Consumer fintech is entering a new, 3rd era that will be defined by consolidation, optimization and intelligent software.

Consumer fintech is in a transitory phase. Consolidation is taking place as value accrues to larger incumbents. We’ve reached peak fragmentation where there is an app for every financial task.

Banking access has largely been solved for younger generations in the US. So we think the next phase will be defined by AI-enabled applications in wealth and spend. And these are increasingly consolidated in vertical superapps. We are tentatively calling this 3rd era of consumer fintech the sophistication era (name suggestions welcome!).

Today there is a relatively small group of VC-backed consumer fintech companies that are worth over $10B in market cap. Just 7 on US exchanges as of this article’s writing: Intuit, PayPal, Block, Nubank, Coinbase, Grab, and Zillow. Eight if you include Mercado Libre (~50% fintech revenue). Intuit is mostly B2B revenue and Zillow isn’t exactly a fintech. So maybe 6.

On one hand, 5 of those IPO’d during the 2nd era of personal finance, the mobile era, so you could argue it was the most successful era of personal finance yet.

On the other hand, many fintech investors feel burned by capital intensive models and CAC wars, so much so that there’s a narrative that consumer fintech is dead. We heavily disagree.

We believe the opportunity for tech-enabled personal finance has never been stronger, and we expect the 3rd era of consumer fintech to continue to advance toward the promise of a personalized finance future.

What might the 3rd era of personal finance look like?

In its most idealistic form, the goal of personal finance is for it to be completely, well, personalized. The complete personalization of finance means each user receives the specific financial help they need at that moment, tailored to their individual financial situation.

We’re not there yet. Today’s rising consumer products all point toward a step before that; the fastest growing categories of consumer fintech activity today revolve around more sophisticated spending and intelligent optimization. Savvy consumers are optimizing their marginal dollar.

Consumer finance’s 3.0 era will be dominated by sophisticated optimization of marginal dollars around 1) wealth management and 2) consumer spending that are 3) increasingly accessed through vertical superapps.

There are large macro trends driving these categories.

In wealth, we are facing the largest wealth transfer ever seen. You all know the details, so we’ll spare a long description, but more than $60 trillion of wealth is expected to change hands in the coming years as baby boomers pass on, and more than 80% of recipients (millennials) are expected to change advisors. There are over 25 million millionaires in the US, so this is not an insignificant number of people. We are also seeing this play out from a bottoms-up perspective: startups growing the most right now in wealth management are tackling several problems serving this need:

- Retirement Plan Administration

- Wealth Transfer

- Estate Planning

- Alternative Asset Access

- Sophisticated Tax Strategies

- Global Accounts as Volatility Hedges

- Yield-bearing products, Fixed-Income Tech

Consumers are becoming more savvy about how they spend their marginal dollar, optimizing for personal efficiency. The macro backdrop of increased spend choices is that this is enabled because payment rails and payment interfaces are undergoing huge changes: the emergence of new government backed rails like Pix, UPI, and FedNow, plus the popularity of stablecoins and crypto payments, mean the card networks are on watch.

We’ve unbundled the bank, now it’s time to unbundle the card networks. We are also seeing this play out from a bottoms-up perspective: startups growing the most right now in spend are tackling several problems serving this need:

- Multiplayer Finance

- Asset backed cards for lower APR

- Savings, Refunds, & Robo Claims

- Pay by Bank

- Digital currencies

- Climate Alignment

- Top of Wallet Spend Optimization

- Debit Rewards + Loyalty

- Global Accounts for Borderless Spend

- Verticalized Spend

In vertical superapps, the macro backdrop is rebundling, taking place after 15 years of bull-market fueled consumer fintech mania due to: macro downturn overfunding and underbuilt startup economic models; consumer fear due to bank collapses (SVB/FRB); and the US’s unique financial market structure not being compatible with the birth of financial superapps like we’ve seen with WePay, Alipay, Mercado Libre, Grab, etc., in other countries.

Acquisitions are underway, startups are dying, and finances are increasingly embedded in workflows and commerce experiences. We are seeing this play out from a bottoms-up perspective: startups we’re meeting that are benefiting from consolidation pressures include:

- Vertical saas fintech (hospitality, restaurant, construction, education)

- Embedded fintech

- BaaS

- Data aggregators

- Growth stage consumer fintechs via m&a and cross selling

Peak Fragmentation

It makes sense that this third era is unfolding now. US consumers already have a plethora of digital banking solutions. The average American has 5-7 debit cards and 6-8 credit cards. Consumers have an overabundance of cards.

In fact, we think we’ve already reached the peak unbundling phase of consumer fintech. There are only 2 business models – unbundling and re-bundling – and after decades of unbundling the bank, we are already starting to see more consolidation.

For example, every mobile banking app of the last decade is now cross-selling their users additional banking products (see part 1 in of this series). The US market is saturated with banking options.

Consumers have their digital banking foundation set. So what do consumers need now?

They need a way to make sense of all their financial activity across institutions. Not just aggregation, but an intelligence layer that optimizes spend. That finds sophisticated wealth and tax solutions. That delivers insights about how to best allocate that consumer’s marginal dollar.

The need for an intelligent solution to optimize consumer spend couldn’t have been timed better; it is arriving just as generative AI sweeps tech. Similar to our identification of SaaS entering its 4th era, the Era of Cognition, personal finances are entering their 3rd era, the Sophistication Era.

Past eras

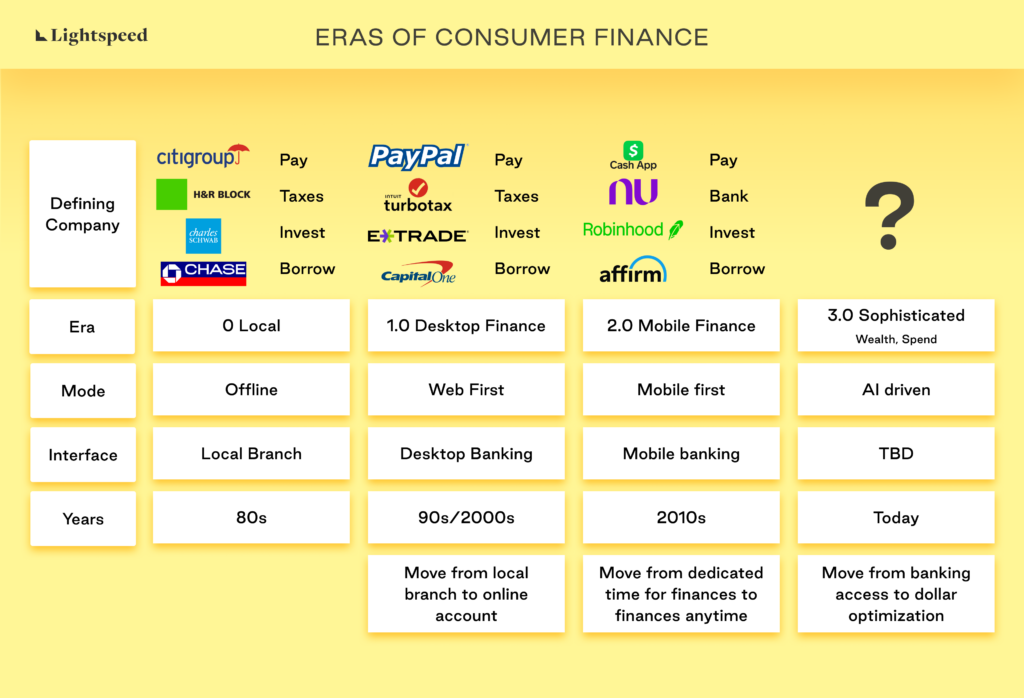

The second era of consumer fintech, the mobile or neo banking era, is ending. Before this, the first 2 eras of consumer fintech in the US were dominated by digital banking and brokerage platforms moving online.

The first era saw PayPal, eTrade, TurboTax (Intuit), Capital One, Mint, etc. grow during the 90s and 2000s as primarily desktop solutions, digitizing previously offline activities (PayPal – spend, eTrade – invest, TurboTax – taxes, Capital One – borrow).

The second wave was mobile first and saw CashApp, Robinhod, Affirm, Coinbase, SoFi, etc., take market share by transitioning those personal finance activities – spending, investing, and banking – into a seamless, on-the-go experience.

The third era, unfolding now, is all about sophisticated spending and wealth management. Despite having all the fintech apps we need, we still can’t answer basic personal finance questions like, “What two things should I do to most improve my financial situation?” or “How much did I spend across all accounts this month?”

As one Twitter user pithily put it, “there is an app for everything but you still cannot do everything in one app.”

AI’s impact on Sophisticated Wealth + Spend Choices

AI will impact wealth and spend. On the wealth side, sophisticated planning is the focus. On the spend side, sophisticated marginal dollar spend is the big focus.

Sophisticated Wealth

We’re seeing AI applied to wealth management strategies in limited contexts today: Roboadvising has been around for a long time and is automation of savings/investing its most basic form. We are also seeing more AI-directed portfolio strategies roll out and reaching strong product-market fit with tech-savvy users, but still require a lot of education for the average consumer.

Instead we are seeing the consumer opt for more sophisticated wealth management choices through tech-enabled tax-advantaged strategies, estate planning, alternatives access, global accounts as volatility hedges, and much more.

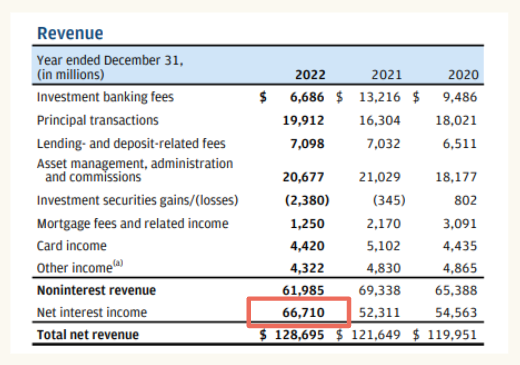

Asset management is also a large line item in JPMorgan’s revenue breakdown. While we believe it will take longer for consumers to trust a fully automated wealth solution, there is a large profit pool up for grabs. 80% of millennials are expected to change advisors when inheriting wealth from their parents: that’s over $50 trillion up for grabs for new financial institutions serving millennials.

We believe it will require a human-in-the-loop for the majority of users for several more years as consumers gain comfort with AI touching their nest egg.

Sophisticated Spend

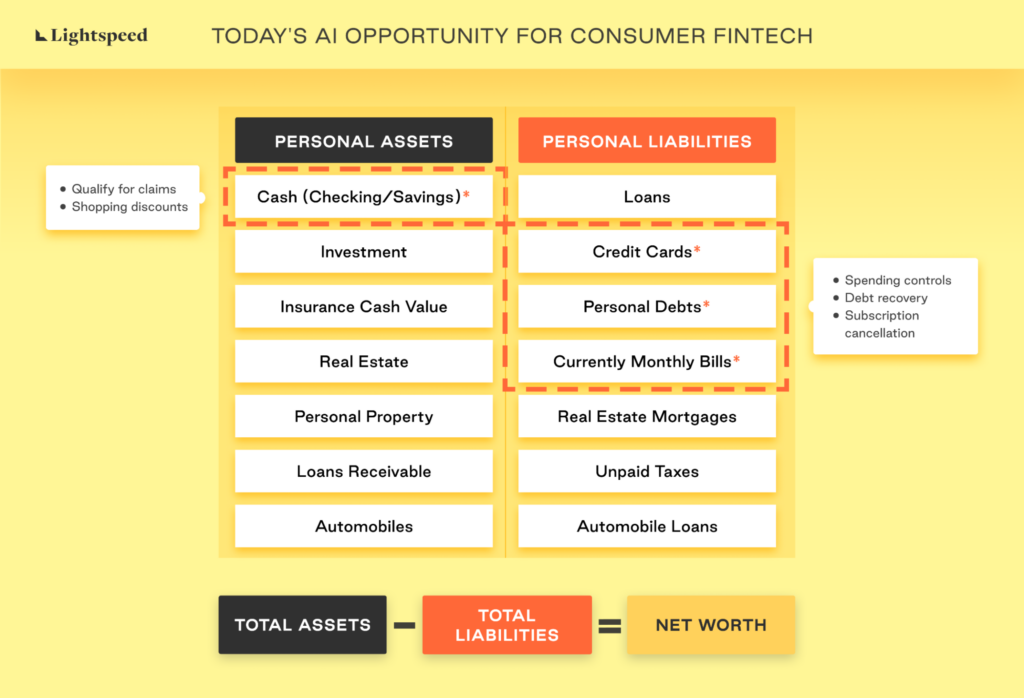

We’re already seeing AI applied to “found money” opportunities, especially liabilities, as users become more savvy about sophisticated spend.

Today, we are already seeing consumers gain comfort with delegating responsibility for select areas of the liabilities side of their balance sheet to AI. Over the next few years, we should expect consumers to gradually increase comfort level to include all liabilities. Several years after that, trust and education levels should increase such that assets (checking, savings, retirement) can begin to be automated for the masses through AI.

After both of those are achieved, then the vision of AI as the consumer fintech AI interface laid out above can begin to unfold.

As we meet founders today in mid 2023, there are only a few reliable areas where consumers trust AI to fully handle their tasks end to end: 1) debt removal 2) subscription cancellation 3) find savings + new money.

This is for a fairly straightforward reason: most consumers are happy to sign up for a service that can help them decrease their liabilities and increase their assets without risk of losing their nest-egg. It’s unclear whether the 3 product categories listed above will create enough touch points with the user to be a strong wedge into a longer banking relationship.

AI will take profits from incumbents

Highly valued consumer fintechs of the last era (Nubank, PayPal, Block, etc) succeeded by attacking structurally high profit margin incumbencies (Brazil banking, international money transfer, external bank transfers, acquiring), which created space for lower friction digital products to emerge.

Consumers’ personal balance sheet – deposits and liabilities – are a bank’s revenue opportunity. Continued advancement in AI will enable consumers to get a better deal.

Just look at JPMorgan’s 2022 revenue breakdown: over 50% of their $128B in revenue came from interest income, or revenue earned from interest bearing assets – a combination of yield bearing assets, lending, etc.

Some areas where we think there are large remaining profit pools in the USA :

- 6% buy and sell commission for home sales

- Wire fees

- Interchange fees from card networks: acquiring + issuing

- 1% AUM fees for wealth management

- 20-25%+ APRs for consumer credit (earned wage access is even higher)

Where else can tech remove friction from a big profit pool business for incumbents now that AI is here? Feel free to write to us with your thoughts.

AI will improve the consumer fintech business model

We outlined some of the common complaints about consumer fintech business models at the start of this piece. There are really 4 areas a consumer fintech can have a cost advantage: cost to acquire, cost to underwrite, cost to service, and cost of capital.

AI has been used to improve the cost of underwriting for a very long time in lending (see our fintech AI blog post). We only expect this to improve.

The area we’re seeing the greatest change in is generative AI’s ability to reduce the cost to serve users. From robo debt recovery calls, to AI-enabled capital markets benchmarking, to extending the number of users a wealth manager can service, to automatic refund cancellation, to sophisticated tax strategies for the masses, automation is reducing COGS by 30 to 80% across companies we’ve met.

Incumbent banks continue to have a massive advantage in operating with a lower cost of capital. We are starting to see fintechs securing better debt terms using AI-driven software.

Acquisition costs are becoming a more even playing field. We’ve seen consumer fintechs using AI chatbots as acquisition tools. We’d love to hear from founders on even more ways you’re improving costs with AI.

Where incumbents bank advantage remains

The two areas where incumbents continue to have a large advantage over consumer fintechs: 1) distribution – cost of acquisition of subsequent products 2) cost of capital advantage – they can fund their working capital cycles at nearly the Fed Funds rate, the lowest cost available.

The counter attacks to big bank’s distribution and cost of capital advantage are 1) turning commerce experiences into banking experiences – enabling anyone to become a bank (consolidation theme) and 2) encouraging users to fund their own risk: incentivizing the right type of behavior / risk alignment by introducing fee-based products and subscriptions tied to greater financial freedom on platform (collateralized assets that bring down the cost of capital – spend theme).

We think there is still a large opportunity to innovate in these two remaining bank strongholds as the 3rd era of sophisticated finance unfolds.

If you’re looking around, seeing the last era of neobanks still early in their journey and wondering if consumer fintech is dead, think again. The category is evolving into one where sophisticated spending, sophisticated investing tools, and vertical superapps will dominate. This shift has created a very uncertain time in consumer fintech. We are in the midst of a paradigm shift from the second era of consumer fintech to the third.

There is so much opportunity ahead.

If you enjoyed this, don’t hesitate to reach out. We can be reached at fintech_contact@lsvp.com. Checkout other related articles including The Successful Consumer Fintech Path, Fintech x AI, and Lightspeed’s 2023 Fintech Trends.

Authors