BFSI continues to have one of the largest technology spend pools ($12B+) in India and especially post COVID, we’ve seen FinSaaS players get to meaningful scale in a relatively short time span. Over the last decade of investing in India, we’ve realised that the largest spend pools still lie with the top banks and to build trust with them and accelerate the sales cycles, you often require a powerful ‘why now’. We are now seeing this urgency in fraud and risk management.

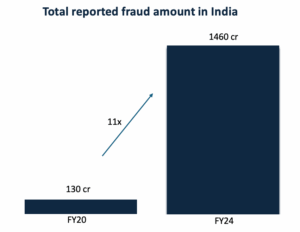

Frauds are the current menace in BFSI – 11x jump in reported digital fraud cases in four years, 10x increase in absolute amount in one year. Ranging from money laundering accounts, payment frauds with account takeover, organized fraud rings or just dishonest loan taking – it’s everywhere. This will only accentuate with AI. For banks this came out as their urgent priority, aided by strong RBI push and penalty (sometimes even license revoke) in case of non-compliance. This is a rapidly growing spend pool with each top bank alone spending $10-15m on this segment.

The current systems are ineffective rule-based decisioning with light KYC/ AML checks – leading to banks/ NBFC to scramble for a superior product. It keeps missing the bad actors while triggering oceans of false positives that anger good customers and invite RBI censure. This is a zipcode where banks care about best-in-class accuracy rate and deeply knowing their customers.

This dire need requires a best-in-class team that looks at this opportunity in a tech and data first manner. Luckily, we came across Data Sutram.

From our first meeting with Rajit, Aisik and Ankit, their differentiated approach of using alternative data to build a holistic ‘trust score’ for every customer stood out. The foundation was simple – all historical digital footprint of a customer and any anomaly in current behaviour is a sharp predictor of identity theft, synthetic identities, and collusion. Their obsession about building the most formidable analytics layer for anything to do with fraud and risk was very visible. So we weren’t surprised when we were told by the banks that they had one of the highest accuracy rates in the industry (capturing 35-40% of the frauds at the onboarding stage itself with <3% false positives vs 9-15% for the industry).

As a result of which, they had managed to crack some very large legacy banks like Axis, HDFC, Canara early in their journey. Typical onboarding for them has been 3-6 months vs 12-18 months for industry. Last year they processed about 115 million applications – 10x more than the year before.

This is just the beginning – Data Sutram’s vision is much grander. We want to make every financial transaction globally risk free. It is not just about fraud intelligence at onboarding, it is about becoming the bank’s most trusted partner throughout the entire customer lifecycle – be it underwriting, collections, constant transaction monitoring or detailed investigations.

We believe this is the strongest team and tech to tackle this opportunity to come out of India and we are thrilled to partner with them towards their journey to power 1B risk-free transactions per day.

Authors