The recent passage of the GENIUS Act was the regulatory spark needed to catch-up to a market that has already started to reimagine global finance. A new generation of builders are constructing the next-generation of financial services at a faster pace than ever before. As Federal Reserve Governor, Chris Waller reminded the crowd at A Very Stable Conference, which Lightspeed co-hosted earlier this year, “The beauty of financial innovation is that if a market demands such an asset, someone will figure out how to supply it. Thus, stablecoins were born.” Stablecoins aren’t just meeting market demand, they are creating entire new markets that couldn’t exist in the legacy financial system.

This is Money 3.0 – founders who intuitively grasp the fusion of financial services conventions and blockchain primitives, and know how to rewire the system in real time.

The Opportunity & What Gets Us Excited

- Money3.0 founders solving for trust at scale.

- The best builders have deep financial services expertise and sharp opinions on where the market’s heading.

- They architect technical frameworks with one key underpinning in mind: inherent trust across the financial network.

- They treat compliance and risk as core differentiators, not operational headaches, and embrace these constraints to empower their creativity.

- They respect the history of why the financial system was built the way it is today, but have a fervent bias towards driving the inevitable restructuring of global finance.

- Platform business models are the only differentiated moat in the long term.

- Single-use stablecoin applications are already commoditizing. The enduring value will accrue to platforms that create network effects — where each additional user makes the service more valuable for all users.

- Founders building core infrastructure today can layer additional services and capture disproportionate value over time.

- Non-crypto traction signals real PMF.

- The most compelling opportunities have growing commercial pull from US-domiciled prospects and traction outside the crypto ecosystem.

- True PMF is when customers use your product despite it being built on blockchain, not because of it.

Stablecoins didn’t emerge from regulatory mandates or technological push, they emerged because the existing system was designed for a pre-digital world. The legacy financial rails were built for batch processing, correspondent banking relationships, and physical settlement. Stablecoins represent a fundamental architectural shift: from batch to real-time, from correspondent to peer-to-peer, from physical to programmable.

The numbers are hard to ignore. Stablecoin market cap hit $232 billion in March 2025, up 45x since December 2019, with projections pointing toward $400 billion by the end of this year. Additionally, many relevant banks, public companies, and fintech startups are taking a deeper look. We expect that volume and interest only to grow with the GENIUS Act, which was passed by Congress with bipartisan support and built regulatory guidance around “payment stablecoins.”

The Four Pace Layers that are Eating Finance

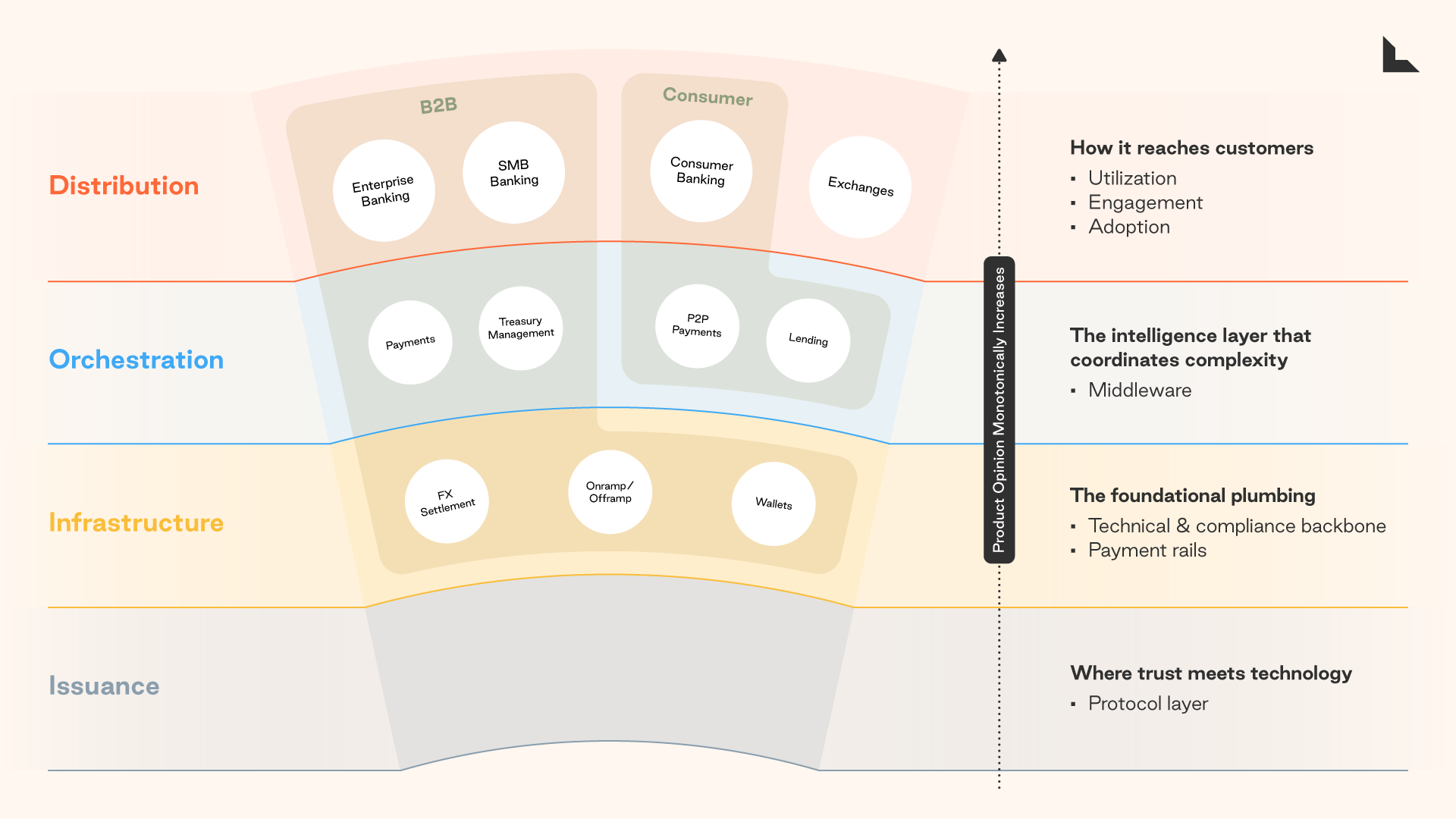

At Lightspeed, we’ve identified how the stablecoin ecosystem creates compounding value through four distinct layers.

Our market structure reflects pace layering: the layers at the bottom move through slower, methodical evolution, while the layers at the top operate in a faster and broader cycle to fuel mainstream reach. Each layer is functionally different from the other and operates separately, but each influences and responds to the layer adjacent to it. As product opinion monotonically increases alongside the pace of each layer, innovation compounds, making every layer essential to building a durable, dynamic system powered by stablecoins.

- Issuance is the layer where trust fundamentally stems from as companies create and manage stablecoin protocols. While Circle and Tether make up most of the concentration, we see opportunity for specialized issuers targeting specific geographies, assets, and use cases.

- Infrastructure is the technical and compliance backbone every stablecoin company needs: FX settlement, wallets, custodial storage, on/off ramps, and data analytics. There can be a “same, same but different” problem here — everyone’s rebuilding or leveraging similar infra stacks.

- Orchestration is where stablecoin use cases are actualized. It’s a middleware layer that translates to B2B payments, treasury management, and emerging use cases like agentic AI payments. This is naturally and by far the most competitive layer, and the winners here need to have clear, long-term product opinion.

- Distribution determines how stablecoins reach end users and fuel utilization, engagement, and adoption. Today, this is done via platforms like exchanges, enterprise banking, SMB banking, and consumer banking. The winners here achieve massive scale through superior distribution strategies.

From our conversations with founders and builders across these layers, we have seen many companies go after the middle layers (infrastructure and orchestration) because there is a natural PMF pull; however, we believe the middle layers are becoming commoditized faster than anyone expected. If you are building infrastructure or orchestration tools, you’re fighting an increasingly brutal margin compression battle as new competitors enter the space.

We believe the real value capture happens at the edges — issuance (where network effects and regulatory moats matter) and distribution (where end user relationship and specialized workflows create defensible differentiation).

To Lightspeed, the stablecoin market today represents a rare combination of massive scale opportunity, clear product-market fit, and favorable regulatory momentum. For founders building in this space, the question isn’t whether stablecoins will succeed; it’s whether they can build the generational platform, serve a new financial market, or create the infrastructure that becomes essential for the next phase of global finance.

At Lightspeed, we’re actively spending time with and investing in exceptional founders that are rewiring global finance. If you’re building in and around stablecoins, we’d love to hear from you. Reach out to us on the Fintech team — Kat Zhang, Aaron Frank, and Justin Overdorff.

The content here should not be viewed as investment advice, nor does it constitute an offer to sell, or a solicitation of an offer to buy, any securities. The views expressed here are those of the individual Lightspeed Management Company, L.L.C. (“Lightspeed”) personnel and are not the views of Lightspeed or its affiliates; other market participants could take different views.

Unless otherwise indicated, the inclusion of any third-party firm and/or company names, brands and/or logos does not imply any affiliation with these firms or companies.

Authors