03/17/2022

Our Investment in Treehouse Finance

Empowering DeFi users to confidently navigate the space

Today we are proud to announce our investment in Treehouse — a company on a mission to deliver data, analytics, and risk management solutions to everyday DeFi investors. Over the years, Lightspeed has invested in over 50+ crypto / blockchain companies across the world, including the likes of FTX, Wintermute, Solana, Pintu, Alchemy, DeversiFi, and Blockchain.com. We continue to be bullish on the broader crypto ecosystem (see our market map here and here) as well as the APAC region from where some of the best crypto entrepreneurs are emerging.

Our investment in Treehouse is anchored, first and foremost, in its founders and the team. Brandon, Ben, and Bryan together have world-class TradFi experiences from Morgan Stanley, Point72, BNP Paribas, and several founding journeys in their past. They also move at “crypto speed” without losing execution quality; having their headquarters in Singapore, but quickly setting up presence in cities such as San Francisco, Beijing, Ho Chi Minh, and Hong Kong. In just the last few months since our investment, they have 2x-ed their team, added support for ETH, AVAX, FTM; and piloted with large institutional clients. The Treehouse Telegram channel also has one of the highest quality daily crypto and TradFi market commentaries in the ecosystem.

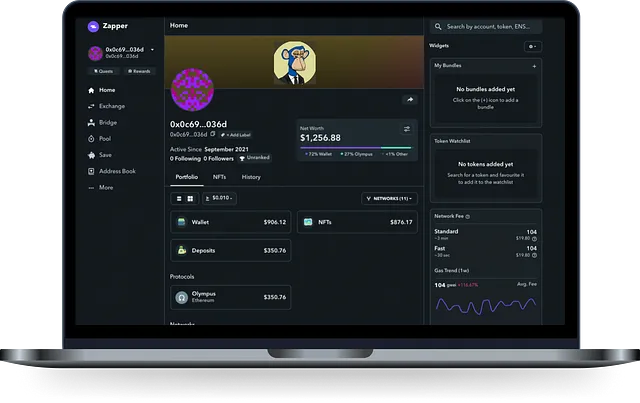

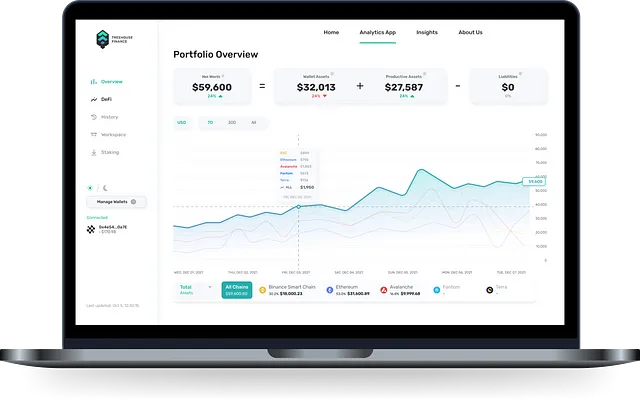

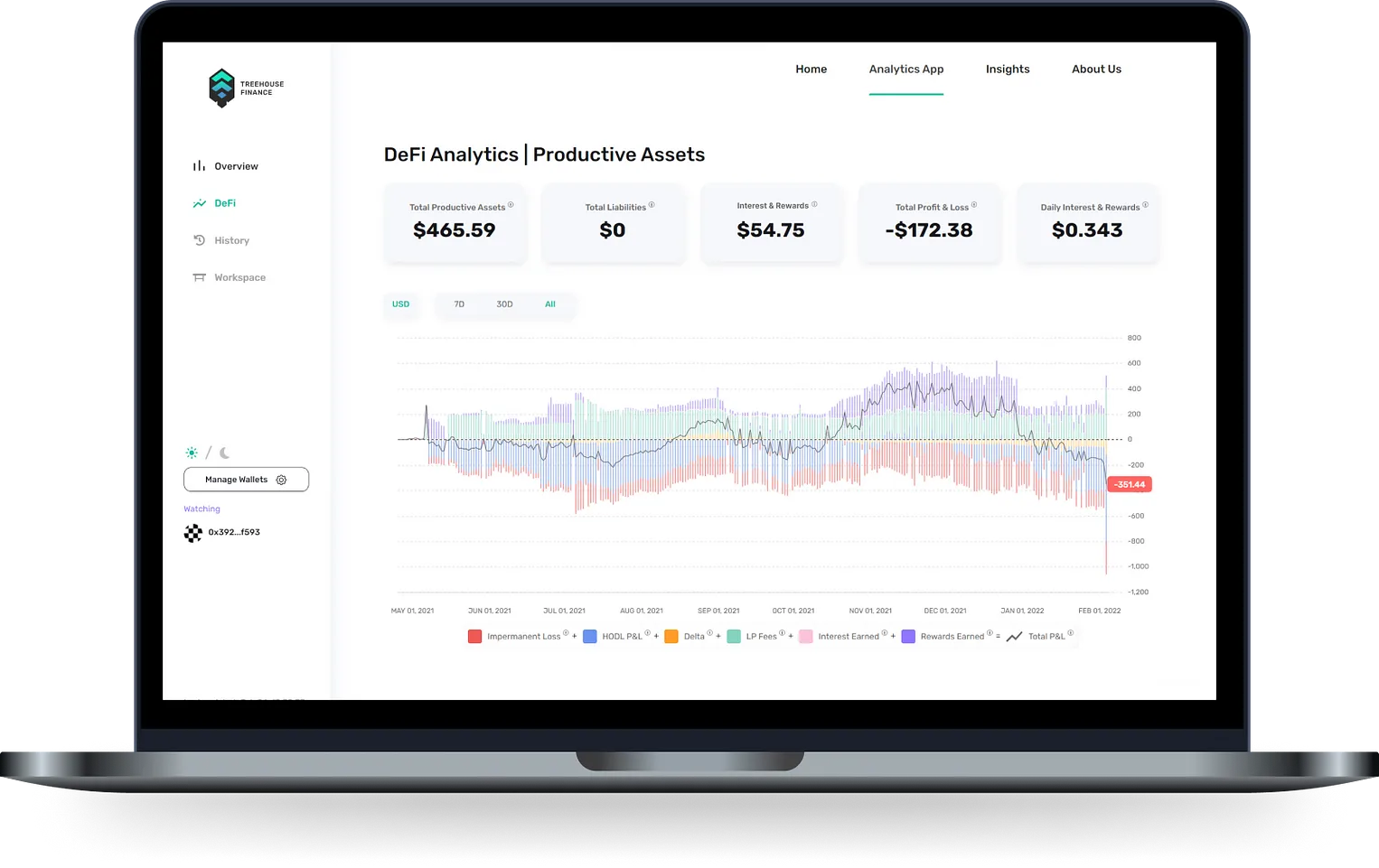

The second is Treehouse’s technology. There are various DeFi dashboards out there, but all of them give you a point-in-time view of your wallet — they can only tell you what your holdings are at that moment. To keep track of your holdings continuously would mean calling dozens of chain-specific APIs, pinging all your wallets every few minutes, and building a time-series view of your holdings. It is technically challenging and expensive. These dashboards risk getting throttled or locked out by protocols as the number of supported wallets scales to the millions, leading to millions of API calls per minute. We believe Treehouse solves this the hard and the right way: running and indexing their own nodes to allow for a historical view of your wallet. This is why their dashboards are far more accurate, user-friendly, and provide a degree of information previously unavailable in any other DeFi dashboard globally. See below for a comparison between a leading DeFi dashboard vs. Treehouse.

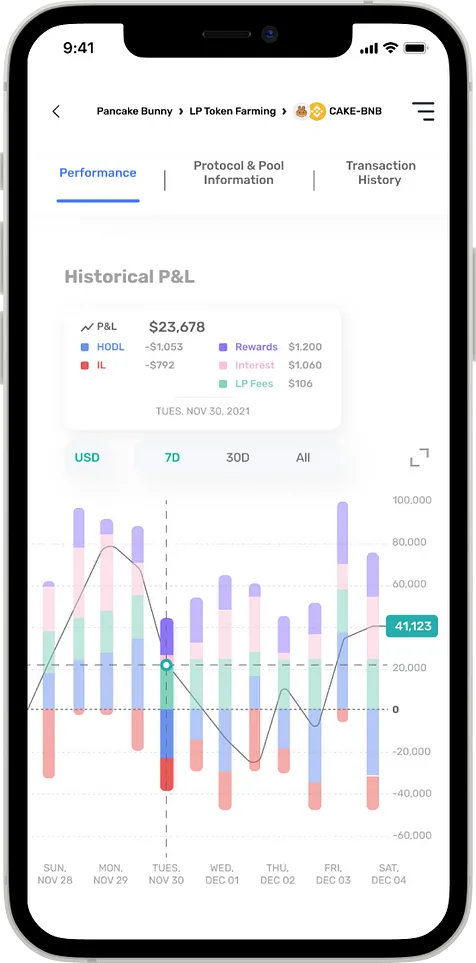

Finally, we believe strongly that the need for such a solution is now urgent and widespread. Individual DeFi products are complex, hard to access, and offer a variety of use cases in a fragmented manner. A single user may be holding a position on multiple chains, putting money into various yield farms, staking cryptocurrencies across a variety of protocols, and holding crypto in multiple wallets. DeFi users today are tracking their positions using Excel, and it is impossible to understand their P&L and risk without a lot of manual calculations.

Monitoring DeFi assets across different chains requires a highly complex process, and Treehouse is solving this one blockchain at a time, starting with BNB Chain, Ethereum, Avalanche, and Fantom. The company’s systems are connected to live nodes and modelled after TradFi institutional databases, ensuring consistently accurate and reliable data. As the number of DeFi protocols, supported L1s, L2s, and bridges increase over time, Treehouse’s approach of building an in-house system-of-record for every DeFi user will become critically valuable and a great differentiator. On top of the technical accuracy is a beautiful, simplified dashboard experience optimized for desktop and mobile to cater to both advanced and retail investors.

DeFi took off in 2021, with over $200B+ TVL (vs. $2B in mid’20). MetaMask, the largest DeFi wallet, has +21M MAUs (+38X vs. 2020). Treehouse will first focus on the ‘prosumer’ DeFi users (wallet wealth >$50K) with the eventual goal to onboard the long-tail of retail DeFi users. We are excited to go on this journey with the Treehouse team alongside amazing partners such as Binance, MassMutual Ventures, Jump, GSR, Wintermute, and Bybit.

— Hemant Mohapatra & Marsha Sugana

About Lightspeed: Lightspeed is a multi-stage venture capital firm focused on accelerating disruptive innovations and trends in the Enterprise, Consumer, and Health sectors. Since 2000, Lightspeed has backed entrepreneurs and helped build companies of tomorrow, including Snap, Affirm, AppDynamics, OYO, Nutanix, Byju’s, and Udaan. Lightspeed and its affiliates currently manage more than $10 Billion across the global Lightspeed platform, with investment professionals and advisors in India, Silicon Valley, Israel, China, Southeast Asia, and Europe.

Authors