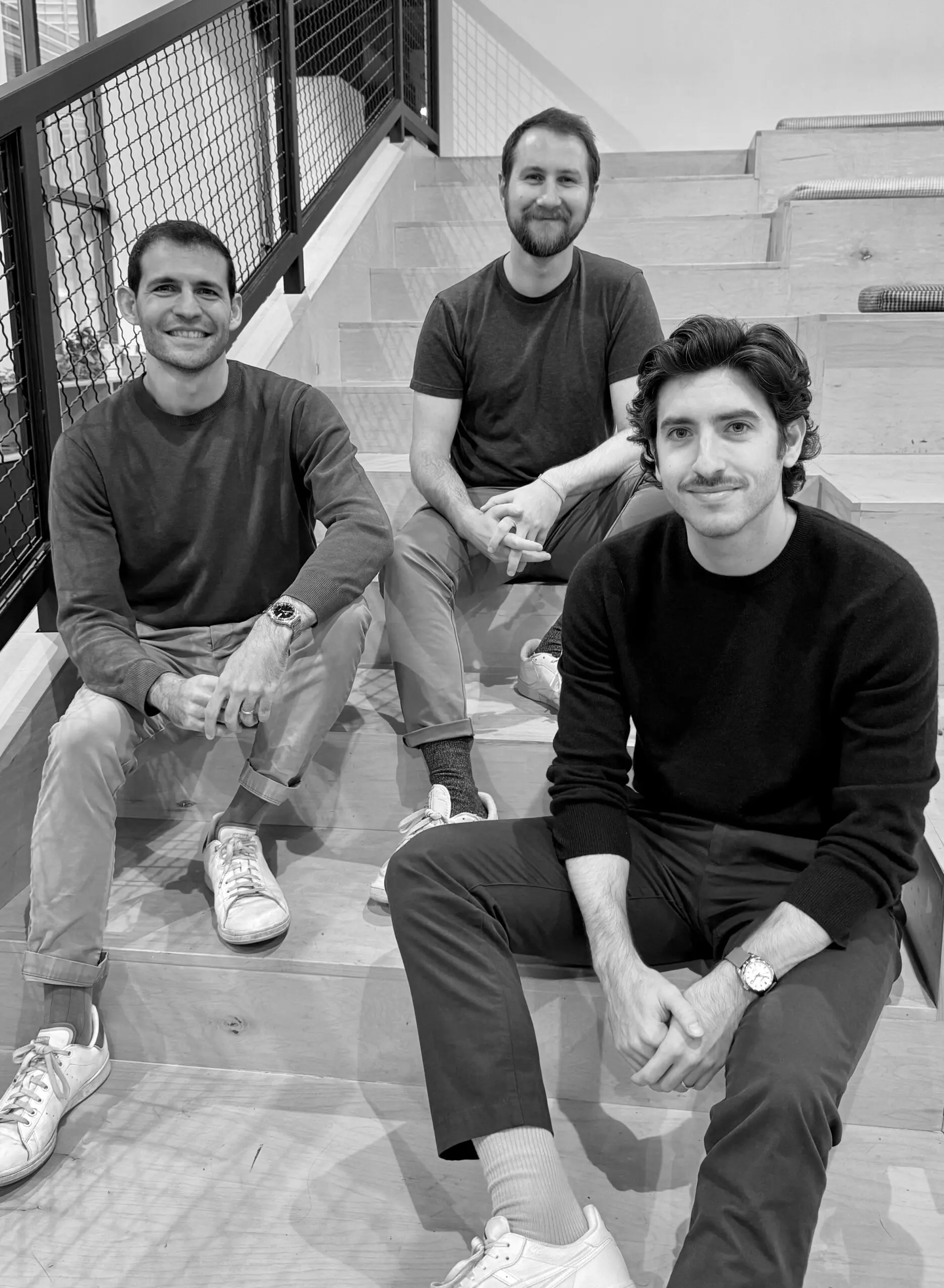

Noetica AI was founded by Dan Wertman, Tom Effland, and Yoni Sebag. Prior to founding Noetica, CEO Dan Wertman worked at Wachtell, Lipton as a financing attorney leading numerous multi-billion dollar credit issuances and restructurings. Having previously spent time on the other side of the deal table at BlackRock, he holds a unique view into the pain points across the credit ecosystem. Meanwhile, CTO Tom Effland, holds a PhD and MS from Columbia, focused on Machine Learning and Natural Language Processing. He has been building solutions adjacent to this area for over 5 years and has specifically focused on how AI can be applied to make sense of vast oceans of text in unstructured, complicated agreements. COO Yoni Sebag, previously developed customer-centric and go-to-market strategies for fortune 500 companies while in strategy and operations at Deloitte. He met Tom during his studies at Columbia and has known Dan since childhood. The extended Noetica team includes PhDs, engineers and data analysts from IBM, Bloomberg, Wachtell, J.P. Morgan, Kirkland & Ellis among other names.

We’ve had the pleasure of getting to know Dan, Tom and Yoni over the last year. We’ve watched them ship iterations of the product at lightning speed and ramp up multiple top 20 law firms onto the platform. The three founder’s deep domain expertise and tireless dedication to the business are unmatched in the ecosystem, and we are thrilled to be on this journey with them!

Authors