While Frontier Tech as a category has started gaining more mind share (and actual share of $s deployed) in VC lately, it is not a novel concept. Venture capital as an asset class began with backing companies with the highest risk profile. For a long time, investors have partnered with founders who tackle extremely complex problems. Some of the most impactful investments in the pre-internet era were in deeply technical areas such as semiconductors (Applied Materials, Fairchild, Intel), biotech (Gilead Sciences), and networking (Cisco, Juniper), among others.

While a significant amount of venture capital $s has been deployed to software businesses post-2000s, Frontier Tech opportunities have also begun to attract mainstream funding from corporate, venture capital, sovereign wealth, and private equity investors.

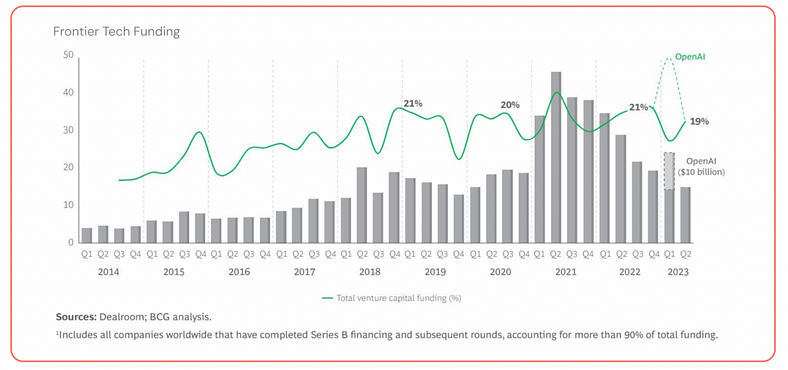

Over the last decade, Frontier Tech companies have increased their share of venture capital funding from ~10% to 20%. All the while, the overall VC funding has also grown from ~US$127B/yr to ~US$285B/yr.

Investors often worry about the viability of Frontier Tech investments, questioning if they can generate returns within the venture time frame and find a relevant exit strategy. However, according to a study by BCG, these concerns have notably diminished. There is a little difference in the percentages of traditional and Frontier Tech venture investments that cashed out via corporate acquisitions (~53% and ~51%, respectively), IPOs (~36% and ~31%), and private equity buyouts (~7% and ~3%). The average IRR-based outcomes have also remained in a similar range. Arguably, the Frontier Tech category has produced standout companies, indicating that venture-expected outcomes are very much possible.

Fig 2

At Lightspeed, we’ve supported various companies and founders worldwide, including in India going after really hard problems. We have invested ~US $1.9B in the Frontier Tech Category across 92 companies. Some notable names are Anduril, Ultima Genomics, and Pixxel Space. We believe that India can also be a fertile ground for such opportunities. In this blog, we explain our view of the landscape and how entrepreneurs can tap into these vast opportunities — in Defense, Robotics, CleanTech, SpaceTech and AI Infrastructure.

Fig 3

Defense Tech

State of the Union

The defense tech category encompasses communications technology, AI/ML, computer vision systems, cybersecurity, and more. Lightspeed has made significant investments in cybersecurity companies, expected to play a key role in protecting national assets, and is an investor in the leading global defense tech startup, Anduril. Historically, innovation in the defense industry has been led by hardware.

However, we believe the next generation of innovation in defense will be driven by software, particularly AI.

The Lightspeed view

India is going through a new cycle in defense focusing on a) modernization, b) expansion, and c) self-reliance. To achieve this, the Indian government has undertaken: a) higher focus on domestic production, b) an increase in domestic procurement — imposing a ban on the import of ~1000 items to promote domestic manufacturing and procurement, c) a reduction in layers required for approval to improve procurement speed, and d) launch of emergency procurement channels. We are seeing many new-age companies taking advantage of these tailwinds.

We believe that defense tech companies focusing on autonomous systems, which allow for increased situational awareness and provide real-time intelligence, have the potential to emerge as large companies in the category in India. Our view is that these will be integrated plays and the importance of Command, Control, Communications, Computers, and Intelligence systems is likely going to increase. We also believe there are adjacent opportunities within defense, including computer vision, and secure communication use cases. Companies like Tonbo Imaging and Optimized Electrotech are developing computer vision infra for existing defense platforms to enhance their situational awareness.

Additionally, we believe companies that follow a multi-product strategy and are plugged into the government + defense prime (such as HAL, BEL, and others) ecosystem have a higher chance of standing out. The multi-product strategy helps companies with more touchpoints with the buyer because the repeatability of contracts for the same equipment or technology is not a given. Many defense tech startups, currently experiencing early signs of success (i.e. starting to secure contracts from the government or prime contractors), have often undergone lengthy processes to secure their first contract (sometimes taking 4–5 years) and are following a diversified approach, offering multiple product lines to increase their chances of securing contracts.

We have also started to see a few early-stage companies catering to international markets. We believe that India’s progress towards becoming the 3rd largest economy in the next 5 years will provide tailwinds to Indian defense tech startups. Diversifying the buyer base can also help defense tech companies generate consistent revenue, which has historically been difficult to achieve. Steady demand also allows these companies to provide more competitive prices to their customers.

Commercial Drones

The commercial drone space in India is also catching up and gaining considerable momentum. Although ~80–90% of revenue generated by drone companies is from defense use cases, the commercial category is growing at a faster pace. This includes enterprise, logistics and agri-based use cases. Each of these sub-segments is at a different stage of development. For example, in agriculture, there’s a blend of commercial and test use cases. In the oil & gas industry, real-use cases are more common, while in mining, more trials are underway. While these segments are individually in their early stages, they show great potential. Most of the focus is around data acquisition, surveillance and analytics plays. In our opinion, the commercial drone market is still early in India. The commercial drone industry is expanding in India, but we believe these companies should target global markets for substantial growth. Indian companies have the technical capabilities to cater to advanced use cases.

Robotics

State of the Union

Advanced robotics is an emerging category in India. While most of the existing warehouse automation or industrial automation solutions (in the region) have focused towards mobility (i.e. transferring objects from one place to another) or performing more structured tasks, the majority of the worker’s time in a warehouse or a factory floor is involved in performing unstructured tasks such as pick-and-place operations or assembling parts. This is the remaining gap in robotics today. For example, industrial robotic arms with vision capabilities still rely on predefined rule-based engines to perform many operations. We certainly do not believe that the market opportunity for existing warehouse automation solutions will disappear, especially since <10% of warehouses globally remain automated. However, it will be challenging for newer companies to distinguish themselves in the mobility or structured automation category against larger companies (such as ABB or Grey Orange).

Advancements in AI are set to play a crucial role in hastening the shift towards more autonomous systems. For example, at GTC 2024, NVIDIA unveiled Project GR00T, a general-purpose foundational model for humanoid robot learning and execution. GR00T can link to large language models from third parties. It can process multimodal and natural language instructions, such as texts, videos, and VR demonstrations, and subsequently generate the next motion for robots to execute.

The Lightspeed view

We believe that hardware is largely a solved problem in robotics (as depicted in the subsequent chart, Fig.4), and new-age solutions are likely to leverage intelligent software, controls, and machine learning to enable robotic systems with human-like dexterity (for example, how to pick any and all objects and do things with them only a human can). The progress in end-to-end AI can drive significant improvement in manipulation and interaction capabilities, which will likely pave the path for Robotics for more generalized tasks.

We anticipate a surge in the development of robotic foundation models, also known as MultiModal LLMs (MMLs), in the future. The current Robotic MMLs are in the early stages of laboratory development. Google’s PaLM-E and RT-2 models have made progress in fundamental generalization and solving long-horizon tasks. However, challenges remain in natural language interaction, data collection (which is already effective for images and text, but not so for sound, touch, or force), and issues related to data annotation and security.

Fig 4

While India may not be a leader in advanced robotics, it does have the capability to generate a significant amount of proprietary data for robot training. For example, humans in India can remotely control robot arms in the US around the clock, performing gestures that train the robots on specific tasks. Thus, India can serve as the starting point as the RLHF in robotics. From an application perspective, we see warehouse automation and automotive as the key early adopters of these generalized robotic solutions. In India, companies such as CynLr and Perceptyne Robots are enabling Industrial Robotic Arms to become more autonomous through their vision-based solutions. Their vision-based tech can be used on existing robotic arms to further augment their capabilities.

Clean Tech

State of the Union

Among the top 50 most polluted cities in the world, India has the highest representation, contributing 24 of these cities. India itself is ranked as the 5th most polluted country in the world on the basis of the Air Quality Index (AQI). However, it’s not all doom and gloom. A recent Nature paper indicates that a rapidly falling cost of clean energy and strengthening climate policies could move us away from the worst of the climate future. As of 2022, the countries (~139 in total) that have made their net-zero pledges cover ~83% of global emissions. If these pledges are met, it would result in a best estimate of under 2℃ warming by 2100. For example, India intends to get to net zero by 2070. These targets have subsequently percolated to both large and small companies in India and SEA.

- In India, 75+ major companies have shared timelines to get to net-zero carbon emissions. For instance, Reliance by 2035, HUL by 2039, HDFC by 2032, etc. In addition, sustainability reporting (which entails publishing the company’s carbon emissions) has been made mandatory for every publicly listed company (~1000+ in number). For SMBs in India, any Indian company supplying to a publicly listed company in the US/Europe is mandated to publish its carbon emissions.

- In SEA, while urgency and adherence vary across the region, Singapore seems to be well ahead of the pack. SGX has started mandating carbon accounting for listed companies and threatens delisting those who do not adhere to this by 2024.

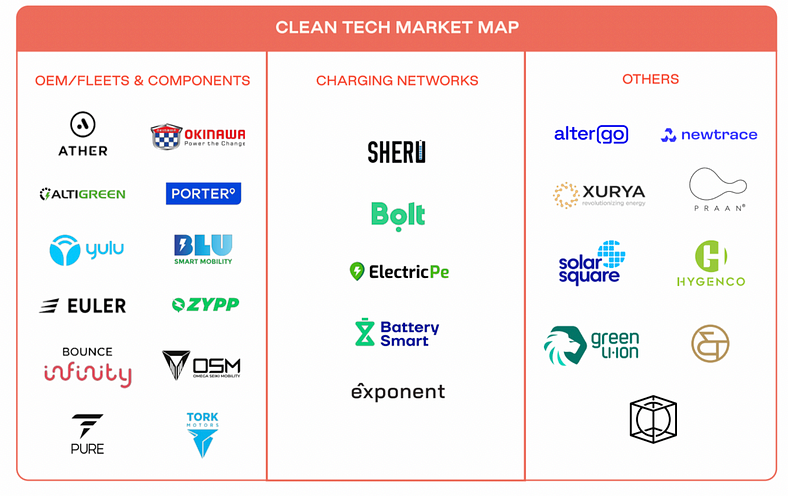

Fig 5

The Lightspeed view

In India and Southeast Asia, most of the innovation in cleantech hardware is mobility-led (i.e. EVs). Road transport in India accounts for >20% of total carbon emissions in India. We anticipate that the immediate adoption of Electric Vehicles (EVs) will primarily be driven by commercial use cases. Initially, 2-wheelers and light 3-wheelers will dominate, followed by 4-wheelers as batteries and motors become more advanced and cost-competitive with Internal Combustion Engine (ICE) vehicles. We identify a clear opportunity for new OEMs to emerge, offering market-leading products with distinctive designs and services.

We’re seeing significant progress with respect to developing charging networks. Battery swapping has gained traction in commercial 2Ws and 3Ws, particularly e-rickshaws while fast-charging networks continue to grow. We anticipate that most charging infrastructure will be interoperable in the future to boost efficiency, paving the way for new business models in charging networks. These could include aggregation, payment-enabling software layers, and identity authenticators, among others. Our portfolio company, Exponent Energy, serves as a prime example of harmonizing this ecosystem. Their unique BMS enhances battery performance, enabling a 15-minute fast charge via their network. By cutting down full charge times, vehicle manufacturers can install smaller battery packs, thereby lowering upfront costs.

We are also witnessing companies going after incredibly hard problems that involve cutting-edge technology from India/SEA. Companies like Cosmos Innovation are creating AI-led fabs to create new-age solar cells that could potentially lead to significant improvements in (solar cell’s) absorption capabilities. Amperesand is building the world’s first grid-connected Solid State Transformer System (SSTs). These systems are likely to be significantly more efficient, flexible, and resilient than traditional transformers. This modularity allows for simple application-specific scaling, which is essential for use cases that involve optimizing the utilization of renewable energy, energy storage, and EV fast-charging deployments.

Space Tech

State of the Union

The Indian Space Sector contributes ~2%-3% to the global space economy and is projected to reach US$13B by 2030. India’s ecosystem is conducive to the growth of full-stack space companies, encompassing everything from rocket design, and launch services to payload manufacturing. We have observed this journey through our portfolio company Pixxel Space which started with building the world’s most advanced hyperspectral camera and has now vertically integrated to also manufacture the satellites in-house. This is enabled by the quality of space talent in India.

ISRO, India’s premier space agency, alone has ~20K employees having a comprehensive focus around everything related to space — i.e. launch services, satellite systems, earth observation, communication, and others.

Typically, there are three sub-categories where new age companies have come up: 1) Satellite plays (such as Pixxel, PierSight, and SatSure, with a focus on either communication or data acquisition/analytics, 2) Launch vehicles or services (such as AgniKul), and 3) Space services such as preventing space debris, refuelling, and others (such as Digantara).

The Lightspeed view

Satellite Data Acquisition and Analysis

This new wave of space-based data acquisition and analysis companies is driven by two factors: 1) The cost of sending a satellite to low-earth orbit has decreased from US$60K+/kg to roughly US$5K/kg over the last 10 years, and 2) The overall payload of an average satellite has decreased. These two factors combined have unlocked various commercial and defense use cases that were not previously possible. For instance, Pixxel is building a constellation of low-earth orbit imaging small satellites to provide an entirely new kind of hi-resolution dataset (hyper-spectral) that was previously not possible. The planned constellation of satellites will provide (a) real-time coverage, (b) higher (<10m) resolution, (c) daily data refreshes, and (d) more dense data info, for example, soil or crop quality. The World Economic Forum recently published an article (Fig.6) talking about the potential commercial areas likely to be disrupted by advancements in earth observation.

Fig 6

Similarly, the miniaturization of SAR (Synthetic Aperture Radar) technology has unlocked many use cases that were previously unavailable. For example, SAR has been the backbone of Russia-Ukraine warfare in providing real-time and high-resolution critical data. New Age companies such as PierSight have gone one step further, unlocking commercial use cases in Maritime to detect oil spillage, piracy, and others. We believe that for companies to be successful in this category, full-stack constellation plays are key — where one controls the satellite, the payload, and the data. Constellation plays are far more strategic as they own the data and can control downstream pricing as well as analytics over time.

Satellite Communication

Satellite-enabled communication, such as the provision of 5G networks in remote areas and seas, has become viable thanks to networks of satellite constellations in low earth orbits. Traditional satellite communication companies often provide low-quality communication infrastructure because they typically rely on a very limited number (often single) of geostationary satellites. The primary value proposition of new-age companies is their significantly improved communication capabilities, often 10X faster than their older counterparts. Companies such as Astrome are powering interesting use cases such as 1) providing secure and fast communication capabilities to defense forces in remote regions, 2) providing private networks for enterprises, and 3) extending the reach of the internet to rural areas.

Launch Vehicles and Other Services

Based on several estimates, there are at least ~4K operational satellites orbiting the Earth today. By 2030, we could see ~65K to 100K satellites in orbit. Most of these are expected to be micro-satellites in the 50–200 kg class and are likely to be privately owned. This also underscores the need for launch services necessary to place the satellites in their relevant orbits. These new-age companies are focusing on two key value propositions: 1) Lower cost of payload, and 2) Positioning of payload in the exact orbit (as opposed to a bus service such as SpaceX that places a satellite in the most optimized orbit). We believe that for a company to genuinely stand out in this category, optimizing the cost of payload is significantly more crucial than reaching the precise orbit. Worth noting that payload cost of a high-priced, reusable rocket is lower than that of inexpensive, single-use rockets (e.g. 3D-printed ones). Hence, companies within the category are more susceptible to competition from SpaceX, ISRO, and others and need to maintain financial discipline given the significant burn profile.

AI Infrastructure & Tooling

Lightspeed was very early to the Generative AI trend in India with its investments in Yellow AI (in conversational AI space) in 2018, Rephrase AI (in Video AI space) in 2019, and Pepper Content (in enterprise marketing space) in 2020. The AI Infrastructure stack consists of three key elements: 1) Compute and Foundation Models, 2) Data Transformation and Pipelines, and 3) Middleware and Tooling (such as Orchestration and Observability). We have maintained a secular focus across all three elements, both regionally and globally. We also believe that there is a need for India-focused AI infrastructure. India, with its ~1.4B population and 22 official languages, is a complex and diverse market. For Indian companies to cater to these consumers on such a large scale, they will need low-cost, efficient models and infrastructure around it, specifically designed for the Indian market.

- Compute and Foundation Models: The compute and foundation model layer involves foundation models and infrastructure for model training and deployment. Such plays have been sparse in the region driven by the complexity and cold start issues. We believe the teams pursuing such plays truly need to be “best in class”, which was our primary motivation in partnering with Sarvam. Most companies in this stack are focusing on enabling enterprises to deploy AI applications. For example, GigaML provides finetuning services for developers, while SimpliSmart and Inferless support full enterprise deployment, focusing significantly on inference optimization. The AI infra stack, like other enterprise stacks, will eventually move towards serverless. However, data privacy concerns may delay this transition. We believe infrastructure abstraction offers benefits like reducing operational complexity, enabling quicker iteration, and efficient resource optimization.

- Data Transformation and Pipelines: The data layer, encompassing ETL, data pipelines, and databases, links LLMs to enterprise data systems. Its importance has grown with RAG becoming the main method for creating Enterprise AI applications, improving output quality by directly interacting with this layer (unlike other techniques like fine-tuning). We also expect the quality of the “info dense” searches to improve significantly as we move towards semantic searches, where the algorithm understands the user’s query context, regardless of medium (text, voice, image). Our investment in Marqo was driven by identifying shortcomings in existing semantic search products, which offer limited functionalities. Marqo offers a comprehensive solution with a vector database, orchestration layer, and model-tuning service.

- Tooling Layer: This includes 1) Tools for Deployment, focusing on managing and orchestrating AI applications — prompt management, model routing and orchestration, and 2) Tools for Observability, designed to monitor run-time LLM behavior and guard against threats. We are witnessing a significant number of companies in both categories. Companies like Ragas are focusing on output evaluation, while companies like DynamoFL aim to make applications compliance-ready by embedding security, safety, and auditability into the AI stack. As more enterprises develop production-ready LLM applications, we anticipate the tooling layer to grow.

Parting Thoughts

We are also actively prospecting other nascent areas in the region. These particularly include AR/VR applications, Quantum Computing, and Semiconductor opportunities. We will share further deep-dives in the future.

* Please note that this list is not exhaustive. We’ve attempted to include a broad range of companies that have achieved significant growth and/or raised external capital. We apologize if we’ve missed any businesses. If you’d like your company to be considered for inclusion in this continually updated market map, please contact us (see below).

Lightspeed India’s Frontier Tech Team brings together decades of experience in prior founding journeys, business and product building, and investing across India and US markets. We have built hardware and software products across application and infrastructure SaaS and developer tools for global companies, including Google, Flipkart, AMD, Stripe, and more, and invested in companies such as Darwinbox, Hubilo, Acceldata, Yellow.ai, Innovaccer, Pixxel, Rattle, Supabase, Sarvam.ai, Portkey, Marqo and many more.

About Lightspeed

Lightspeed is a global multi-stage venture capital firm focused on accelerating disruptive innovations and trends in the Enterprise, Consumer, Health, and Fintech sectors. Over the past two decades, the Lightspeed team has backed hundreds of entrepreneurs and helped build more than 500 companies globally including Affirm, Acceldata, Carta, Cato Networks, Darwinbox, Epic Games, Faire, Innovaccer, Guardant Health, Mulesoft, Navan, Netskope, Nutanix, Rubrik, Sharechat, Snap, OYO Ultima Genomics and more. Lightspeed and its global team currently manage $25B in AUM across the Lightspeed platform, with investment professionals and advisors in the U.S., Europe, India, Israel, and Southeast Asia. www.lsip.com

References:

Fig.1 — [ref]. Fig.2 — [ref]. Fig.4 — [ref]. Fig.5 — [ref]. Fig.6 — [ref]

Authors