While we’ve seen a wave of innovation across the CFO suite over the last few years, Accounts Receivable (AR) remains the “forgotten module” of modern finance. The status quo for billing and invoicing is highly manual and bespoke, given the heavy variance in contract formatting. A vast majority of companies still do their AR workflow in the ERP system manually – requiring manual entry of contract terms, silo-ed data from various point solutions, and manual generation of invoice schedules and bill tabulations. A typical firm spends $250K+ on employee cost to handle the manual workflow and implements 4-5 different point solutions. Even with these processes in place, 80% of invoices are not paid within their contracted payment terms.

The global B2B market processes around $125 trillion of transactions globally, with $25 trillion located in the US. Millions of venture dollars have been spent to modernize the Accounts Payable process for these transactions, yet streamlining AR is just as large of a challenge. The global Accounts Receivable (AR) Automation market is expected to reach $6.5B in 5 years, growing at a CAGR of 14.2%.

Previous attempts to digitize AR have been met with two main barriers: (1) reliance on structured data integrations between ERP and CRM, which is customized and expensive, and (2) companies’ prioritization of growth over executing on the collections process.

Enter Tabs.

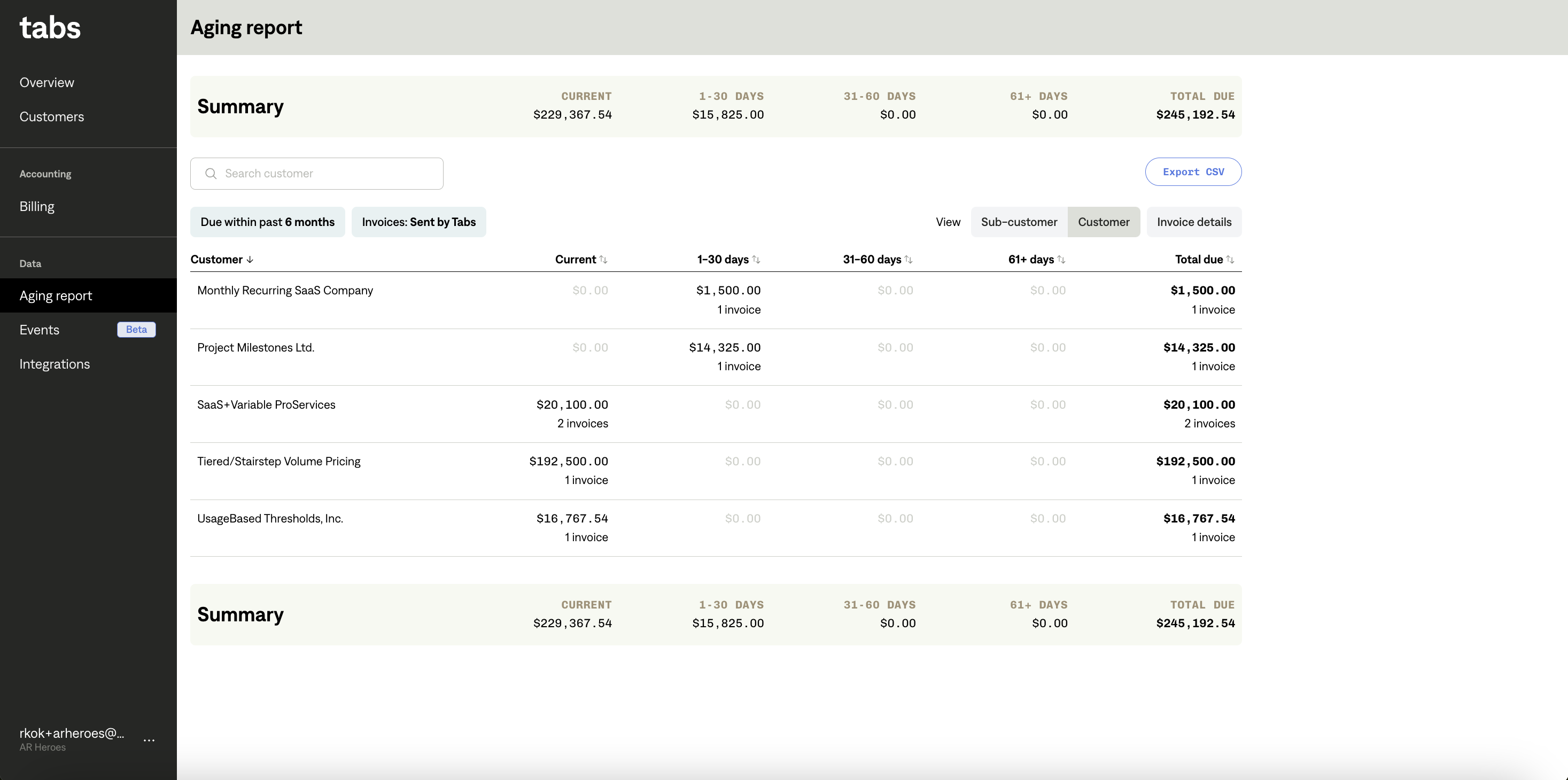

Founded in 2023, Tabs is the first and only purpose-built “Contract-to-Cash” platform that automates the tedious and time-consuming invoicing and collections process to create a more modern digital payment experience. Specifically, Tabs’ AI-enabled platform automates billing administration (document management, billing schedules, invoice creation), communications and dunning (streamlines collections and decreases overdue payments), and payments and reconciliation for businesses. Tabs leverages LLMs to automatically extract commercial terms from signed contracts, generate billing schedules and auto-compute invoices. It also handles communications on an ongoing basis, automating invoice delivery via email or to the Accounts Payable portal, removing friction and speeding up time to payment.

With Tabs, companies have one end-to-end software to handle all AR workflows, helping users save time, resources and dollars on revenue management, improve their cash conversion conversion cycle, decrease bad debt and collections issues and ultimately collect funds faster. Moreover, the company has an exciting long-term vision of expanding into an AI-powered Finance CRM, building on their initial products and deployments to provide a slate of solutions to make life easier across the board for the unsung heroes in the finance department.

In less than two years of operating, the company has already made a name for itself in the accounts receivable space among finance teams across various industries and company sizes. Tabs’ impressive initial traction, technology development and leadership team make them an sciting innovator poised to capture an underserved market, and we’re honored to lead their $7M Seed round.

Tabs was founded by Ali Hussain and Deepak Bapat. Prior to founding Tabs, CEO Ali Hussain worked at Latch as COO, growing the company from Seed to IPO during his tenure. In this role, he dealt with the complexities of accounts receivable processes first-hand, giving him a deep understanding of the operational challenges and inefficiencies in AR. Meanwhile, CTO Deepak Bapat spent 13 years in software engineering – most recently at Latch as Director of Software, developing a sophisticated operating system built with a bevy of useful integrations. Together, the Tabs team has a deep understanding of fintech and product through roles at companies like Microsoft, Plaid, Peloton and Yext.

We’ve had the pleasure of getting to know Ali and Deepak over the last year. We’ve watched them rapidly refine the product and ramp up customers seamlessly onto the platform. The founders’ deep domain expertise and tireless dedication to customer satisfaction are unmatched in the ecosystem, and we believe they are in a compelling position to solve a real business challenge that’s gone unaddressed for too long!

Authors