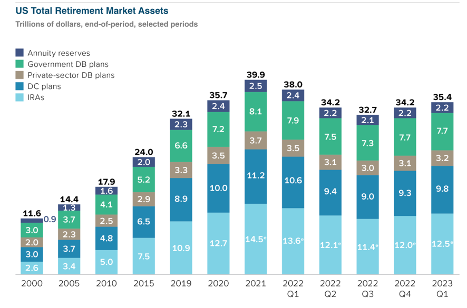

The Retirement & Benefits system is one of the largest and most important financial wellness systems in the United States, doubling in size to reach $35 Trillion in asset value as of Q1 2023 and accounting for 31% of all household financial assets.

This rapid growth in the past decade is due to a variety of factors, but most meaningfully, it is driven by the shift from Defined Benefits (DB) plans to Defined Contributions (DC) plans and IRAs. DC and IRAs make up $25 Trillion assets or 60% of the total retirement dollars in the United States, growing at 9% CAGR. This shift has enabled employees to take a more active role in their retirement plans and as such, increase contributions.

In addition, the retirement ecosystem has also seen significant regulatory change the last few years, including the SECURE ACT (2019) and SECURE 2.0 ACT (2022). This legislation includes a number of provisions that create market tailwinds for the retirement industry, but the most important is the automatic enrollment in 401(k) plans. Starting in 2023, all employers with 100 or more employees will need to have default contribution rates of 3% of salary, and at least 1% employee contributions.

Despite the market size and the tailwinds pushing it forward, the industry has historically been dominated by large and opaque financial institutions and asset managers with solutions geared to large corporations. The technology powering these systems is dated and lacks the customizability needed to serve various sets of end customers.

Vestwell is rethinking the modern day retirement stack to close the American savings gap.

Vestwell is a cloud-based modern recordkeeping platform providing the underlying infrastructure to power state and workplace retirement programs at scale. Founded in 2016, the New York City-based fintech company partners with financial institutions, third party administrators, and payroll providers to allow businesses and states to seamlessly offer and administer workplace investing programs, such as the 401(k), 529s, and pensions. Through these partnerships, Vestwell has become a leading infrastructure layer for the Wealth and Benefits system in the United States.

With Vestwell, wealth advisors, plan sponsors, and participants get access to the tools they need to streamline the plan selection and administration process. The company creates a smooth and reliable user experience for all channels by providing API infrastructure for real time recordkeeping, modular components for bundled or unbundled solutions, and white labeled capabilities to best cater towards each partners’ go-to-market needs.

Vestwell’s platform not only serves large financial institutions and employers, but also the rapidly growing SMB market which has been previously inaccessible due to high cost to serve. Vestwell has quickly become the leading employer and individual savings platform, now powering thousands of advisors, 35+ state savings programs and 50,000+ businesses, and over 1.2 million U.S. savers.

On the back of this extraordinary growth, we at Lightspeed are excited to announce today that we’re leading a $125M Series D financing round in Vestwell. We have known the Vestwell team for a long time and have been very impressed to see the product velocity over this past year. In 2023 alone, the company released several new products and secured multiple large-scale partnerships with major financial institutions and state governments. This includes being selected by JPMorgan to expand its 401(k) product, adding to Vestwell’s existing relationships with leading firms such as Morgan Stanley, and a streak of winning state-sponsored IRA programs across the country.

Beyond the massive market opportunity and macroeconomic tailwinds, we believe Vestwell’s unique product infrastructure allows institutions and employers to serve savers unlike any competitor on the market.

Vestwell CEO and Founder, Aaron Schumm, has been building in the fintech industry for over two decades, where he started as a Product Manager at Fiserv. Over the years, he has managed product lines at large financial institutions such as Citibank, and built, advised and sold two fintech businesses. At Vestwell, Aaron has assembled a team with top tier talent across the ecosystem with decades of experience. The Vestwell team’s deep domain expertise and modern approach to the business are unmatched in the ecosystem, and they are well positioned to build the leading, modern-day, retirement recordkeeping platform.

We could not be more thrilled to be along for the ride with Vestwell!

Authors