(#latergram alert — most of this was written in spurts between May2021-Dec’22. I sat on this piece for a year after. As a consequence, many of the numbers cited in this piece will be out of date but the broader point hopefully still resonates.)

The Narrator

Jody McCoy, my first manager at AMD, once told me “you aren’t an interesting person till you’ve had at least 3 completely unrelated jobs”. Jody was the guy at AMD who looked at Intel chips under an electron microscope to interpret their architectural advantages at a logic gate level! This is so hardcore technical that when I first heard about it, I thought Jody was bluffing. For those wondering, after 30+ years at AMD, Jody wrote a book and is now a pastor at a church in Texas. By his own definition, Jody made it. I had neither his clarity of purpose nor his faith, so I wandered around engineering, product, and business roles for years. All the while trying to hack it as a writer.

Many of you reading this today know me as an investor but for a majority of my life, I’ve held dual internal identities. Depending on who you ask from my past life, many would know me as an engineer who spent his nights and weekends trying to make it as a poet/writer. Others — the writers mostly — would remember me as someone who “did something in IT on the side” to pay rent. My creative career peaked a decade ago when I published alongside Haruki Murakami. I don’t know about being an interesting person, but throughout my different careers, the core of what I carried with me were mostly lessons I picked up writing, reading, and conversing with writers I admired.

As a VC, it took me years to bridge the two parts of me. One that wants to viscerally experience the beauty and ferocity of raw human ambition — or as Jack Gilbert calls it, “a merit born in struggle” — with the part that is analytical and wants to intellectually understand and dissect it. When I sat down to write this piece towards the end of 2022, I thought it would be mostly about crypto. As I began putting words on paper, I realized this piece was going to be as much about my experience of crypto as a writer as it was about my unique vantage to this industry as an investor.

The Prologue

Humans are unique in that we love stories. Stories have put babies to sleep. Stories have dismantled entire regimes. One of my favorite poets, Stephen Dunn, said it best in his magnum opus The Vanishings — “one day there’ll be almost nothing // except what you’ve written down, // then only what you’ve written down well, // then little of that”. I often think of that in our increasingly noisy world. The best written stories are both tightly knit and accessible. They follow an underlying narrative arc: a scaffolding of sorts that allows writers to summarize that which resists summary. Narratives, important as they are to writers, play a surprisingly critical role in investing. Narratives are so important that anti-narratives can be an investable category by itself.

The writer in me is still a sucker for a good narrative. And crypto has been fascinating to watch in how much of it is narrative driven. Over the 4 years, and especially in the last couple, I have been pitched to by over 1000 crypto companies globally and in this post I attempt to lay out what I have learned about this fascinating, perplexing and exciting category. Large parts of this was written during the peak cycle of Nov 2021 and then May 2022 for internal consumption at Lightspeed. I’ve taken the liberty to share much of that as-is with some tuning and flourish. Some of this may also sound dated if you take a 6–12 month context, but the observations are hopefully correct in identifying underlying forces in crypto (and in investing) — both the good and the bad.

Act 1- the myth

Crypto is quite narrative driven — e.g. freedom from dictatorial finance, de-centralized everything, borderless access, inflationary hedge, and more. If you entered the crypto scene during 2020–21, you would have witnessed a feeding frenzy unlike any other. Facebook became Meta, Square became Block; Crypto.com renamed LA Staples after itself for a $700M all-cash deal; several $100–500M financings, several VC funds raised billions; El Salvador adopted crypto and ~24 countries (US, UK, India, Canada included) started exploring CBDCs seriously; Goldman started a crypto trading desk, Morgan Stanley followed soon, as did JPM, BNY Mellon; Blackrock revealed they’ve been trading crypto for a while now — a significant departure from their CEO Larry Fink saying “not even a single client was interested in crypto” in 2018.

Fast forward a year and crypto is the new pariah. What happened? Insiders would argue that the trigger for the recent crash was a combination of the Ukraine crisis, overheated capital markets, over-capitalized crypto markets, covid-19, gamestop, LUNA crash, FTX, and, perhaps most critically, increasing interest rates that led to fall in almost all high-risk asset classes. However, if you are a dispassionate observer, a lot of the vibrancy as well as the violence in crypto has been driven by narratives.

From the outside, Crypto feels like a realm of myth making. Riding on the double whammy of bull cycle and meme masters, the myths often overtook what reality offered. One of the most enduring myths of crypto is about what stage the crypto movement is at. It goes like this: there are ~300M users of crypto, similar to how many internet users were there in the late 90s. Today the internet has several billion users; ergo, crypto will get there too.

Those who had the benefit of being alive and on the internet in the 90s would know that by the time the internet had 300M odd active users, there had been ~30 years of research on protocols, operating systems, and even hardware that had reached their respective logical conclusions. Protocol wars had ended in favor of TCP/IP, OS wars had narrowed to Microsoft and a few variants of Unix (HP-UX, Solaris, BSD, etc). X86 had won the hardware wars. Also, the primary use cases of the internet — communicating with other humans — passed the “toothbrush test”: every day, minimum twice. If we look at true adoption of Crypto — like, really true daily users — we may really just be in the 70s of the internet. We have massive choke-points in stability, scalability, security and usability of literally every layer of crypto.

Don’t believe me? Take the life of a developer. To spin up a node and write “hello world” in crypto takes weeks versus the few minutes it takes in a web2 framework. Setting up nodes, skimming various discords for basic documentation, learning a new language, testing and staging, all of it takes an extraordinary amount of effort today.

Things aren’t much better in user-land. Imagine a world where you have to pay $0.05 every time you search on Google. Instead of giving up your “data’’ to Google, worth 150$/yr, you now pay Google $150 (0.05$ x 10 searches/day x 300 days/yr) split over 3000 transactions. At 2B daily users globally, this business model will net Google ~300B/yr; pretty much what Google made in 2022 with an ad-based model. Except, the former is just so much more painful for the users for the exact same economic outcome. That’s how difficult Crypto is today — you have to make wallet switches, swap coins, go through various bridges, and then pay inconsistent gas fees for every crypto transaction.

If these problems sound familiar, it’s because the early users and builders of the internet faced very similar problems at every step — high costs of internet access, high complexity in building anything new, lack of documentation, poor standardization of libraries and protocols, and more. Without these issues getting solved, building on upper layers will always struggle with either usability, or scalability, or business-model related issues.

Act 2- the money

The problem with falling and flying is that they both feel the same for a while. Till they do not.

There’s just too much money in this ecosystem — much of it fueled by low interest rates that made everyone try their luck as a professional VC. Over $65B of VC/PE money was poured in crypto through 2020–22. Let’s say in a few years this number will hit $100B. Assuming crypto investors expect a 10x ROI (=$1T) given the materially higher category risk, and that, at exit, you own ~10% of the assets you invested in, the overall market cap for crypto needs to be ~10T for this to make sense. That’s ~10% of global GDP by 2030. A tall ask. While this is bound to reduce ROI for investors — especially ones that are somewhat late — this ecosystem still feels quite immature and unprepared to know what to do with all this money. The current crypto cycle rests a lot on CeFi, NFT and Defi ecosystems with the DAO and Blockchain gaming ecosystems still emerging. Massive as these ecosystems already are, it’s important to also note just how early we are and how much road-kill is yet to come.

- The CeFi and DeFi ecosystem is beleaguered with hacks. During the bull cycle, every other week there was a massive loss in DeFi (badgerDAO lost $120M) or CeFi (BitMart lost $190M). The anonymous nature of DeFi also led to low accountability and legal recourse to fraud. CeFi suffered in other ways with newcomers to the ecosystem getting targeted by “rug pulls” — pump & dump schemes by centralized platforms who then ran away with user capital.

- Moving on to the DAO ecosystem, there is plenty of in-fighting typical of what you’d expect in a decentralized leader-less org: ConstitutionDAO raised $40M in 2021 to bid for a copy of the US constitution but once they lost the bid, there was utter chaos on what to do next: will there be refunds? Who is handling it? There was also a lot of negative chatter around how “centralized” the ConstitutionDAO really was in terms of who got to decide what to do next, as opposed to the “D = decentralized” part of DAO. A high-profile DeFi payment platform Celo had a “mutiny” — devs from Celo took over a part of the asset pool putting over $36M in limbo. Sushiswap — one of the most well-known DAO and DEX globally — pretty much unraveled with some serious SEC probing going on because of mishandling of the funds.

- In the NFT ecosystem, the volumes are cooling off; down from ~3B in Dec 2021 to ~678M in Dec 2022, though they are up significantly from ~$10M in Dec 2020. The major concern with this ecosystem is that it’s likely suffering from the “house money” effect — a term borrowed from the poker world, it’s the tendency of investors to take on a much greater risk profile when reinvesting profit earned through investing than they would from money earned in other ways (i.e. wages). Crypto, according to estimates, has created over 100,000 millionaires at the previous peak . Of this, almost 10,000 people were worth at least $10M. This is basically “free” money. During a bear cycle, a lot of NFT rags to riches may turn to rags and that could lead to a death spiral similar to Axie Infinity.

My conjecture is that one of the biggest threats to crypto broadly is perhaps just human nature: greed, self-serving behavior, pride, ego. The rest of it is organizational. All of us in crypto ideologically want full decentralization, but decentralization also means fully decentralized accountability and responsibility. It’s all fun and games when things are going up and right (“wagmi!, yay, high fives, we are a family!”) but turns ugly when they are not (“ok, who is responsible / not me! Me neither!”). Bottom-line: when you are in an ER, decentralizing all decisions leads to patient death. I am not yet sure whether some of these issues can be solved by process or the failure modes are so ingrained in human nature that over time they’ll leak into any airtight process and corrode the machinery no matter what.

Act 3 — the mirage

Mirage is something that looks deceptively real and lures people in but proves to be a hollow promise upon closer inspection. For both users and investors, there is definitely the myth to constantly question in crypto, but also several mirages to be aware of.

Role of founder confidence

In 2021 I took a pitch I’ll never forget. Founder showed up to the meeting over zoom, topless, sitting in a pool, with a cigar in one hand and a beer in the other. He was raising a 10M round at 100M post. The business was actually doing well. We passed on the opportunity but I still think of that moment sometimes.

One of the rarest commodities in the venture world is founder confidence. It is that quality that makes the founder go what Bezos calls Gradatim Ferociter every day — step by step, ferociously. As a founder, you wake up every day inside a house on fire and you then have to wake up and make breakfast in it. Without confidence, you are toast — no pun intended. That is why VCs place such a high premium on confidence. That said, what is often missed — and is much more of a mirage in crypto — is what is the source of this confidence. Confidence can be traced back to (1) money in the bank (2) knowing something inside out. Often these two are related but in crypto there are plenty of folks with money in the bank not because they’ve figured out how to build something of value yet but because they were early to a trend that took off. If you can literally bank-roll your company yourself, you really have no reason not to be confident pitching for external capital. In our business, it’s critical to back those who have the confidence of a builder.

“Yield” as product

A big, if not the biggest, issue with a lot of crypto projects is their focus on “yields”. A typical crypto project kicks off with a protocol or smart contract launched with some UI/UX around it. To bring people to their protocol, they launch a token and offer high yields (often as high as 100–1000% APY) for users to hold their tokens. Users holding tokens allows the protocol to build up some AUM which then allows them to stake it on other protocols or high risk yield farms, or just raise VC money to then offer unnatural yields to their initial users from equity. This “yield as product” approach focuses too much on generating supply, but often ignores the demand side — i.e. why would users come to your protocol and use it on their own besides accessing the yield — gets missed.

Why do founders / projects / protocols do it — i.e. launch tokens early, hoover up AUM/TVL? My guess is that everyone gets sucked into the potential of early hockey stick growth that is quite common in crypto but ultimately unsustainable for a vast majority of the projects. Much of DeFi, for example, is composable: you can take a successful protocol, copy-paste it, and launch it as your own overnight and put a strong market-buzz engine behind it to get somewhere! This is dangerous because yield curves flatten after a while — in fact, the faster you grow TVL, the faster you’ll disappoint any yield expectations you set.

Building great products takes time and most founders won’t be able to launch a solid product before protocol yields start to decay. Early users will leak to the next protocol, next game, next ecosystem because picking a new platform in crypto is a few clicks away.

User loyalty

User retention is a massive problem in crypto today. This is tied to the earlier point made re: more focus on supply-side incentives based on future yield promises vs demand side value adding product and tech innovation. These supply-first incentives attract speculators much earlier than it does real users and risks a death spiral that young projects will find tough to get out of.

Even more important in crypto to build for organic retention where users are often rewarded for not being loyal to a product. This is such a crucial point to understand. User retention is impossible to fake. You can do airdrops to bring them back periodically. You can have an axie-like “grind it daily” behavior built into the product. You can keep offering higher yields by investing into riskier baskets. Nothing — nothing — is as sustainable as building a product whose value is felt versus one that needs to be constantly explained.

Coda

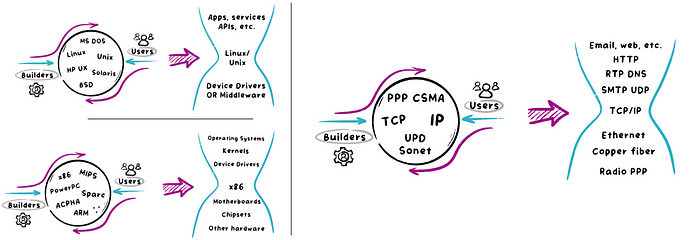

There is a concept of “slim waists” in technology. In the beginning, all technological innovations are messy ecosystems — think of them as hot cauldrons in which ideas are gurgling for years. And for years, there is a feedback⇔friction loop that goes on between users and builders that starts to “pinch” at the edges and only allows certain ideas to pass through. Over enough time, these spheres start to look more like hourglasses with the center as the “winning” choice — usually a combination of superior tech or developer popularity or ease of use or all of the above. As these hourglasses get more stable, a Cambrian explosion takes place on both sides where new ecosystems emerge that build for and on these hour-glass necks.

Take for example the protocol wars of the early internet — perhaps a dozen of these duked it out before TCP/IP won out leading a cambrian explosion of hardware and software companies that were built to the TCP/IP spec, or built on top of it. Similarly for microprocessor or OS wars in which x86 (Intel/AMD) and Microsoft/Unix won over the others. Over time large ecosystems were built for/on x86 and MSFT/Unix ecosystems — platform hardware (e.g. Dell, HP, etc), chipsets (Intel, ATI, Broadcom, etc), applications (Google, FB, etc) and more.

There are a few new “slim-waists” emerging in our world — generative AI being one, and blockchains being another. For those claiming “generative AI” has found mass adoption in <6mos, it’s worth remembering that the first generative AI model was created in 1953 and at least 30–40yrs of concentrated research has gone into it already.

I’ll say it again: crypto today is where the internet was in the 70s or 80s. The biggest stories of crypto have often been the applications, but barring a few exceptions, it’s hard to imagine a Google or Facebook being built when underlying protocols are too expensive or too slow.

The most important companies of this era will look a lot more like IBM, HP, Microsoft, or Xerox than Google or Instagram.

Only when the underlying protocols mature and friction to create new products goes to zero, can we expect a cambrian explosion of new crypto companies to emerge. And only then can we stumble into a killer use-case or two. And only then we’ll have a shot at a business model that could scale crypto to billions of users. After 30+ years of the world-wide-web, we still have only one business model that dominates — ads — and at that altar were sacrificed thousands of companies to get us here. We are a long way away still. We need to be patient and set the building blocks in place for this exploration to happen quickly and cheaply.

While all that I have said above sounds ominous, there are obvious green shoots amongst all of this if you know where to look.

- The GTV in CeFi in 2020, 21, and 22 was $1.8T, $14T, $12.8T respectively — it’s come down from the peak but grown a lot in just 2 years.

- NFT monthly vol in Dec 2020, 21, 22 was $8M, $3B, $678M respectively — a fraction of the peak but multiples of where things were in 2020.

- Number of compute-hours at Alchemy as a signal of build activity is at an all time high.

- The % of global NFT volumes in NFTs priced under 200$ is over 50% indicating the retail adoption of this asset class.

- Ethereum in 2018 peaked at ~1.2M trx/day (this was a sharp pointy peak), in 2019 bear it went down to 400–600K transactions and in 21–22 bull, it sustained for many months at 1–1.3M trx. Now it is around ~1M.

- Solana in Dec 2020 went from 6M daily trx to 26M daily trx by the end of the month. At peak bull, it climbed up to 50M+. It is now between 18–25M. Meanwhile, Polygon peak transaction was 6–8M/day and is now at ~3M.

With a 1–1.5yr view, it sounds like everything has crashed, but things change when you take a 2–3 year view.

We need to remember that narrative follows price, and not the other way around. When crypto prices go up, everyone in the media talks it up, when it goes down, everyone talks about BTC going bust. Both up/down cycles are therefore reinforced in the respective directions, except, as Soros puts it, boom cycles take long and bust cycles are steep. We should maintain calm on both sides of this cycle and deploy capital such that we have enough shots at the boom and, more importantly, enough to go shop during the bust cycles.

Epilogue

The famous British philosopher Bertrand Russell was once giving a lecture on astronomy and an old lady stood up in the audience to claim the earth was not “a sphere swimming in empty space” as Russell put it. It was, in fact, sitting flat and pretty on the back of a large turtle. Russell must’ve thought I’ve got her now! when he asked what the turtle was standing on. Pat came the reply: “Ah, son, you see… it’s turtles all the way down.” Many parts of crypto feel like turtles all the way down but it’s not because the technology is such. Crypto just suffers from loud narrators who speak in circular analogies and “what ifs…”. Underneath all this myth-building, when you get to the core, there is a seething underbelly of some of the smartest code the world may have ever seen.

Bill Gates stood for the software revolution. Steve Jobs stood for the personal computing revolution. We need founders — and investors need to back those founders — who would stand for the 40yr long crypto revolution.

Crypto deserves a better class of investors and founders.

Long term builders and investors who are willing to suffer years of pain and uncertainty to come out the other side a champion. Every technology needs to find a business model to succeed long term — this is how the benefits offered by the technology discovers the value the market is willing to offer in exchange for it.

This cycle of building, failing, rebuilding takes a while. We at Lightspeed are therefore focused on bringing the costs— economic costs and cost in terms of effort needed by all stakeholders — down to zero for building, launching, scaling, and using crypto. This isn’t our first rodeo, we’ve seen 3 bear cycles so far. I am writing this less as an investor and more as someone who suffered through years and years of rejection as a writer — one day there’ll be almost nothing // except what you’ve written down, // then only what you’ve written down well, // then little of that — keep writing, keep building, keep shipping to the best of your abilities. If you are going through hell, keep going. No one can predict what technologies will find omnipresence, what will find obsolescence. All we can do is build what excites us, what challenges us, what inspires us.

Authors