“Can I PayTM it or can I PhonePe it?” is the new “Have you Googled it?” for Indians. A larger number of people in India now make payments using their phones, ignoring or skipping cards altogether and, more importantly, ignoring cash. This is a monumental change for a cash-loving economy like India.

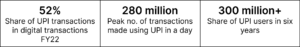

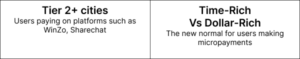

The meteoric rise of UPI has also created a powerful trendline for digital micropayments. We define a digital micropayment as a payment with an average ticket size of $2 (<INR 150). Interestingly, micropayments (for online commerce and services) are at the heart of a silent revolution in India – a new business model is emerging – and founders should think about incorporating this business model into their business.

Unsurprisingly, India has always had a history of micropayments. It is the land where sachet usage was invented. Sachet soaps and shampoos eventually led to small-value top-ups on phones (remember those mobile stands where you could top up for 10 rupees), which then migrated from cash to digital as smartphones became prevalent across India.

Many Online Use-cases for Micropayments

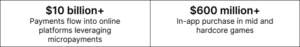

We’re now seeing tech startups adopt micropayments as a core business model, from fintech to content, gaming to social media, and many other sectors and subsectors.

The lion’s share (85%+) of these payment inflows is led by play-to-earn companies like in real money gaming (RMG) and opinion trading, such as Dream11, MPL, Winzo, Probo and Zupee. More users than we thought are willing to pay, at great scale. Imagine having a customer base that can pay $1 a month for a year with an initial TAM of 1 billion.

- Play-to-earn – Users come with the primary driver of making money from this experience. Segments include fantasy sports RMG, non-sports RMG and opinion trading. Users pay for game/tournament entry, in-app purchases and wagering

- Games – Segments include mid-core games, hard-core games, hyper-casual/casual games. Users pay in-app for digital goods such as upleveling, attire and weapons. An interesting areas is India-native mid-core games, solving the gap left by BGMI.

- Social/content – Segments include audio OTT, video OTT, social networking, live-streaming, dating, astrology and religion. Users pay per episode, for gifts or fees to creators, to bump up their chances of being discovered on dating sites. Platforms such as Webtoon, which is on a $1.2 billion revenue run-rate, Tapas, and Ximalaya have monetised different content formats. Others such as Bytedance, QC Music, Taobao not only let customers access digital assets but also tip their favourite creators.

- Utilities – Segments include micro-investing, micro-advisory, social investing and grocery. Users pay to invest spare change, for micro-credit and for low-AOV commerce baskets. Jiebei Ant/ Alipay became the largest digital lender in China by disbursing unsecured micro-loans and upselling higher average order values (AOVs). Yu’ebao Ant, Alipay, and Acorns have also expanded to broader wealth management plays.

Keys to Success for Micropayments-based Business Models

We have seen startups in our portfolio and across the ecosystem starting to benefit from adoption of micropayments as a core business model. Keys to success include:

- Double or triple your ARPU: Subscription-based companies typically charge the same for a power user and an casual user. This kept casual users away from paying the upfront high costs. Some startups have seen their Average Revenue per User (ARPU) double after making the shift to micropayments-based models from monthly subscriptions.

- Identify your core usage driver: most micropayments-based services run on the Pareto principle – 20% of content leads to 80% of the consumption, eg cricket for real-money gaming. Identify and focus on the content that drives 80% of usage.

- Turn non-users into casual users: Low-ticket sizes make it easier for new customers to give a digital good/service a try. Provide a no-brainer, friction-free, easy on-ramp into your service. A high number of daily active users (DAUs) doesn’t mean all of them pay for your product or service. Founders must give customers something they can’t live without, like cliffhangers, to convert them from non-paying to paying.

- Turn casual users into power users: Paying users show a strong Pareto effect where whales or power users transact at least 10X more than normal users. Track your whales, figure out what converts casual users to whales and scale this effort.

- Drive high retention: Identify categories where you can create an obsession for your users aka high usage frequency. This drives high retention which is crucial since you don’t have your users locked in with annual subscriptions. Retention is the glue that holds together LTV, CAC and payback periods.

- Build trust, then upsell. Transacting at low ticket sizes eventually leads to upsells at higher ticket sizes in the future.

- Beware low take rates: Be aware of your variable costs per transaction. Is it 90% gross margin or 10%? Do you own what you are serving to users (like most digital goods or gaming assets) or pay for content (like in music) or share revenue with creators?

Background on the Micropayments Megatrend

Micropayments are a Global Success Story

Micropayments have already reached mass-market saturation across the world. Pioneering low cost, real-time digital payments have skyrocketed across economies like China with mobile wallets and QR codes and, most recently, Brazil with Pix. In the US, Android and iOS app stores enable micropayments for almost 100% of the population.

Globally, companies have created meaningful impact with micropayments. Gaming is an obvious beneficiary with almost 70% of revenue coming from micro-transactions, such as in-app purchases, subscriptions, and entry fees. Then there are loot boxes, which generate over $35 billion in revenue in 2020 alone.

Convenience

At 5.55%, credit card penetration continues to be pretty low in the country. Debit cards are arguably more in number, but UPI was already eating into their market share. Debit cards do not offer the same rewards or cashbacks, and generally lack the greater trust that comes through credit card transactions.

UPI has a super value proposition, including widespread distribution, instant and interoperable transactions, low merchant discount rate, low fraud rates and strong government support. Very soon, cash may no longer be king.

Massive Offline Acceptance

There is increasing acceptance across offline merchants.

Arguably, offline acceptance drove the wide usage of UPI, including at almost every restaurant, retail store, temple and dhaba. We’ve also seen QR codes plastered across our cities and villages. Offline acceptance for taxis, auto rickshaws, buses and trains has also driven widespread adoption. We have to thank your local dosa restaurant, dhaba, cable TV provider, electricity provider, gas provider, taxi wala and temple for driving offline usage of digital micropayments.

From Offline to Online

The platform is now in place for mass adoption of micropayments online as well. We are not far from the day when one billion Indians could be using micropayments.

The demographics of city tier or affluence are no longer the considerations driving digital micropayments. Surprisingly, it is not just the affluent users from metropolitan cities who are paying. Increasingly, it is people from diverse socio-economic brackets, including from India’s smaller cities and towns.

Authors