Crypto and blockchain tech are entering the mainstream zeitgeist in a meaningful way. The latest crypto rally began in Sept 2020, driven by institutional financial services and F500 investors, as well as retail investors across markets such as US, India, Indonesia, S. Korea and China, when Bitcoin prices grew from ~$10k to a peak of $63k in Oct 2021. Global cryptocurrency monthly trading volumes have also significantly increased in 2021, growing from $271B in Q1 2020, to $793B in Q4 2020, to a peak of $2.2T in May 2021 [1].

As is well-known in the crypto ecosystem, the economic interest in crypto comes in waves — we have already gone through two waves of this and are in the middle of a third one. However, all through this, the ecosystem has been maturing quietly and resolutely underneath all the hype and noise. As a result, the crypto opportunity has significantly expanded over the last few years. The early days were all about coins and trading. Now we see a highly diversified set of opportunities spanning exchanges and brokerages (global and regional), NFTs, gaming, DAOs, DeFi, wallets, blockchain infrastructure, and much, much more. We are also in a fundamentally different place with regards to capital, talent and regulatory support for this fast-emerging category.

1.There is now more capital flowing towards crypto than ever before. We are starting to see global break-out companies raise large rounds e.g. FTX ($1.3B), BlockFi ($350M), Paxos ($300M), Blockchain.com ($300M) and BitSo ($250M). Regional leaders such as Indonesia’s Pintu ($35M), and India’s CoinDCX ($110M) and CoinSwitch ($300M), also raised large rounds in 2021. Globally, over $8B of investments funneled into crypto and blockchain companies in 1H 2021 versus ~$4B in all of 2020[2]. This expansion is both due to regional and institutional diversification within the capital base. The funding growth has been particularly strong in India where crypto founders raised over $0.5B this year so far, up from just $37M in 2020[3], partly due to signs of regulatory clarity amidst a fast growing consumer adoption of crypto.

2.Crypto is attracting both experienced and new developers alike, leading to more code and more robust code written in a shorter period of time. Globally, smart contract specific programming languages such as Rust and Solidity are gaining traction. India has become a hotbed for blockchain talent in particular.

There are over 10,000 “blockchain developer” jobs currently open in India on LinkedIn alone, compared to 30,000 in the US. Few years ago, this number was in the 100s at best.

3.Crypto regulation is finally part of mainstream politics in large markets such as the US, China, India and Indonesia. In India, 2021 is a far cry from 2018 when the cofounders of a crypto exchange were briefly in police custody for putting up a “Bitcoin ATM” in a Bangalore shopping mall. Large trading platforms such as CoinSwitch and CoinDCX have now started to on-board Bollywood mega-stars as brand ambassadors or sponsoring large-scale cricket events to reach mass audiences. In Indonesia, as crypto trading users (7.4mn) surpassed retail investors in capital markets (5.7mn) in 2021[4], the government has taken a clear stance of regulating crypto versus banning it. In India as well, years of regulatory pushback has begun to ease off, starting with the Supreme Court of India overturning a prior directive by the Reserve Bank of India prohibiting banks from dealing with cryptocurrencies.

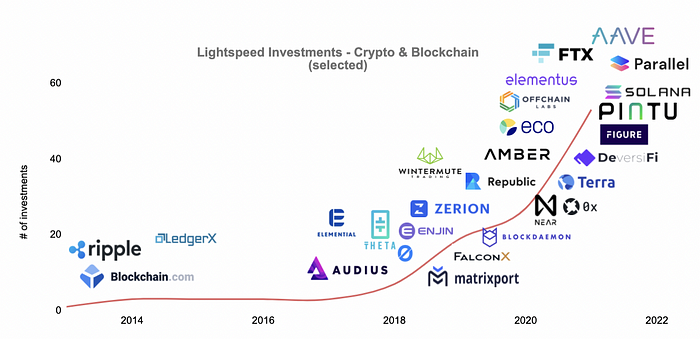

At Lightspeed we’ve been active in the category since 2013. We started our crypto investment journey with an investment in Blockchain.com — a global leader in crypto services and the market-leading BTC wallet representing over 35% of all BTC on-chain transactions. Since then, we have directly or indirectly (via LP positions) invested in over 50 leading companies across all categories of crypto and blockchain including brokerages, market-makers and exchanges across the world, such as Pintu, Amber, Wintermute and FTX; DeFi products such as Aave, 0x, Zerion, Parallel; and L1 & L2s such as NEAR, Theta, Terra, OffChain Labs/Arbitrum, and more.

We are global investors but in this post we will focus on our India and SEA specific work and market maps. India and South Asia is one of the largest epicenters of crypto and blockchain tech. While advanced crypto economies such as China and US are seeing a shift from peer-to-peer volume to more institutional volume, there is significant headroom in the emerging crypto markets in just peer-to-peer volume alone powered by both decentralized (DEXes) and centralized (CEXes) exchanges. Favorable regulation, currency debasement, and a lackluster stock market performance from the last decade in many countries in this region is also causing a lot of the younger people to select crypto as their first choice of investment over stocks. Chainanalysis ranked Vietnam and India as #1 and #2 respectively in their recent global crypto adoption 2021 index, and Pakistan, Thailand, and the Philippines are in the top 15.

CeFi

State of the union

Unlike equities, which typically trade primarily on a regional exchanges, during fixed hours, and against a single fiat local to that market, crypto trades 24×7 on a large and growing number of exchanges globally across a wide variety of fiats and other crypto pairs (eg BTC:USD, BTC:Euro, BTC:ETH, BTC:XRP etc). Most of these exchanges/brokerages (some of which are also large enough to market-make) are highly profitable businesses that capitalize on volatility (up or down) inherent in the crypto markets and make money via a combination of trading fee — 0.1–0.7% per transaction is typical — and OTC trades: high-AOV trades that needs a support desk / ops at a higher fee rake. Over time, these exchanges add new trade-able categories e.g. WazirX adding NFTs, or an exchange token e.g. WRX token. Over a longer period, some of the retail-user focused brokers may enter neo-bank categories in crypto (e.g. yield products, wallets, crypto bank-like features).

Exchanges, brokerages and market makers remain one of the most dominant forces in crypto today. Different exchanges have strengths in different crypto assets, different geographies and different user bases.

Whereas network effects have concentrated equity exchanges, we have not seen the same effect in crypto, yet.

In fact, the rise of DeFi is reducing the capital concentration of centralized exchanges. Along with this, we are also seeing the rise of regional (Pintu, CoinDCX, CoinSwitch) or pan-regional (Upbit, Binance) crypto brokerages and exchanges. While “mega exchanges” tend to get really big (e.g. Binance / Coinbase valuations are in the $50–100B range), we believe over time regional exchanges will become quite large themselves by virtue of supportive regulation and better localization/brand.

The Lightspeed view

Our thesis is that exchanges/brokerages that are compliant with local laws and regulations and plugged into the local banking ecosystem will have a key advantage over international players over time.

Large global exchanges that operate in foreign markets are often doing so without the necessary legal compliances. In the absence of these compliances, user experience suffers over time. On and off-ramping into local fiat becomes a multi-step complicated process that often breaks, partnerships with local banks is out of the question, and offering innovative products such as yield-producing crypto accounts is also not possible. We believe the long term winners will be local players that work closely with regulators and understand regional nuances deeply.

Furthermore, we believe that crypto — not stocks — is going to be the asset-class of choice for new-to-investing millennials in India/SEA markets. Many of these markets have under-performing equity markets with no aspirational stock symbols that the young investors want to own. The 5yr return for the stock exchange in Indonesia sits at -3%, +5.4% for Thailand, and -16% for Malaysia[5]. Young people in these markets now have an opportunity to invest into globally known symbols — BTC, ETH and DOGE!

The India/SEA region has seen a swathe of these businesses emerge in the last few years. We now expect this category to consolidate in the coming years as larger exchanges pull ahead and brokerages start to differentiate on ease-of-use, brand, and customer service. This is an area of prime focus for Lightspeed and we are always looking to invest in highly differentiated products (e.g. social investing) built by strong teams.

DeFi

State of the union

In traditional finance, most customer transactions, whether savings, loans, trades or payments, all depend on trusted intermediaries, such as banks, exchanges or brokers acting as custodians of funds and assets before, during and after a transaction. This is also true for the first generation of crypto companies. If you buy BTC from Coinbase, you trust Coinbase to hold the BTC on your behalf. Within the crypto community, one of the longstanding concerns about working with a trusted intermediary is that they may not, in fact, be trustworthy or could fall to the censorship or surveillance trap that many centralized platforms fall to. For example, a third party e.g. a government or the CEO of a company can choose to restrict certain transactions because centralization makes it easy to apply pressure to induce a certain outcome. There have also been many instances of custodial wallets or exchanges being hacked or operators of centralized crypto companies simply stealing from their customers, causing end customers to lose their crypto. There is limited recourse for customers because crypto is pseudonymous and transactions are irreversible.

DeFi is an attempt to solve these issues. The simplest way to think about DeFi is peer-to-peer finance without any intermediary. The major pillars of finance — owning assets, generating yield on these assets, borrowing, and lending — all of these are offered by various DeFi products using protocols running on programmable blockchains such as Ethereum. The contractual aspects of finance — for example, what happens when you default — are taken care of by the underlying mathematics of crypto/blockchain. It is still early days of DeFi and a lot of the assurances offered by central/traditional financial institutions aren’t available on DeFi yet. What you get, however, is the ability to digitally lend and borrow with no real-world paperwork in a fraction of the time it takes to do the same in fiat. You could, for example, borrow $1M for 10 seconds from a DeFi liquidity pool where 1000 individuals have parked $1000 each, use it to execute against a trade, and then return the capital with an interest rate based on the collateral provided, demand/supply curve, and so on — all of this governed by the underlying DeFi protocols.

The best measure of the popularity of DeFi is Total Value Locked, which includes all of the crypto that is controlled by the various smart contracts across the DeFi space.

DeFi really took off in the last year, with over $200B+ locked. Just over half of this is locked in lending and this proportion has been rising the fastest, driven in large part by experienced crypto users with large stakes engaging in liquidity farming and yield farming. Besides lending and trading, minting and trading NFTs, and blockchain gaming are the other fastest emerging categories in DeFi.

The Lightspeed view

Unsurprisingly, the DeFi space is extremely fragmented, with many new projects launching frequently. And if you think it is complicated to trade crypto on a regular exchange like Coinbase, wait until you try to use DeFi. It’s really complicated, not-user friendly, and as a result, DeFi is mostly used only by sophisticated crypto users today. Given the complexity in the DeFi ecosystems, often new-to-crypto users (and sometimes even seasoned ones) can get scammed. In the last one year over $400M[6] of funds have been stolen just in the DeFi ecosystem alone. However, what’s worth noting is that despite all the friction, users are still flocking to this ecosystem.

DeFi is an active area of investment for Lightspeed. Given the fragmentation in the ecosystem we are particularly interested in interoperability solutions between dApps and chains. Fraud is, of course, another area of focus for us. Another major challenge is capital efficiency in DeFi. A lot of capital sitting on platforms such as Uniswap or Sushiswap remains idle. We are starting to see interesting liquid staking platforms that help generate yield and liquidity on staked assets. Cross-chain communication and bridges will play an increasingly critical role in a multi-chain future and is a critical area for us at Lightspeed Finally, we would love to see founders tackle real-world problems such as a crypto-backed credit/debit card, SMB credit or international remittances — all large unmet needs in India/SEA markets.

Blockchain Infra

State of the union

Blockchains are, at their core, databases that have certain characteristics, the most well-known of which is the immutability of what is already recorded in the database. Additionally, they’re open source, open state (anybody can read from them) and open execution (anybody can write to them for a price). They however suffer from some of the same core issues as any database does — scalability, security, performance, and so on. In the early days of blockchain, you could only write a few transactions into the blockchain ledger per second, but as the ecosystem scaled, demand sky-rocketed, and today every new txn on the main blockchain (called “main-net”or L1) is now holding back 1000s of other txns that need to also be recorded. Moreover, not every transaction is as time-critical, but writing any new entry on the blockchain takes the same amount of time, creating arbitrage opportunities that increases the cost of each transaction during times of congestion (“gas fee”). To solve this, new Layer2 (L2) and sidechain solutions are being developed that off-load the execution of transactions away and then batch-write the post-transaction data to the primary blockchain during idle hours. As a result, they reduce congestion and also gas-fee. L2s and sidechains can offer a lot more technical benefits besides speed and costs: security, data privacy, etc. Polygon and Arbitrum are examples of L2/sidechain solutions within the Ethereum ecosystem.

While L2s solve the scaling and cost issues for the underlying L1 blockchains, there are alternative L1s being built to solve for specific use-cases that run on blockchains. Today, Ethereum has the largest developer community and user traction in the world, with 75% of total value locked across all chains and 400+ applications built on the network. However, Ethereum’s % of total DeFi has decreased since the beginning of the year as other blockchains (“Layer 1/ L1 blockchains”) have attracted developers to build applications in each respective network, which in turn attracts users to the network. Outside of Ethereum, the top alternative L1s are Binance Smart Chain (BSC), Solana, Avalanche, and Cosmos. Each L1 blockchain is architected with unique strengths, with Ethereum being the first open source blockchain to offer smart contract functionality and optimized for security; Polkadot optimizing for cross-chain communications; BSC optimized for low fees; Avalanche for time-to-finality; and Solana for high transaction throughput. Other specialized use-cases such as Blockchain games (or “NFT games”) have also necessitated the development of specialized L1s. For example, Axie Infinity — a popular play-to-earn game company based out of SEA — recently relaunched their game off of Ethereum to their own side-chain called Ronin in order to drop transaction fees and improve performance.

The Lightspeed view

We think L1 alternatives and L2 solutions as well as other building blocks of web3.0 are key areas of infrastructure that’ll allow interesting use-cases to pop up on top of blockchains. We also see a wide range of blockchain infra / middleware and dev tools that will be built as different L1s and L2s scale up, providing integrations to enable transfer of assets, messages, notifications among others. It is also an area where we have been the most active in terms of our investments.

As the internet shifts from web2.0 to web3.0, there are large parts of what makes the internet work that would need to be rebuilt for web3.0.

Does it mean we need to rebuild the entire web2.0 stack — from all the way down to metal and hardware, to the layers above it such as storage & networking infra, operating systems, databases, middleware, and finally the application? Perhaps not, but we certainly will need a mix of general purpose and special purpose architecture to allow web3.0 products to emerge from web2.0. We are already seeing a lot of innovation in the web3.0 database layers — essentially the L1 and L2s. On storage, web3.0 is shifting to decentralized platforms such as Filecoin, Arweave and Arcana network. Pieces of the networking infra are becoming decentralized — e.g. ENS, Handshake are building decentralized DNS. Applications such as Audius, BitClout and Braintrust are building decentralized versions of Spotify, Twitter, and Upwork respectively. We are barely scratching the surface of what’s possible.

Needless to say, Blockchain infrastructure is a generational opportunity to build the nuts and bolts of this emerging ecosystem. The stewards of web2.0 have extracted a lot of rent for being a reliable proxy for trust and quality. With crypto economics, it’s finally possible to align incentives across all layers of web3.0 and solve for trust and quality in a decentralized way. We are truly excited to see what innovations could come out of this category — how does one bring analytics and AI to what are effectively decentralized (and often encrypted) data-sets? How do you search and index this new world? How do you solve for distribution? Will every user of web3.0 now hold dozens (or hundreds) of tokens in an array of wallets with complicated pass-phrases to then use dozens of dApps? Just how many communities and DAOs can one truly be a participant to? These are some fundamental questions that will be answered in the coming decade and we can’t wait to back founders who are tackling these thorny challenges.

NFTs

State of the union

The simplest way to think of NFTs is as a blockchain native file format that inherits the properties typical of a blockchain asset: ownership status, prior ownership/transaction lineage, as well as lineage of value associated with the asset — all of it shared openly and transparently. While you could think of NFTs as a way to tokenize a variety of digital and physical assets and put them on a blockchain, at its core NFTs are yet another way for people to show off in the digital world. They’ve been around since 2015, but have recently seen a lot of buzz. OpenSea, the largest NFT marketplace in the world, is going to pass $10B in cumulative trading volume[7] in October 2021. It had crossed $1B in cumulative trades only in July 2021, so the growth has been phenomenal. Typically we see NFTs being used in digital art (artist created and generative), pop-culture (old memes getting sold as NFTs), sports moments (NBA top-shots), games, and even life experiences (creators recording a unique 1-off video for a fan). As visible in the chart, while NFT trading volumes were initially dominated by art/collectibles, lately gaming-related NFTs have started to see strong adoption within the NFT community.

Which brings us to perhaps one of the most interesting consumer applications that have emerged out of the NFT ecosystem: Blockchain games (or “Play to Earn/P2E” games). These are games that incorporate blockchain technology to allow players to mint and trade in-game items as NFTs. You could then trade these NFTs on-chain within the game or even on DEX or CEXes via tokenization. While a majority of the art-NFT volumes are related to a small number of highly-priced and sought-after NFTs/NFT-collections, gaming-NFTs have by far the lion’s share of the transactional volume albeit at low average prices. It is this mass appeal and accessibility of gaming-NFTs that is very exciting.

While the early cohort of blockchain games such as Gods Unchained (ImmutableX), Crypto Kitties (Dapper Labs), Decentraland, the Sandbox, and others have reached mixed degrees of NFT/token sale success and generally low player engagement, blockchain gaming reached mainstream attention with the explosive growth of Axie Infinity, a PokemonGo-style collectibles game. The inflection of Axie Infinity in June 2021 coincided with a growing base of play-to-earn players from the Philippines, streamers gaining traction on Twitch, and most-importantly, the team’s decision to re-launch the game off of Ethereum to their own side-chain called Ronin in order to drop transaction fees and improve performance. Outside of Axie, companies like SoRare have leveraged NFTs to create a new wedge in fantasy gaming, unlocking player rewards and earnings through fantasy and potential capital appreciation on collected NFTs.

The Lightspeed view

The NFT ecosystem in particular has grown tremendously over the last few quarters and we are excited for what creators/artists, gamers and crypto enthusiasts will build with this increased interest and liquidity flowing to this category. To take the ecosystem forward we need simple one-click experiences that allow the next billion users to create, mint, discover and be discovered, and trade NFTs easily. Tools that generate yield on NFTs, or integrate interesting real-world uses for NFTs (e.g. VIP access to events). Verification tools to protect users against NFT fraud/phishing attacks. NFT SaaS tools to let brands build communities and connect with their audience, and more. Perhaps a BNPL for NFTs?

On the NFT gaming side, a variety of play-2-earn use-cases are emerging that are particularly relevant for India & SEA markets given the labor arbitrage. Platforms like Yield Guild have an early lead in building into the P2E movement. Just like the transition that is taking place from web2.0 to web3.0, we believe there will be a transition from centralized to decentralized gaming in the coming decade that would require various pieces of the gaming stack to be re-imagined. Starting with the game engine themselves — games like Ember Sword built their own game engine — all the way to various plugins for crypto economics, marketplaces, guilds, NFT integrations and more.

As a fund that has sophisticated gaming and crypto practices, we are spending a lot of time in this category and would love to meet strong founders who are building the next generation of gaming and NFT.

The overall market map of 70+ crypto and blockchain companies in the above-mentioned and adjacent categories is below. It is worth noting that this list is by no means meant to be exhaustive — we have tried our best to include a wide swath of companies that have scaled to a reasonable degree and / or raised some external capital. Our sincere apologies if we have missed any company — to have us consider your company for inclusion in this ever-evolving market map please reach out to us (see below).

In future posts, we also plan to dive deeper into specifics of a few emerging but critical areas in our opinion of web3 evolution including (1) the DAO stack for India & SEA (2) Multi-chain enablement infra and, (3) Metaverse intersecting crypto. If you are a founder building in this ecosystem, we would love to have a conversation — DMs open (hemant, romit, amy, sam, marsha) or submit a pitch to us here.

Let’s BUIDL!

References: [1], [2] [3], [4], [5], [6], [7]

Thanks to the following crypto leaders and community members for helping us with this market map

Jeth Soetoyo (Pintu); Vaibhav Chellani & Rishabh Khurana (MOVR); Mohak Agarwal (Claystack); Tarun Gupta (Coinshift); Sumit Gupta (CoinDCX); Akshay BD (Solana); Rahul Sanghi (TigerFeathers); Edul Patel (Mudrex); Aniket Jindal (Biconomy)

— Hemant Mohapatra, Amy Wu, Sam Harrison, Romit Mehta, and Marsha Sugana

About Lightspeed: Lightspeed is a multi-stage venture capital firm focused on accelerating disruptive innovations and trends in the Enterprise, Consumer, and Health sectors. Since 2000, Lightspeed has backed entrepreneurs and helped build companies of tomorrow, including Snap, Affirm, AppDynamics, OYO, Nutanix, Byju’s, and Udaan. Lightspeed and its affiliates currently manage more than $10 Billion across the global Lightspeed platform, with investment professionals and advisors in India, Silicon Valley, Israel, China, Southeast Asia and Europe.

Authors