This iconic cartoon by Tom Toro was published in the New Yorker on Nov 25th 2012, almost exactly a decade ago. Since then, this innocuous yet ominous graphic has become an exquisite summation of the opposing forces of the climate change movement. On the one hand, we live on a planet with finite resources, and on the other hand, we live in an economic world order that rewards infinite consumption and growth at all costs. The cost often being the very resources the planet has a finite supply of.

In 1776, when Adam Smith published The Wealth of Nations, probably the most influential book on market economics ever written, the world population was under a billion and largely rural. Britain was just entering the first industrial revolution. The combined human progress at that time had hardly any impact on the natural world. Today, when everything is produced, consumed, trashed and reproduced again in the billions of units every year, the same economic order of a rational and free market that Adam Smith helped popularise is pushing us to the brink of civilizational collapse.

We have to be rational though. Corporations aren’t evil or good by themselves. Corporations are built to drive shareholder value and — just like humans — cannot be expected to put themselves out of business to save the planet. The biggest hurdle in going green is therefore our inability to understand the tradeoffs involved. What is the economic cost of a declining honeybee population? Or that of dumping garbage in a lake? Higher costs to the planet have not (yet) resulted in higher prices for consumers because these environmental impacts have been hard to accurately measure. That we cannot measure, we cannot make more efficient, we cannot reduce, or make the case to replace with an alternative.

What if the lowest priced goods were also the ones causing the least environmental damage? The cheapest cars were the ones that ran on environmentally friendly fuel? Cheapest clothes were those that were made from recycled materials? Cheapest food was one that was grown organically without soil-damaging fertilizers? Our work indicates that by accurately measuring the environmental impacts of business practices and bringing it into the core accounting practices of corporations, we can finally start to align incentives in a way that natural market forces can take care of shareholders and the planet alike.

Now is as good a time as any

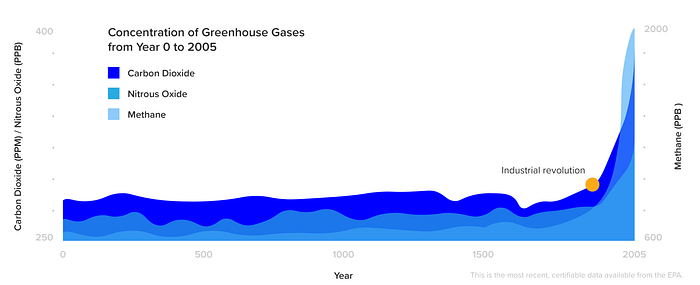

While founders and investors have taken swings at solving climate challenges before, we are hopeful that with more wisdom and experience from prior failures, all the major stakeholders — founders, policymakers, corporations, and consumers — can have more success in this regard in the coming decades. We don’t have much of a choice. In 2019, over 7 million people became climate refugees. The last decade was the warmest on record. Seasons themselves have started to shift. Wildfires, floods, draughts, and hurricanes have all become more frequent and more severe.

It’s not all doom & gloom however. A recent Nature paper [2] indicates that a rapidly falling cost of clean energy and strengthening climate policies could move us away from the worst of the climate future. As of 2022, the countries (~139 in total) that have made their net-zero pledges cover ~83% of global emissions. If these pledges are met, it would result in a best-estimate of under 2C warming by 2100. For example, India intends to get to net-zero by 2070. These targets have subsequently percolated to both large and small companies in India and SEA.

- In India, 75+ major companies have shared timelines to get to net-zero carbon emissions. For e.g. Reliance by 2035, HUL by 2039, HDFC by 2032 etc. In addition, in India, sustainability reporting (which entails publishing the company’s carbon emission) has been made mandatory for every publicly listed company (~1000+ in number). For SMBs in India, any Indian company supplying to a public listed company in US / Europe, is mandated to publish its carbon emission.

- In SEA, while urgency and adherence varies across the region, Singapore seems to be well-ahead of the pack. SGX has started to mandate carbon accounting for listed companies and threaten a delisting for those who do not adhere to this by 2024.

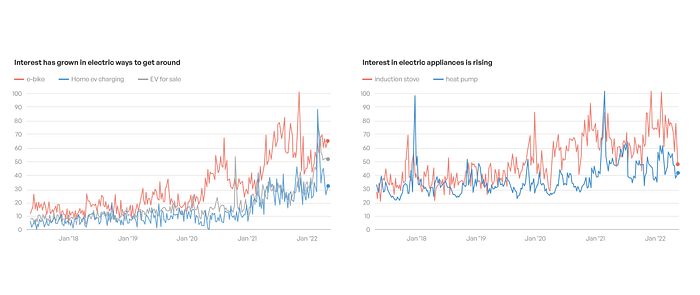

- Climate has become part of the Gen-Z identity thanks to activists such as Greta Thunberg. Search volume related to energy efficient electrical appliances, or electric vehicles, and gas / electricity prices have significantly grown over the last few years.

Underlying all these trends — and what is frankly the most exciting development for us — is the shifting of talent from “not green” to “green” job options. Employees are increasingly acquiring green skills and transitioning into green and greening jobs, resulting in positive net transitions into these jobs. Younger generations are the largest sources of incoming talent into green careers across the world with millennials leading the charge. Companies such as terra.do are helping accelerate this shift. While this volume of talent entering climate-related roles is still too low to have a transformative impact by itself, we are encouraged by these shifts.

Consequently, we at Lightspeed see the spectrum of companies solving for climate broadly divided into four major categories : (1) measuring and reporting your individual or institutional carbon/GHG footprint (2) reducing your footprint through operational or efficiency-related changes (3) replacing your current footprint with more greener options, and finally (4) offsetting whatever remains via directly sequestering carbon or buying credits for it via a marketplace that does sequestration on your behalf.

Given how early the entire climate change category is, there are still a lot of misconceptions around what is needed, what is urgent, and what is sold as a product vs as a service. We attempt to simplify some of this. Where possible, we’ve linked to deeper work or investment theses.

Carbon emission measurement, reporting and management

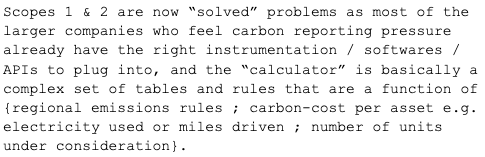

The idea is that you cannot fix what you cannot measure, so, many companies are starting to measure. Measuring (and then managing) your carbon footprint is part science and part art today. For example, if we were to do this for Lightspeed, we’d first find out what are the assets we own and consume — it can be done manually by visiting our offices and someone building a list of “x wooden chairs, y tables, z computers, 2 company cars, xx miles flown/ month, etc”, and then using a rule-engine to translate these assets to their carbon footprint. This direct accounting of our fixed and operating footprint is called Scope1 emissions.

Scope2 involves doing the same exercise with indirect carbon impact: i.e. things we use such as electricity, water, food, that don’t directly cause emissions while we use them (e.g. eating food doesn’t have a carbon footprint by itself), but have emissions as part of their own production.

Scope3 involves reporting the carbon footprint of a company’s supply chain. In the Lightspeed example, it could be the emissions emitted as part of building and transporting the chair or tables we use and, based on regulations, could also include Scopes 1–3 of our investee companies! For most companies — especially ones that rely on a vast supply chain for operations — scope 3 is 70–90% of their overall emissions and measuring it would entail measuring the scope 1–3 of their vendors etc.

The Lightspeed View

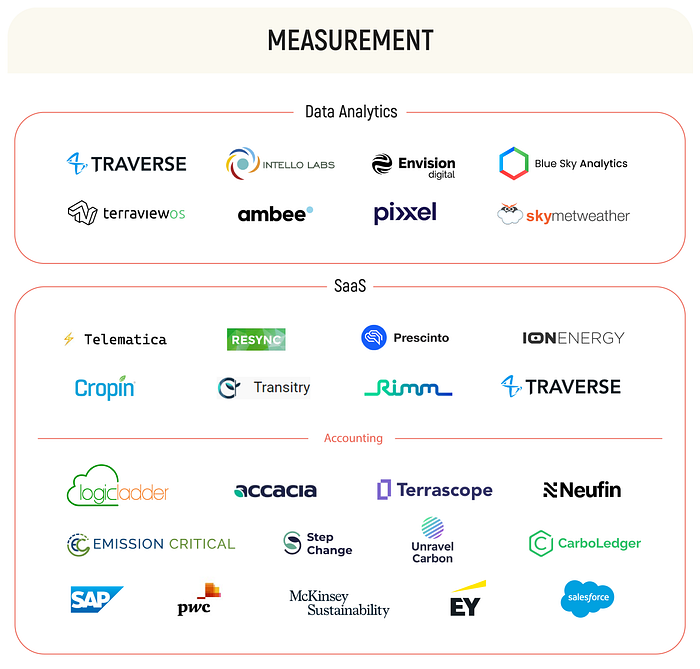

Measurement of carbon footprint is a fairly complex endeavour. Traditionally, consultants have been the first port of call here, but now a number of startups are turning various parts of this complex process into a product or a platform. These include SaaS startups that plug into enterprise ERPs to calculate footprints, IoT companies that measure emissions in the field, and even satellite-data and analytics companies (such as our portfolio company Pixxel.space) that help capture emissions data from space to help companies understand their GHG footprint.

The tech layers startups have added include rapid assessment tools where companies can plug in their own data to calculate their carbon footprints, dashboards that help businesses to monitor progress (and see if they’re doing better than their competitors) and easy-to- purchase, curated ranges of carbon offsets. Some startups, such as Plan A and Sweep, have also built consulting arms to help educate businesses on how to reduce its carbon impact. Larger players such as Salesforce have partnered with the likes of AT&T to provide more detailed assessments by bringing together data from ERPs and IoT devices across the supply chain. Others e.g. Supercritical have developed differentiated positioning around the range of carbon offsets they offer, or around the industries they are targeting, e.g. Accacia for Real Estate, or companies going for regional domination e.g. Unravel Carbon in SEA.

While it is not possible to dive into every one of these categories here, we wanted to provide some more colour on Carbon measurement and reporting SaaS tools since this is where most companies need to begin their net-zero journey.

Carbon SaaS Platforms

For these GHG/carbon accounting and reporting platforms, there are already a few large players in the US/EU but SEA/India is still wide open. For APAC (minus China), we believe the overall SAM for just software is somewhere in the $1–2B range. This assumes that most publicly listed companies and seriesB+ funded companies would start feeling pressure to get to net-zero in the very near term. The SAM is likely to grow to $7–10B by 2030 assuming (a) wider growth in overall number of companies wanting to report carbon footprint — especially the SMBs and (b) 2–3x ACV expansion up from $50–100K/year for public enterprises and $25–50K/year for private series B+ companies today. Both are reasonable expectations in our opinion and we already see some of our portfolio companies spend $200–400K / year on these technologies.

We believe a mix of founding team with deep carbon consulting network or experience and a very easy to use product that solves for scopes 1–3 (especially scope-3) will be critical to success. A strong vertical-focus to build the accurate and deep supply chain models for the carbon-emissions will also help but the role of data will be limited in early years. And finally, a strong channel partnerships approach especially with the Big 4 will be important to co-sell / bid for larger RFPs. The bar for winning in this category is high. Several large corporations e.g. SAP, Salesforce, as well as the Big 4 are active in this category (and in India/SEA) and have built their own softwares with an army of consultants pushing it into client workflows.

It is worth noting that the carbon accounting / measurement category is likely to be highly competitive. In the last 2 years, a number of carbon offset and accounting startups have really taken off — in India we saw 5–6 funded new companies in 2022 alone; in EU, Sylvera, Plan A, Sweep, Supercritical, Normative, Vaayu and several others exist; the US has a lot more.

Founders entering this category will have to have a strong POV on how they’ll defend their territory against a larger, better capitalised global player entering their region. Alternatively, if they plan to enter the US or EU, they would need partners who can open up access to customers, talent, and capital.

Carbon/GHG reduction via removal and recycle

Once a corporation has started measuring its GHG/carbon footprint, the next thing they want are recommendations on how to reduce, replace, or offset it. Multiple plays are emerging in this category. In India, large players such as ITC are paving the way and have already become carbon net-zero. We spoke to a variety of big corporations such as ITC, DBS, InBev, as well as our friends at McKinsey, PwC and EY to arrive at a few broad learnings.

Reduction via operational efficiency improvements — contributed to 30–40% reduction at companies such as ITC. The spend here will again be a combination of (a) Consultants and SaaS companies that will recommend ways to fix over-spending (e.g. “your electricity consumption in factory-3 >> that in factory-1 while both are at similar output”) and (b) actual implementation projects that will make existing operations more efficient e.g. a drip-irrigation project for a farm-to-fork agri produce company or installing new brake-pads for a fleet of trucks for a full-stack logistics company.

Reduction via recycle / replacing with greener options — contributed to 40–50% reduction at ITC primarily due to installing solar panels and reducing coal-based electricity. This category of recommendation could range from building a circular economy for an apparel company, or executing a replacement strategy from coal to solar, or ICs to EVs, or carbon sequestration technologies installed in factories or farms to sequester air- or soil-based carbon.

The Lightspeed View

Asyou can guess, there are a lot of consultative elements to this category and much of the actual spending will be captured outside of any SaaS tool. While our assessment for the TAM for SaaS tools to measure and monitor carbon is in the $1–2B range (for APAC minus China) going to $7–10B by 2030, the TAM for reduction and removal can be in the 100s of billions of dollars. Some of the investment areas in this category — e.g. pure consulting or inventing new forms of nuclear fusion sources — may either not be venture appropriate or be better served by government research grants. That said, we believe this category is critical to solve the climate crisis and potentially high risk/reward from a venture perspective. We are interested in exploring a variety of solutions — e.g. carbon sequestration from air/soil, green fuel-cells and/or materials, EVs, solar, water and waste recycling tech and more.

Again, not possible to dive into every one of these categories here, but we wanted to provide some more colour on electric mobility/EVs since road transport contributes to almost a fifth of total carbon emissions in India.

Electric Mobility

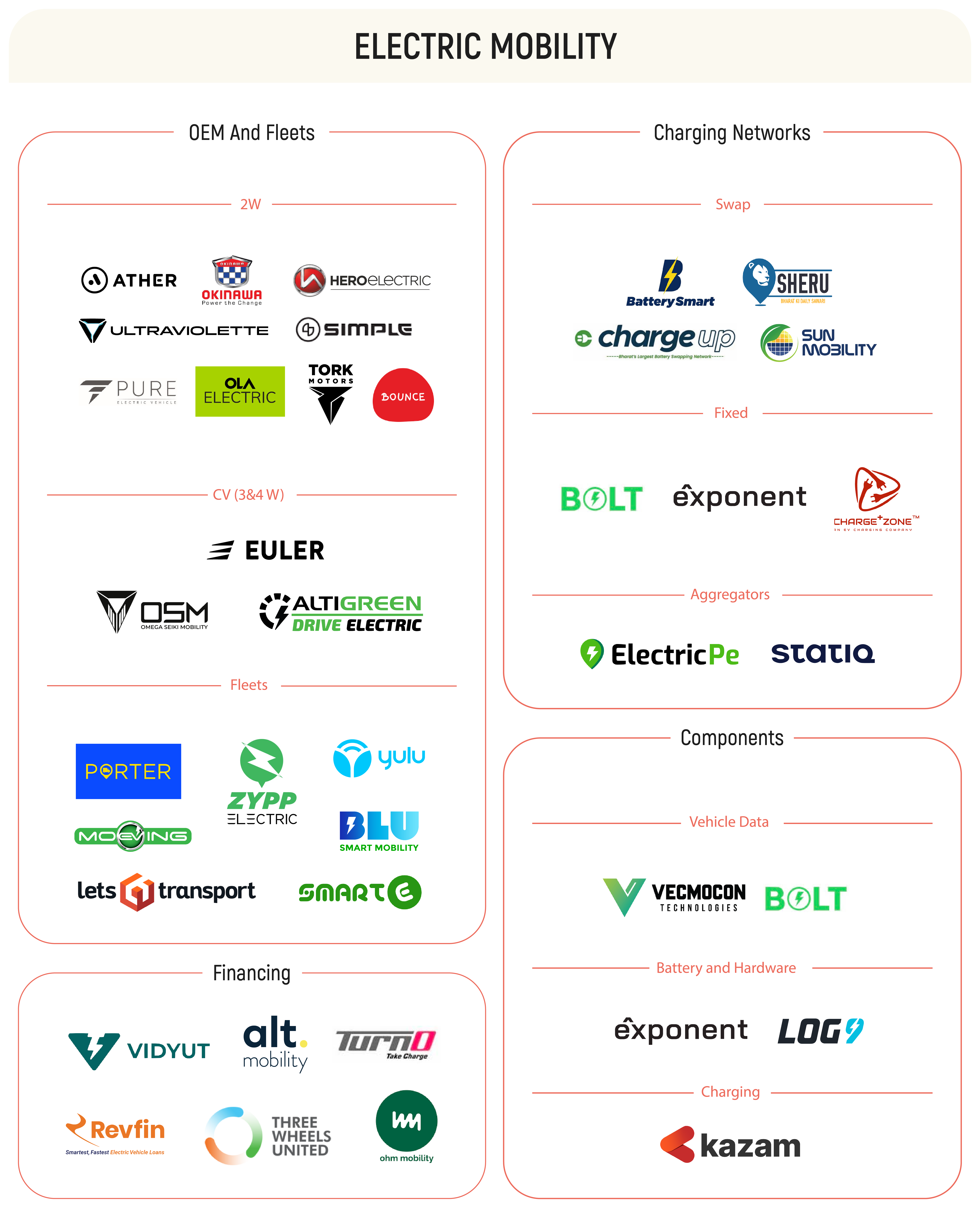

The EV revolution is already underway in India/SEA. Unlike the west, we believe that the story of EV adoption in India will be written by commercial vehicles (eCVs) due to a clear TCO advantage. These will initially be 2-wheelers and light 3-wheelers, followed by 4-wheelers as batteries and motors get more advanced and cost-competitive with ICE vehicles. We see a clear opportunity for new OEMs to emerge and create market-leading products with differentiated design and service.

A majority share of these vehicles will be ‘smart’ and will generate data. This will open a new class of auto supply chain startups that capture and provide analytics on data, potentially providing remote diagnostics and monitoring state of battery among other value-add services. The generation of data will also revolutionise financing and ownership models. Financiers understand the residual value of an ICE vehicle, allowing them to underwrite the vehicle and the owner. However, given the opacity of the residual value of an EV, financiers underwrite the owners leading to high financing costs. In the future, purely vehicle-driven underwriting will also spawn lease models of ownership with features such as pay-as-you-go among others.

Lastly, we are seeing significant progress in the build-out of charging networks. While swapping has made headway in commercial 2Ws and 3Ws (especially e-rickshaws), fast- charging networks are expanding as well. We believe that most charging infra will be interoperable over time to maximise efficiency. This will lead to new business models in charging networks, including aggregation, software layers to enable payments, and identity authenticators among others. Our portfolio company, Exponent Energy is a good example of bringing this ecosystem together. Their proprietary BMS unlocks high battery performance allowing 15-mins fast charge, through their network. By reducing the time for a full charge, OEMs can put smaller battery packs in vehicles, reducing upfront costs. Given connectivity, battery performance can be tracked, allowing them to be underwritten by financiers.

While unfavourable unit economics and range anxiety have impeded growth, these are now being addressed. We are seeing both rapid technological progress and a sustained policy push. The price of batteries (40–50% of EV cost) is today at $132 KWh, down 87% through the decade. At the same time, advances in cell chemistry and battery management systems (BMS) are unlocking fast charge capabilities. On the policy front, the FAME II subsidy scheme for EVs has played its part by reducing the upfront costs further. The Indian government has also laid down guidelines providing clarity on charging tariffs and enabling infrastructure.

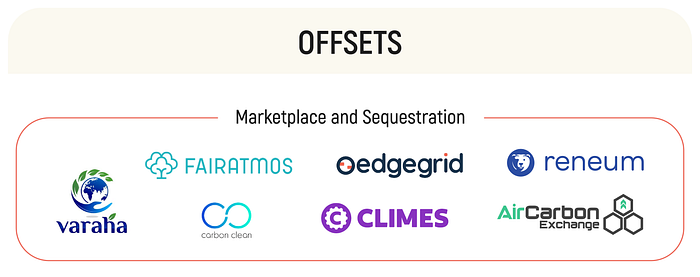

Carbon/GHG offsets

Reduction via Offsets or direct sequestration — whatever companies cannot reduce via efficiency improvements, recycling, or equipment upgrades, will be solved via companies “buying their way” in net-zero. So they’ll either buy carbon capture technologies and install it next to their warehouses or factories, or go to a carbon marketplace and buy additional credits to get to neutral. Buying your way into net-zero is also possible without doing any of the hard work entailed in making operational changes, but it’s frowned upon and will likely go out of fashion over time.

The Lightspeed View

The demand for carbon offset marketplaces specifically has been steadily increasing in India: less than $50M worth of credits were traded in India in 2017–18; 2021 saw $300Mn worth of credits being traded. McKinsey projects $10Bn worth of credits may be traded in India alone by 2030. The Indian government is also planning to build its own carbon exchange, so the opportunity here may be promising but limited. We are looking for founders with a deep understanding of the local regulations and those that have prior experience shoring up complex supply (e.g. solar, biogas) to kick off the liquidity flywheel.

Parting thoughts

Weat Lightspeed India have been evaluating climate investments since 2019. That exercise has been both sobering and alarming. Capitalism is part of our job profile so it hasn’t been easy to come to terms with the role we as venture capitalists might have played in damaging our world. Large amounts of venture and entrepreneurial resources have gone to help serve more targeted advertisements to drive overconsumption of things — clothes, gadgets, household items — that are themselves built to last only a few years by design.

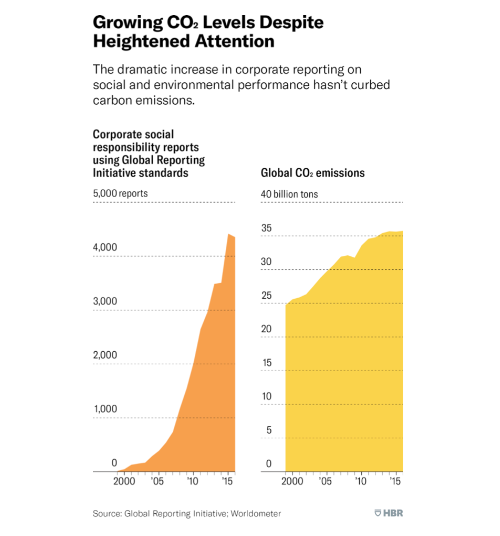

While there have been a lot of investments that have gone into climate tech recently, we have to be intellectually honest. Sustainability as a trendline has inflected lately, but it’s a 20+yr old trend. During these 20 years, on one hand the number of companies filing CSR reports has grown 100x, and on the other hand carbon emissions have continued to rise[5].

What this indicates is that measuring and reporting alone is insufficient. The right solution will report and reduce carbon footprint without this coming at the expense of top-line growth. We advise founders to avoid cul-de-sac approaches that focus on only reporting or take a narrow and easy view of this category that will fall out of favour under broader scrutiny and challenge. We also have to recognize that free markets alone won’t solve these challenges. A strong push from investors, policymakers and the general public are also needed for success. Founders who ignore or cannot influence these stakeholders will fail despite best intentions.

Climate change is simultaneously the most pressing and the most ignored problem in the world. In the venture business, we care a lot about “timing the market” — too early and you make no money, too late and everyone makes very little money. However, we believe that in the case of climate change, timing the market would be an incorrect and dangerous strategy. This category would require long-term and patient capital.

At Lightspeed, we manage over $18B of AUM globally and can be very long term partners to founders who are willing to dedicate their lives to solving “climate related problems”. If you are one of those founders, we would love to hear from you. Please reach out to us at lsip.com/team.

An easy-to-share PDF for the blog available here

Meanwhile — and because it’s topical — we’ve been playing around with hugging-face/stabilityAI and here is a sample of what comes out when you prompt the AI to paint a picture of a futuristic post-apocalyptic earth in the style of Hayao Miyazaki.

References:

[1] EPA data

[2] https://www.nature.com/articles/d41586-022-00874-1

[3] https://www.protocol.com/climate/google-trends-home-climate

[4] Linkedin green economy report - 2022

[5] WorldoMeter

About Lightspeed: Lightspeed is a multi-stage venture capital firm focused on accelerating disruptive innovations and trends in the Enterprise, Consumer, and Health sectors. Since 2000, Lightspeed has backed entrepreneurs and helped build companies of tomorrow, including Snap, Hasura, OYO, Affirm, AppDynamics, Nutanix, Supabase, Byju’s, and Udaan. Lightspeed and its affiliates currently manage more than $18 Billion across the global Lightspeed platform, with investment professionals and advisors in India, Silicon Valley, Israel, China, Southeast Asia and Europe.