How bigtech AI CAPEX spending will reshape future corporate cost structures

One of the things we hear often about AI is how it’ll bring a productivity surge to society and have a deflationary impact on GDP. Technical revolutions, over a long enough horizon, do tend to make societies better off economically but we wanted to go deeper into what is the nature of productivity today, where does it come from, what do the productivity curves for large tech & non-tech categories look like, and then understand exactly where, and how will AI have the most impact on these productivity curves.

Over the course of this piece, we’ll go on to show how the massive CAPEX spends being undertaken by bigtech is essentially a huge transfer of wealth to everyone else in terms of productivity improvement. AI-enabled Corporate balance sheets will look very different because AI is eventually going to shift large parts of the corporation’s fixed expenses to variable expenses leading to a P&L that is far more resilient to business demand changes.

Productivity = Automation + Specialization

Productivity of nation states is a function of the accumulated productivities of the organizations within it. GDP per capita is a good proxy for productivity of a nation. Most GDP & capita graphs would look like the one above. Mathematically, the GDP/capita will grow if the numerator (GDP) grows faster than capita, or the denominator (capita) shrinks. While there are nations out there where population is declining, we’ll focus more on GDP growth for now. Two independent levers to grow GDP — (1) deploy more of your “capita” to build higher margin products or (2) produce more with the same “capita”. Former is essentially a case for specialization, and the latter, for automation. GDP / capita grows fastest of course, when a nation does both. Taiwan going from an agrarian economy with a GDP/capita of ~150$ in the 1950s to a semiconductor powerhouse with a GDP/capita of $7000 by the 1980s is an example. Also worth noting that without automation, it’s hard to free up enough resources to move up the specialization curve. We’ll see later in the article that the same logic would apply to businesses — improving specialization & automation is directly related to productivity.

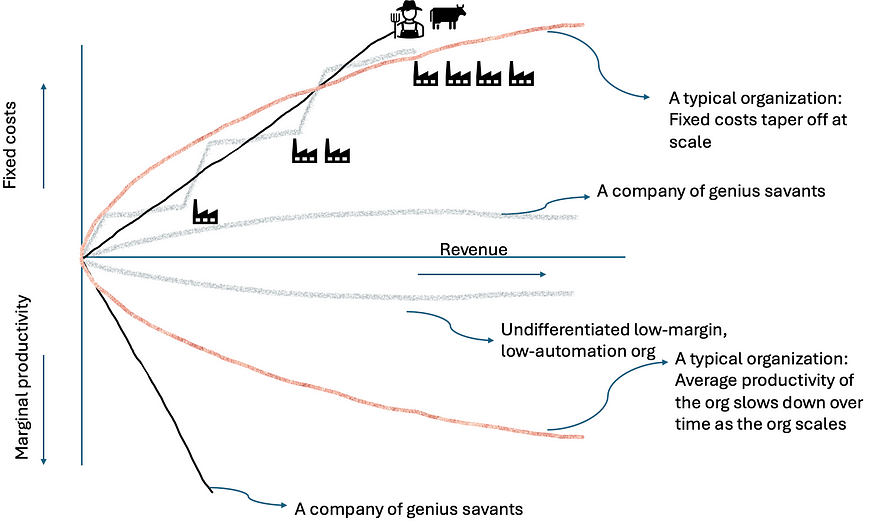

Now let’s understand the nature of “productivity” and for the sake of simplicity, the productivity of organizations. Our starting hypothesis was that as organizations scale, their marginal productivity comes down and their fixed costs go up but at different rates. If your business is very people-driven — e.g. you plow land using a bull — to double production you need to double capacity and your fixed cost (salary for the human, food for cow, etc) doubles as well. They get paid, they eat, weather or not you plow the land any given day. For businesses with shared resources — say a factory — fixed costs may grow in spurts as you build new factories. IP-driven businesses can scale with only a few people — e.g. a hedge fund with proprietary trading skills, or a solo inventor who just keeps inventing and licensing the patents for royalties. And then there will be everyone else in between. So, on average, the fixed cost profile of sectors would look somewhat like the upper half of this graph.

Bottom of the graph is marginal productivity. Our intuition was that even when overall productivity of a business goes up over time due to efficiencies, processes, automation, the marginal productivity likely doesn’t. Part of that has to do with scale — you can’t have the same impact as the early employees at 100x the scale. But part of that is also the fact that the 10,000th employee simply isn’t doing the work that’ll change the company’s overall trajectory. They are just tuning screws, not designing a new engine. In software that translates to writing glue-code, maintaining code, versus designing the new industry-defining algorithm. We’ll get back to this point later in our piece.

Revenue vs Employees for different sectors

So it turns out when we unpacked the efficiency profiles of top 10–15 companies globally across several industrial categories, data was in line with our intuition. The Technology / TMT sector had the highest productivity (measured as revenue per employee) as they scaled. At the bottom were services companies with “people as product” as their business models. As expected, their efficiencies got even worse with scale. In the middle were sectors such as pharma, retail, manufacturing, etc.

Marginal Productivity curves. (L) TMT & Services (R) Zoom-in on a few TMT & Services Cos

No matter which sector you are in, the marginal productivity drops over time — faster for services sector, and slower for TMT. Every organization reaches a scale beyond which the next 1000 FTEs add less value to the topline as the prior 1000 FTEs.

Death, taxes and productivity decline — three inevitabilities of a corporation’s lives.

So there are few conclusions we can broadly draw from here and none of them should be surprising:

- The more automation an organization has, the steeper (=better) their productivity curves. They squeeze more from the same capita.

- Innovation or IP-driven companies have remarkably higher productivity curves even amongst their sector-peers. Specialization scales non-linearly.

- The more people the organization has, the marginal productivity of each new member drops off especially as the organizations enter “maintenance mode” from “innovation mode”. For these organizations, the fixed costs of payroll alone grows as a % of revenue.

AI is going to transform these productivity curves

We are currently in the “loading” phase of AI. The entire landscape is wide open and there is a land-grab going on. Companies such as Google, Microsoft, Meta, Nvidia, OpenAI, Anthropic etc are on a CAPEX spree. If you think of the “AI Token” as a commodity resource over time — similar to a CPU/GPU cycle, or an oil droplet — it makes sense why there is a CAPEX spree. Commodity categories work only with economies of scale, so the largest players tend to get larger. Price is the core differentiator as technical gaps diminishes over time. This is already happening in the LLM category. The flag to plant is some version of “cost per token” and whoever plants it can claim this land and then seek perpetual rent on whoever builds cities on it.

Where will all these near-free tokens go? What is the size of the prize that’s making folks like Larry Page say internally at Google “I am willing to go bankrupt rather than lose this race” ?

To understand that, let’s look at the modern corporate income statement. Specifically let’s look at the components in COGS that have to do with direct labor, or components in fixed costs that have to do with salaries, rents, general & administrative expenses. Together, there are people-driven cost items primarily. People that perform certain software defined tasks — e.g., coding or designing. People that perform certain physical tasks — e.g., a human agent selling a product on the phone, or a receptionist answering a call, to a human picking a package and placing it elsewhere. The costs for these (salaries, equipments/rent, overhead) are far larger than what corporations spend on software today (roughly ~$1T).

There are over $20T of expenses that are finally becoming available to software as AI reaches near-human capabilities in software and in robotics

Operational expenses such as R&D, SG&A are mostly fixed costs — e.g. you have to pay rent & salaries whether or not you met your quarterly targets! Moreover, we already saw how marginal productivity flatlines as organizations scale. Salaries and overheads do not. An AI-Agent can potentially 4x the productivity (24×7 vs 40hrs/wk) at constant SLA — in fact, the SLA might improve over time as it learns with more data. These elements of OPEX are starting to get addressed with co-pilots, agents (support, SDRs, BDRs) and end-to-end zero-shot models (photo / audio / video). This is where OpenAI, Anthropic, Mistral, Sarvam, Microsoft, etc would want to dominate in the model layers.

In the case of industries such as construction, mining, or manufacturing, direct labor is a large part of COGS and embodied AI / robotics is going after that. At the model layer, companies such as xAI or SKILD are likely to dominate, and looks like they are also going to verticalise with humanoid robots.

Services Company P&L — from status quo → Co-pilot heavy → Agent heavy P&L

We believe AI-enabled P&L will be stronger, they will be more resilient. Take the case above — a services company with 70% of COGS going into labor and 15% operating margins. With Co-pilot, we posit, they’d make a 20% productivity gain and improve GMs from 30% to 41%, and OMs from 15% to ~30%. With agents replacing large parts of the lowest producvitiy segments of human labor (e.g. glue-code creation, repetitive CRM tasks, form-filling, compliance, etc), we can expect OMs to go as high as 60%+ up from 15%. Not just that, we will see some of the costs move from Fixed to Variable — when demand slows, fewer agentic flows get triggered, lower the cost, and smoother your P&L Q/Q. Agility is critical and an agent-heavy company can maintain cost discipline faster during down-swings and also “hire” faster during upswings. The result? A far more resilient P&L through up and down cycles.

P&Ls for AI-enabled companies will look a lot stronger and resilient than P&Ls for non-AI enabled companies.

So where do we expect the maximum opportunities? Let’s go back to the productivity graphs we had laid out earlier. The lower the productivity graph, the lower hanging the fruit.

- Lowest productivity curves industries such as construction, contract manufacturing, and services, AI is likely to have the maximum impact. Either in form of AI-first robotics or outright specialized AI replacing humans.

- The fixed-to-variable costs shift will enforce the pricing of these platforms to be usage-driven or outcome driven versus seat driven. In the case of robotics, e.g. you’d likely price it at # of picks & place / hour. A SDR agent gets “paid” only when it brings in new qualified leads into the pipeline, etc.

- High IP-driven sectors such as Netflix, Nvidia, Regeneron where human intuition plays a huge role in unlocking alpha may be the most protected from AI.

We wanted to end the piece where we began — with a discussion on productivity as the primary lever of societal development and growth. To achieve this we need both (a) specialization and (b) automation and AI’s role will be near transformational in the (b) and, if nothing else, will allow human resources to be deployed towards the (a). A few topics of discussion could follow from here. For example — as AI automates jobs away, what happens to those humans in-between when they are getting up-skilled towards specialization? What happens to organizations as all the low-skill / high-repetition jobs get automated? Do we see smaller and smaller orgs over time, more decentralized? What sorts of new skills should younger folks orient towards? No easy answers but here are a few predictions that seem to flow from the above:

- UBI: More and more, there seems to be a need for UBI (universal basic income). Transformative forces like AI could add huge value over the long term but disrupt societal balance in the short term. As people get replaced by automation, organizations & governments need to prepare appropriate support systems to ensure smoother transitions.

- More Elons, flatter orgs: Mid-management layers in organizations may get heavily impacted with AI handling routine decision-making and tasks. Companies might adopt flatter structures where strategic decision-making is concentrated at the top and everything below is optimized and executed by AI and specialized teams. Likely how Elon operates today.

- Vanishing departments: Over time, entire departments will vanish. Just like we no longer have mailrooms, stenographers, manual payrollers, switchboard operators, or filing departments any more. It took just 10–20yrs for some of these roles to simply go away between 1980s to 2000s.

- Role of critical thinking, creativity, EQ: This may be the most far-reaching prediction, but AI is going to flatten access to complexities. We may be nearing the “rise of the nerds” era. To succeed in AI-heavy world, critical thinking, creativity, confidence, charm, and EQ will become increasingly more important. A poet who can now also spin up a beautiful vercel web experience overnight using claude — hard to beat that at a party 🙂

As always, Lightspeed is keen to hear from founders across the world building into this brave new world. We are on X / Linkedin at Hemant (x, LI), and Abhiram (x, LI).

Authors