01/16/2025

AI

New York Tech Keeps Rolling: 2024 Insights

New York’s 2024 rebound sees $18.7B raised, AI/ML sector expanding, and venture capital returning to 2020-era trends with a renewed focus on growth-stage deals.

New York City is cementing its position as the world’s second-leading startup ecosystem, trailing only the Bay Area — and its influence in AI/ML is growing. In 2023, we wrote our State of New York Tech Report, highlighting the city’s resilience and adaptability in the face of fundraising declines.

Fast-forward to 2024, and we’re seeing a robust rebound: New York-based startups raised $18.7 billion across 869 deals, signaling a return to pre-pandemic venture capital trends.

Here are some of our key takeaways from this latest phase of New York’s tech resurgence:

Steady deal flow for NYC startups

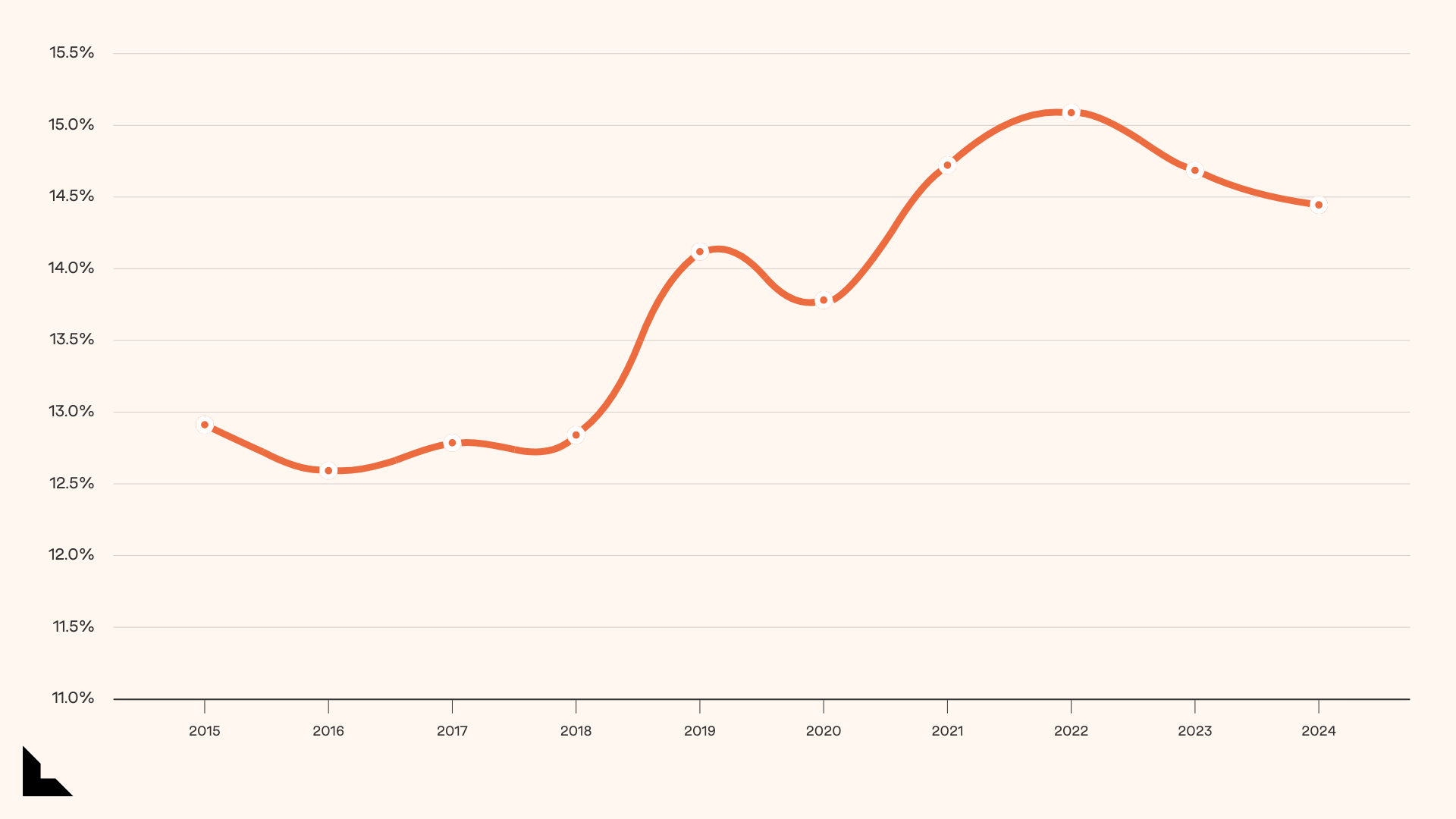

New York startups’ share of U.S. fundraising remained steady at 14% of total deal count, though their share of invested capital dipped slightly from 14% in 2023 to 13% in 2024.

NYC’s emerging AI/ML hub

While the Bay Area remains the leader in AI/ML funding and talent, New York is gaining ground, accounting for 14% of the U.S. Seed and Series A fundraisings in AI/ML. NYU and Columbia serve as prominent AI and machine learning hubs, continuing to contribute to the rich AI/ML research ecosystem.

New York also has a growing roster of AI companies headquartered in the city, including DataDog, UiPath, Dataiku, Dataminr, Cyera, Grafana, Hebbia, Modal, Reflection, Pinecone, and Tennr. On the talent front, 10% of all U.S. AI tech jobs are now based in New York.

Diversifying sector strengths and tech talent

Fintech remains a major pillar in New York, capturing 36% of U.S. fintech fundraising in 2024, up from 25% the prior year. Lightspeed has continued to lead in this sector, announcing investments in Noetica, Tabs, Casap, Farther, and Finaloop.

Beyond fintech, other sector strengths include eCommerce, Blockchain, AdTech, Real Estate Tech, and InsurTech. Within the broader Lightspeed NYC portfolio, we’ve announced investments in Wiz, Daily Harvest, Grafana Labs, Tennr, Axonius, Beehiiv, Chaos Labs, Eon, Keychain, Table22, and more.

Additionally, companies are recruiting engineering roles alongside traditional product and go-to-market talent, with notable expansions by OpenAI, Anthropic, and Google’s Hudson Square office.

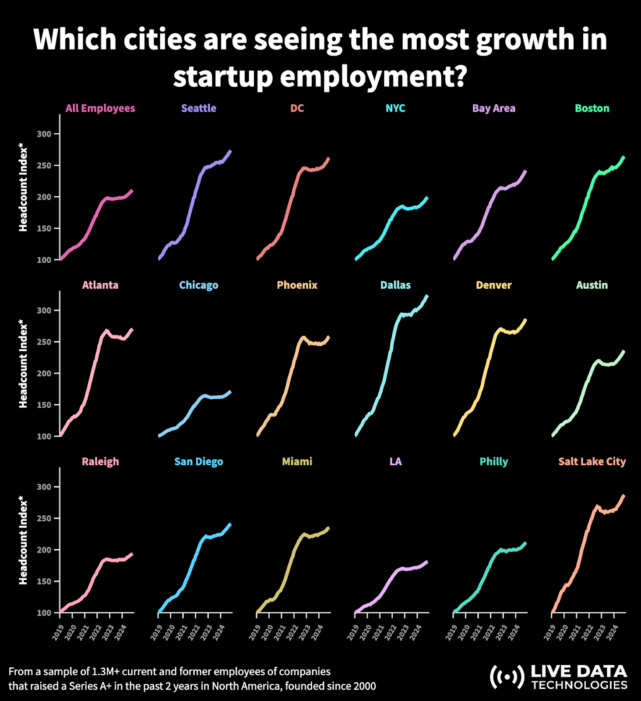

Looking at startups that have raised a Series A in the past five years in North America, the headcount of these companies in New York has doubled since 2019.

Historical boundaries between industries — healthcare in Boston, financial services in New York, and tech in the Bay Area — are increasingly blurred.

Continued European NYC expansion and VC activity

New York’s tech ecosystem has become a gateway for international companies seeking a U.S. foothold. We continue to see European companies open NYC offices (e.g., Anterior, Contentsquare, DeepL, ElevenLabs, Hyperexponential, RobinAI, Sylvera, and Taktile).

Meanwhile, more VC funds are setting up shop — of the 70 VC funds under $200M announced in 2024, 20 were in NYC (on par with the Bay Area’s 20). Note, amid this evolution, many observers see a “bifurcation” emerging across venture capital with giant, multi-stage funds on one side and smaller, specialized funds on the other. In this environment, the seed-stage venture fund market has become increasingly important to fuel future growth.

The shift to growth-stage investing

Venture capitalists are prioritizing quality over quantity, favoring fewer but larger deals. While early-stage investments declined, growth-stage rounds saw a resurgence in deal volume:

- Series B: +39% YoY

- Series C: +39% YoY

This late-stage activity has been encouraging, offering much-needed liquidity amid a muted IPO market and subdued M&A activity. Despite the availability of capital, this indicates a shift towards larger, more concentrated investments in promising startups.

We’re also seeing a tighter geographical focus at later stages of funding — namely, in tier-1 cities like the Bay Area, New York Metro, and Boston.

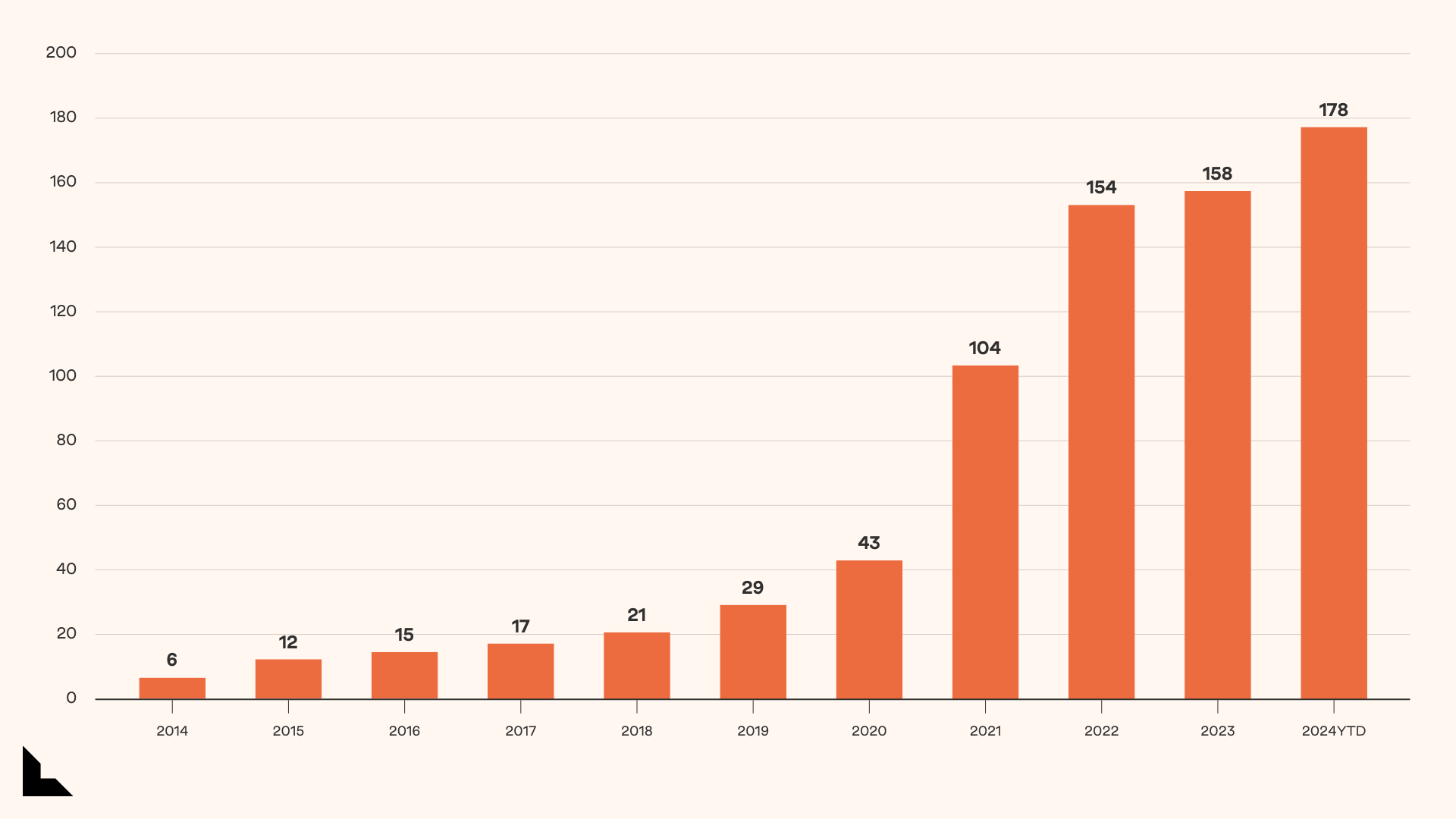

The New York Metro area now boasts 178 unicorns, a 13% rise from 2023, driven by notable additions in healthcare, AI, and SaaS.

NYC investment activity: A deep dive into the numbers

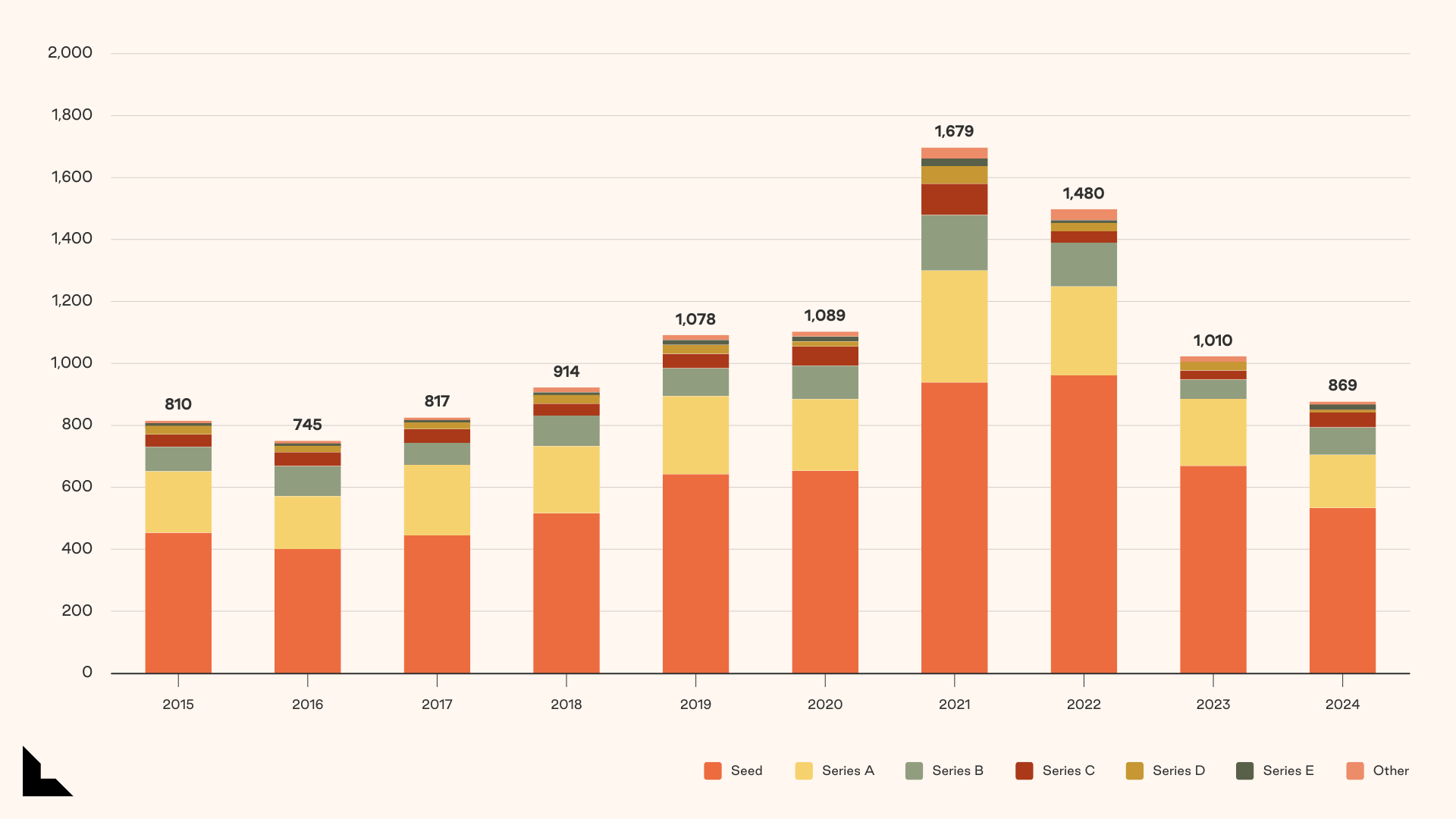

Number of investments

In aggregate, there were 869 deals in New York-headquartered startups, representing a 14% decline year-over-year (YoY). Early-stage funding took the biggest hit, with Seed and Series A investments dropping by 19% and 23%, respectively.

- 535 Seed and 165 Series A deals were closed.

- 92 Series B, 39 Series C, and 38 Series D+ investments.

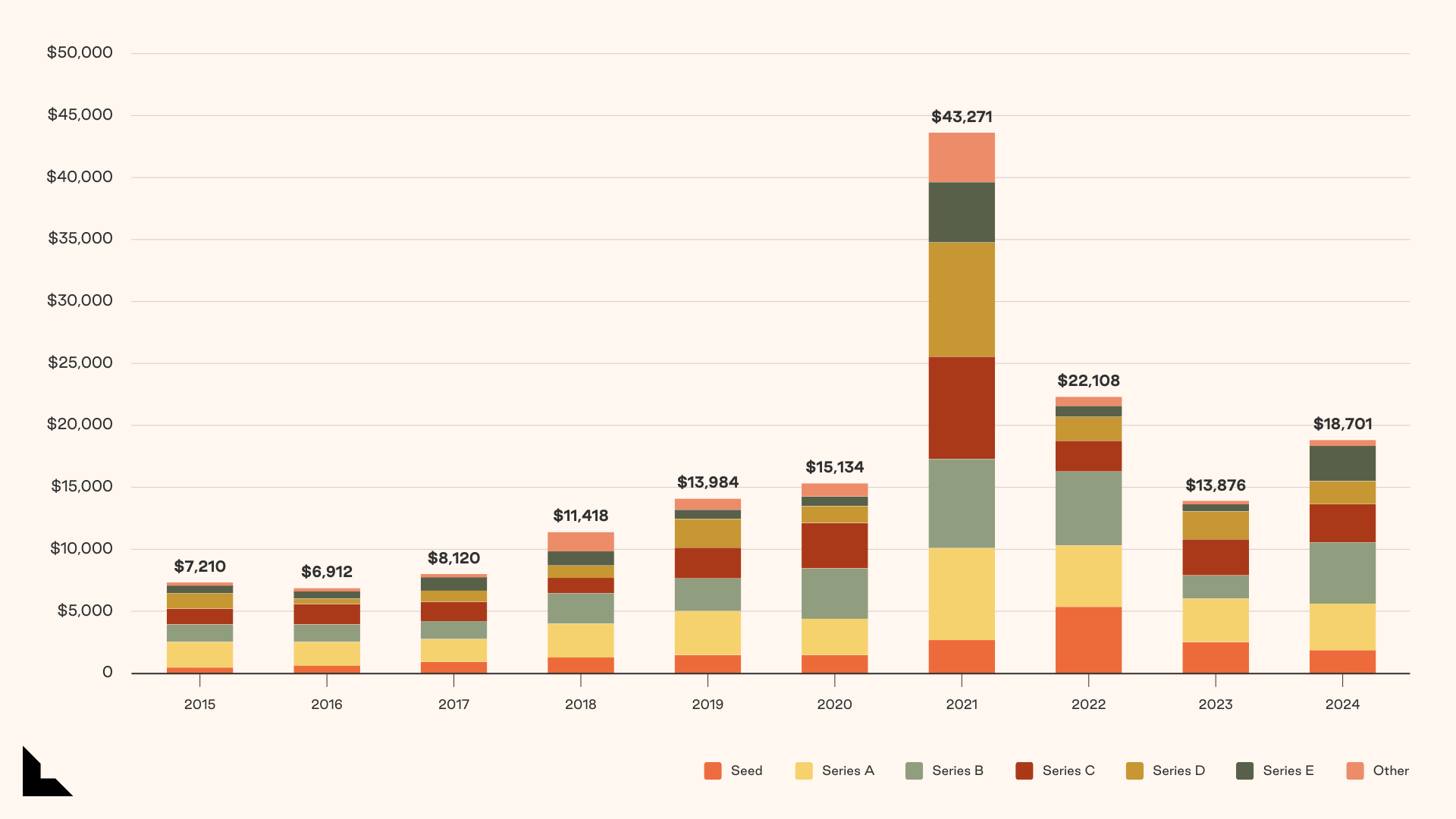

Total capital invested ($M)

Total capital invested rose 35% YoY, climbing from $13.9B in 2023 to $18.7B in 2024.

The total dollar volume at the Seed stage reduced the least year-on-year, down (18%), whereas Series A rose +5% and Series B +154%. In other words, we’ve seen a rebound in post-product-market-fit stage businesses.

Number of unicorns

The New York Metro area remains a fertile ground for unicorns, now home to 178 unicorns, up from 158 in 2023. Circa 40-45% of these unicorns have not announced any new financings in the past two years.

Notable unicorn companies include:

| Name | Category | Description | Fundraise |

| Altana | AI/ML | Supply chain intelligence and insights platform | $221M |

| Blink Health | Healthcare | Making prescriptions more affordable through a digital pharmacy | $81M |

| Clay | AI/Productivity | AI Relationship management platform | $62M |

| Cognition | AI/ML | An applied AI lab for software engineering | $185M |

| Cyera | Cybersecurity | AI-driven cloud data security | $300M |

| ElevenLabs | AI/ML | AI audio platform | $200M |

| EliseAI | PropTech | Conversational AI for real estate | $75M |

| Eon | DevTools | Cloud backup posture management platform | $70M |

| Formation Bio | Biotech | Drug discovery and bioengineering | $372M |

| Grow Therapy | HealthTech | Therapy and mental health care services | $88M |

New York market share as % deal count

New York retains a 14% share of total U.S. venture deals, a slight uptick from 2023, while the Bay Area increased its market share to 25% (from 23% in 2023).

Sector performance: NYC v. Bay Area

New York was significantly behind the Bay Area in AI/ML deployment (Bay Area has a 38% market share vs. 15% for New York Metro), Big Data (35% vs. 16%), Cyber (33% vs. 14%), CloudTech and Dev Ops (42% vs. 11%).

The data also suggests that while the Bay Area saw a significant uptick in absolute fundraising dollars — particularly in sectors like SaaS (36% → 67%), AI/ML (41% → 73%), and DevOps (50% → 76%) — New York remains competitive in areas like FinTech, E-Commerce, and AdTech.

| Sector | Bay Area (%) | NY Metro (%) | ||

| Deal Count as % US Total | 2023 | 2024 | 2023 | 2024 |

| SaaS | 27% | 31% | 16% | 16% |

| AI/ML | 35% | 38% | 14% | 15% |

| FinTech | 23% | 24% | 23% | 25% |

| HealthTech | 16% | 20% | 13% | 14% |

| Big Data | 32% | 35% | 16% | 16% |

| Cryptocurrency / Blockchain | 26% | 28% | 20% | 18% |

| E-Commerce | 12% | 13% | 18% | 19% |

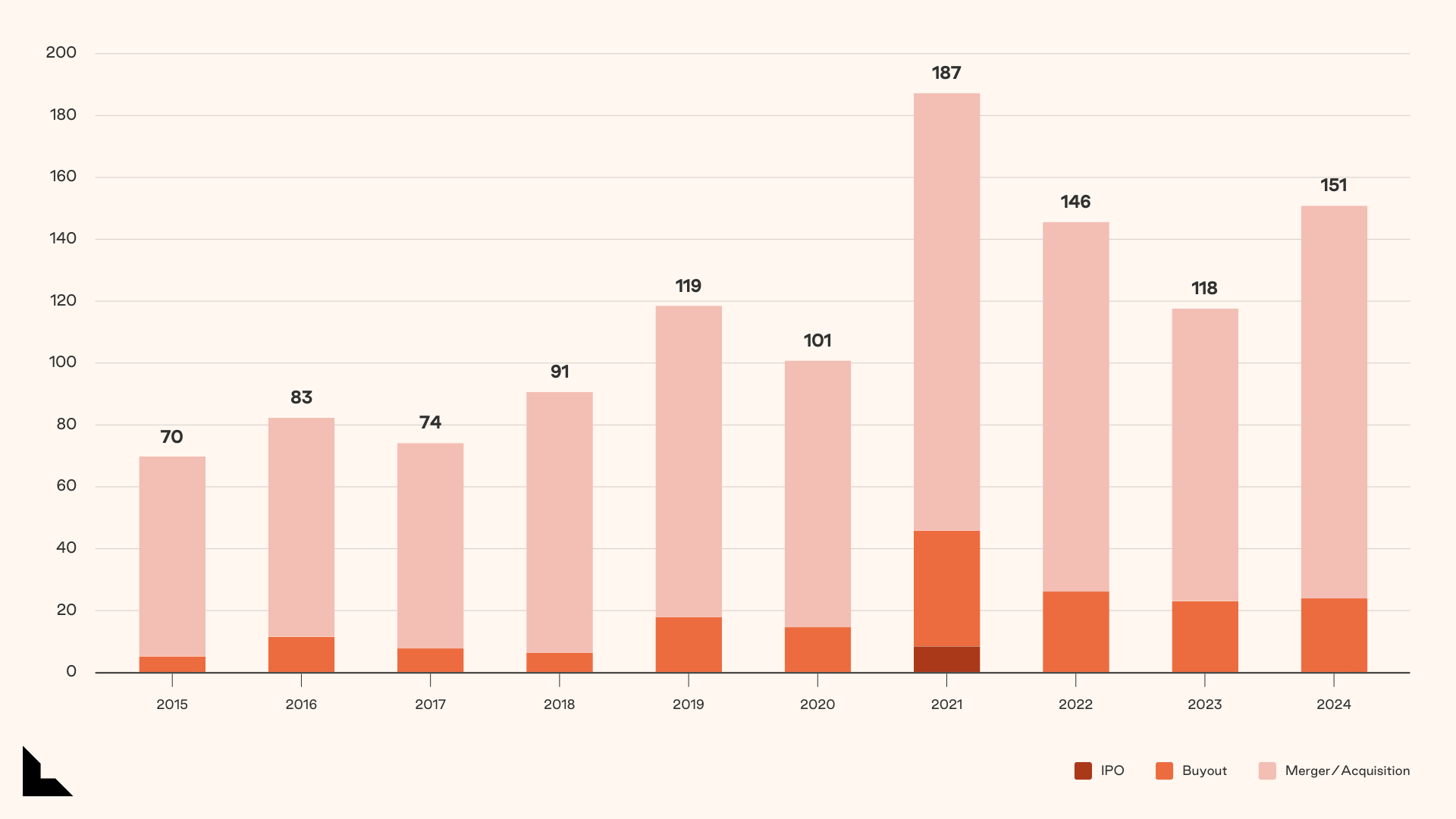

Exit environment / IPO and M&A exits

From an exit perspective, the number of mergers and acquisitions, buyouts, or IPOs of VC-backed businesses increased from 118 in 2023 to 151 in 2024. That said, there were no New York Metro VC-backed tech IPOs in 2024.

Outside of VC-backed companies, we saw Workday acquire HiredScore for $530M, Tradeweb acquire ICD for $785M, Gen Digital acquire MoneyLion for $969M, EssilorLuxottica acquire Supreme Clothing for $1.5B, AMD acquire ZT Systems for $4.9B, and Skydance Media merge with Paramount Global for $26.7B combined enterprise value.

Notable exits of previously VC-backed companies included:

| Name | Category | Description | Deal Size |

| Squarespace | SaaS | Website building and hosting | $7.2B public-to-private LBO |

| Own | SaaS | Cloud data protection platform | $1.9B acquisition by Salesforce |

| Gem | CyberSecurity | Cloud security automation | $350M acquisition by Wiz |

| Launchmetrics | AdTech | Marketing and analytics platform | $340M acquisition by Lectra |

| Aerodome | Robotics | Air support and drones for first responders | $300M acquisition by Flock Safety |

| Device42 | Big Data / SaaS | Discovery and dependency mapping for data centers | $230M acquisition by Freshworks |

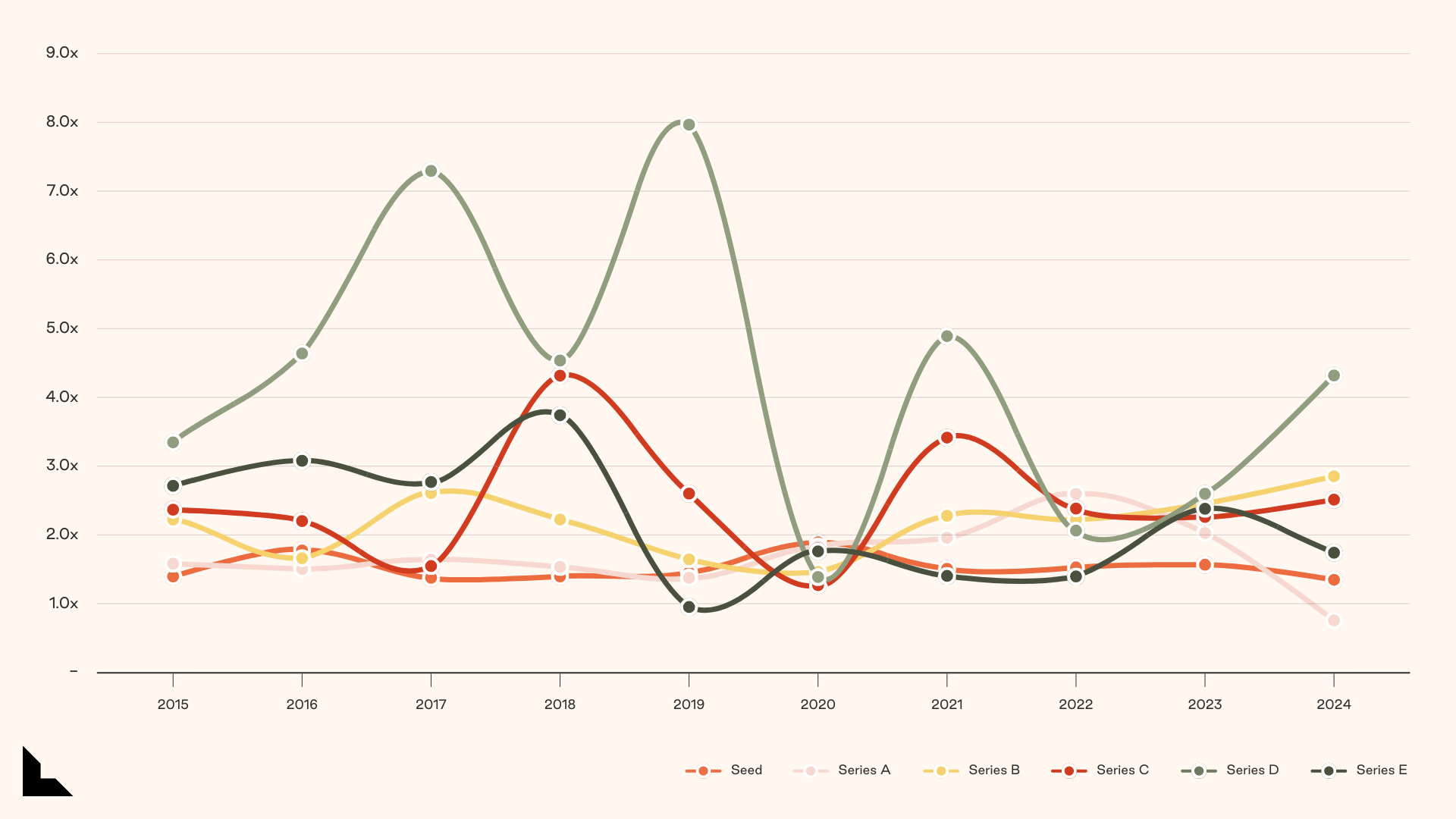

“Bid-Ask” spread and valuations

The “bid-ask spread” (difference in pre-money valuation quartiles) tightened for early-stage investments but widened significantly for Series B+ startups. This reflects increased competition for high-quality, post-PMF companies.

AI/ML “Bid-Ask” spread

In the AI/ML space, valuation discrepancies widened further in 2024, especially for later stage rounds. In our previous article, Welcome to the Hypersonic Innovation Cycle, we explored the shift left in the innovation cycle in this new paradigm. Part of this divergence in Series B+ stage AI/ML companies is larger capital requirements and venture funds deploying sizeable and concentrated growth checks in startups with explosive growth curves.

Largest deals of 2024

New York’s largest deals spanned cybersecurity, fintech, SaaS, and AI/ML. Some of the biggest fundraises included:

Notable >$250M fundraising:

| Name | Category | Description | Fundraise |

| Wiz | Cyber Security | Cloud visibility services for enterprise security | $1B |

| Wonder | FoodTech | Cloud kitchen platform | $950M |

| Clear Street | Fintech | Multi-asset execution, clearing and custody for equities | $685M |

| AlphaSense | SaaS | Market intelligence and search platform | $650M |

| Axonius | CyberSecurity | Cyber asset management platform for connected devices | $400MM |

| Formation Bio | Life Sciences | AI-driven drug development | $372M |

| Infinite Reality | AI/ML | Virtual worlds for businesses | $350M |

| Grafana Labs | SaaS | Open source analytics and monitoring platform | $300M |

| Cyera | Cybersecurity | AI data security | $300M |

| Doc | Healthcare | Telemedicine | $300M |

Notable $100-250M fundraising:

| Name | Category | Description | Fundraise |

| Altana | SaaS | Global supply chain platform | $221M |

| Cognition | AI / ML | End-to-end software agents | $185M |

| Melio | Fintech | Accounts payable and receivable | $150M |

| Ramp | Fintech | Spend management platform | $150M |

| Bilt | Fintech | Rewards platform and credit card for renters | $150M |

| Public | Fintech | Neobroker | $135M |

| Hebbia | AI/ML | AI agents for knowledge workers | $140M |

| Cover Genius | InsurTech | Embedded insurance | $100M |

| Headway | Digital Health | Virtual network of therapists | $100M |

| Spring Health | HealthTech | Digital healthcare platform | $100M |

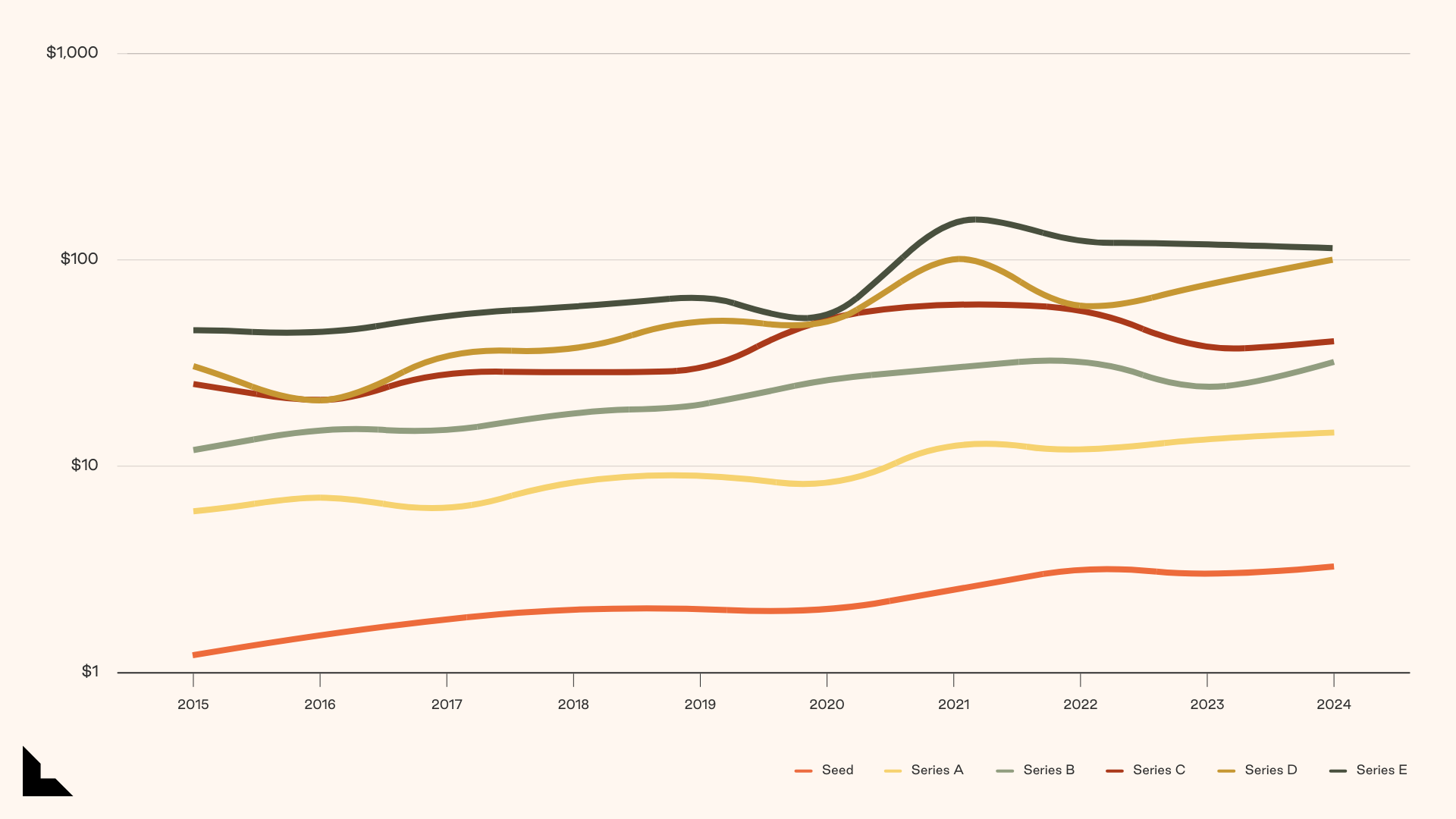

Round sizes $M (median capital invested by series on log scale)

After a split in funding trends during 2023 — where early-stage rounds (Seed and Series A) grew while growth-stage rounds (Series B, C, and D) shrank — in 2024, we saw an increase in round sizes across all stages.

- Seed: Median round size remained steady year-over-year at $3M.

- Series A: Climbed to $15M, marking a 7% YoY increase.

- Series B and beyond: Rebounded sharply, with round sizes up 30%+, reversing last year’s downward trend.

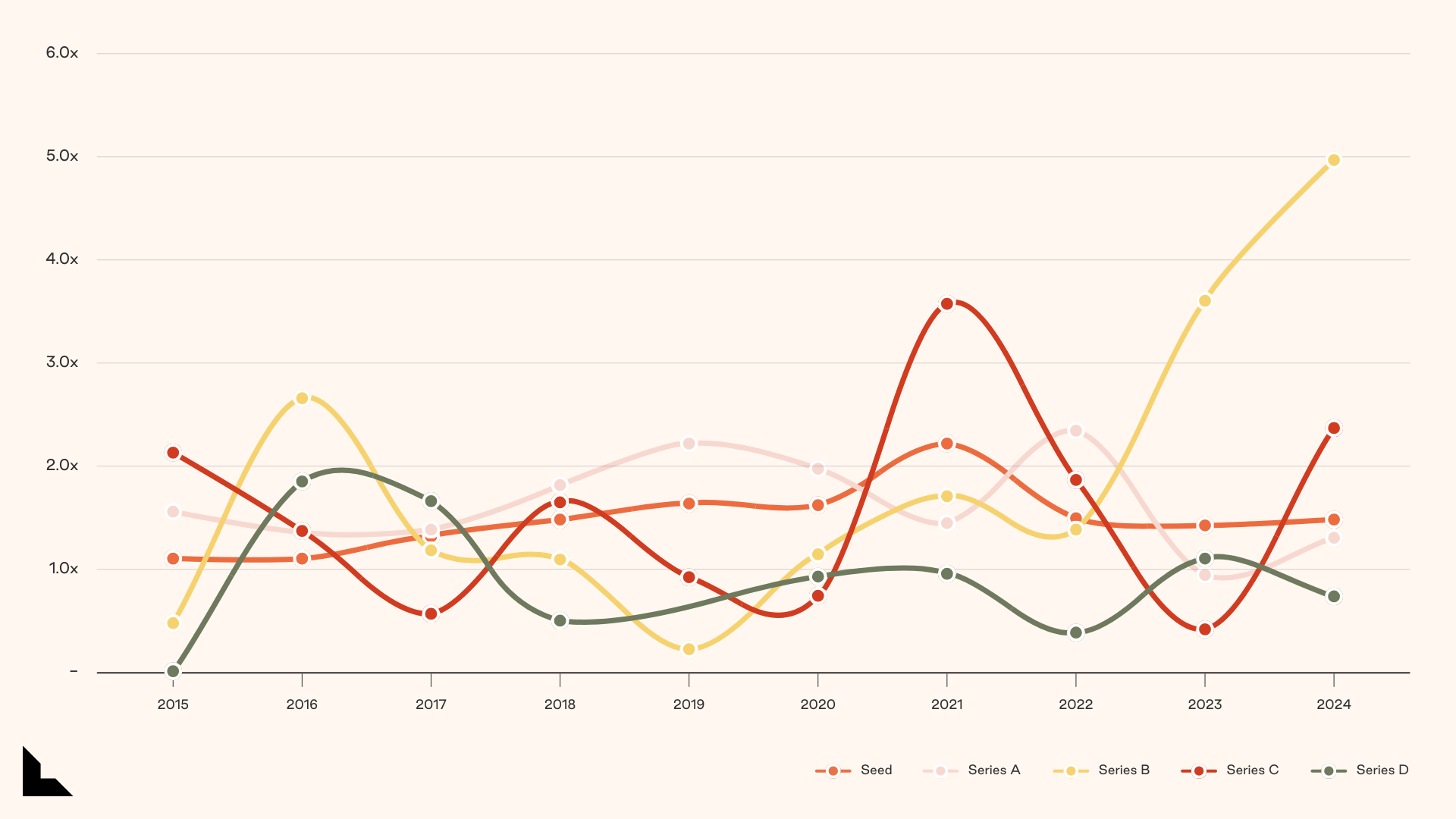

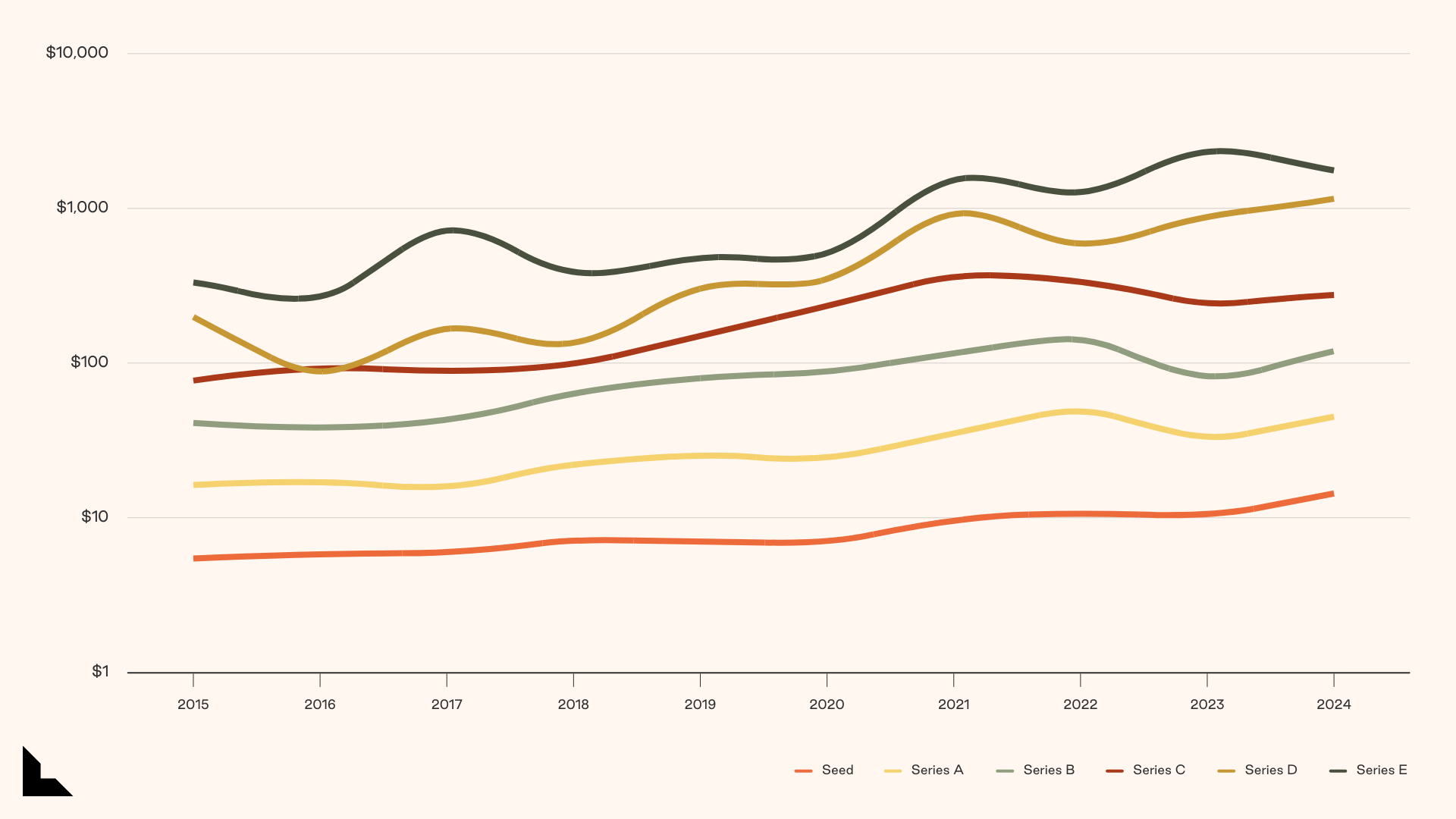

Valuations (fundraising amount $M on log scale)

Valuations, which dipped across Seed to Series C in 2023 — with Series B hit hardest — have largely recovered in 2024, except for Series C, which continued to lag. Valuation step-ups between rounds have not compressed — the jump from Seed to Series A (3.1x) and Series A to B (2.7x) is in-line with last year’s sharper increases (3.2x and 2.5x, respectively).

Median pre-money valuation by stage:

- Seed: $15M vs. $11M in 2023 (+38%)

- Series A: $44M vs. $33M in 2023 (+33%) → 3.1x jump from Seed

- Series B: $121M vs. $82M in 2023 (+47%) → 2.7x jump from Series A

- Series C: $279M vs. $250M in 2023 (+12%) → 2.3x jump from Series B

- Series D: $1.1B vs. $890B in 2023 (+30%)

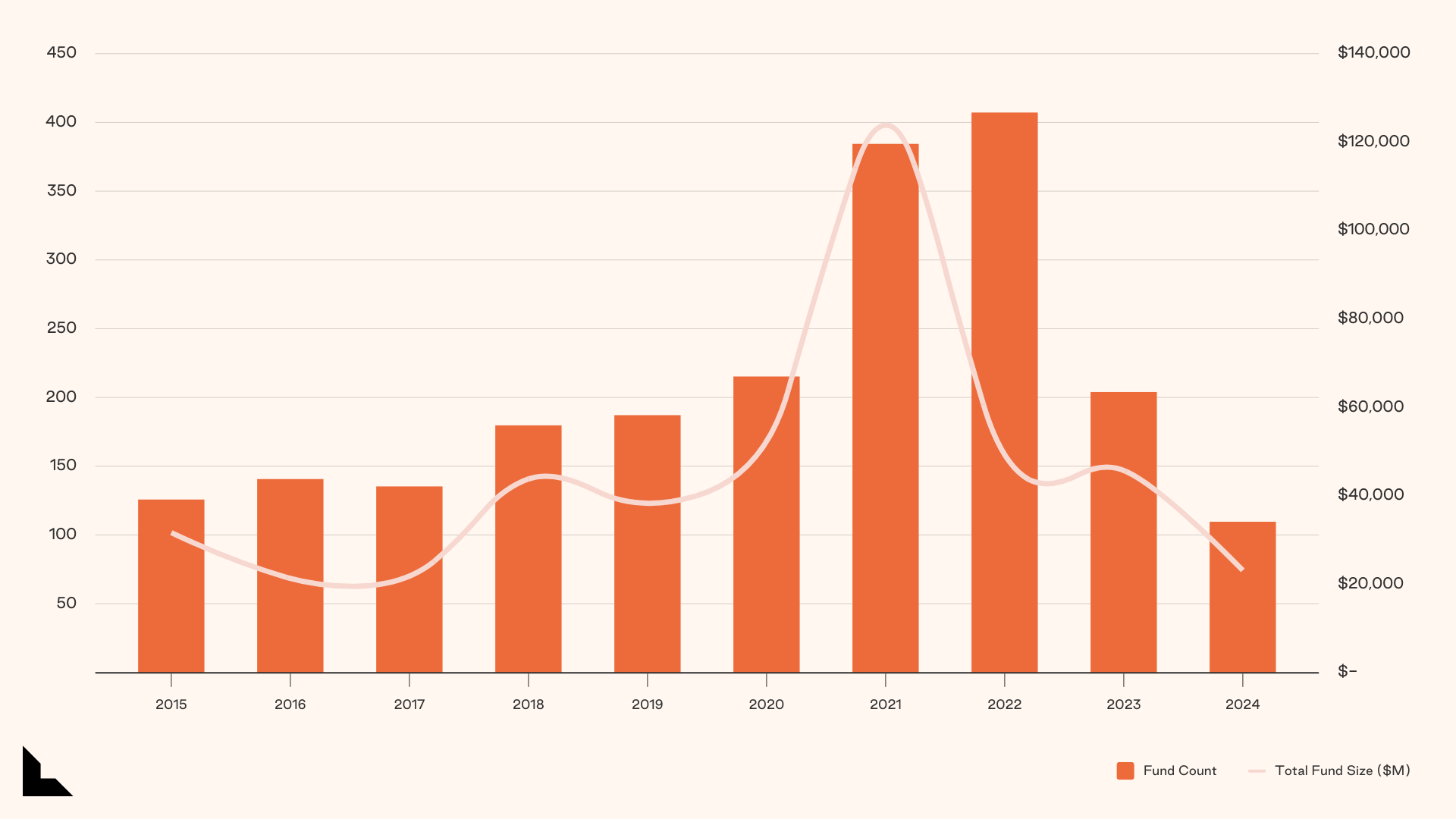

Venture capital fundraising

New York-based venture firms raised 110 new funds in 2024, a significant drop from 206 funds in 2023. The combined fund size totaled $23.3B, down 49% YoY from $45.8B the prior year.

Despite this slowdown, NY-headquartered funds still hold substantial weight — with the past five vintages collectively sitting on $64B in deployable capital. Under the surface, the 2024 fundraising environment has become more bifurcated: on one end, emerging managers raising smaller funds xxx, while at the other end, established multi-stage venture platforms.

Total funds by vintage and fund size ($M)

Conclusion

New York’s ecosystem is unafraid to evolve and expand beyond its roots. With AI/ML making rapid inroads — thanks to local talent pipelines at NYU and Columbia, as well as growing AI/ML unicorns and existing DevTools scale-ups — the city continues to keep rolling. The numbers speak for themselves: $18.7B raised, a 35% YoY increase in total capital invested, and a record 178 unicorns headquartered in the New York Metro area.

Beyond the raw figures is a larger story of dynamic interplay — between talent, capital, and market access. It is a key reason why New York’s tech scene is so vibrant. Even amid a challenging IPO market, growth-stage deals are buoying late-stage startups, and international companies continue to plant flags in the city. It’s a market poised to push boundaries, creating new opportunities not just for founders and investors, but for the broader community seeking to build the next generation of innovation.

Notes

- Financings include equity deals raised in USD by New York Metro-headquartered corporations (including New York, New Jersey, and Connecticut).

- Sector/verticals are not de-duplicated for companies across multiple sub sectors.

- Unicorn tags are based on publicly available information. Undisclosed valuations are not included.

Sources

- Sources: Pitchbook, Crunchbase, Stanford Business Insights, Stanford University Research, Live Data Technologies, City of New York, NYC Gov, and CompTIA State of Tech Workforce.

- *Live Data Technologies, has developed a method of prompt-engineering major search engines — Google, Bing, Baidu, Yandex, and more to capture near real-time data on employment shifts across the U.S. By leveraging publicly available information, the company performs over 300M employment verifications and tracks more than 1M job changes every month through its proprietary processes. This enables a comprehensive view of hiring trends across companies, roles, functions, industries, levels, and locations.

- https://www.gsb.stanford.edu/insights/how-much-does-venture-capital-drive-us-economy>

- https://www.cyberstates.org/pdf/CompTIA_State_of_the_tech_workforce_2023.pdf

Authors