06/22/2023

Building with Supercritical—Pioneering the Climate Battle

Why Lightspeed is investing in a leader in the carbon dioxide removal marketplace

We are excited to announce our recent UK-based investment in Supercritical, one of the leading Carbon Dioxide Removal (CDR) marketplaces, co-founded by Michelle You and Aaron Randall. Climate change is one of the most pressing challenges we face today, and CDR is one of several tools the world needs if it is to achieve anything close to the net zero targets set out in the Paris Agreement.

Supercritical solves a vital problem for businesses looking to mitigate their carbon impact by allowing them to purchase high quality, durable, credits that unquestionably remove carbon dioxide from the atmosphere.

There’s a lot of confusion in the carbon markets overall. What’s a CDR credit? Is that the same as a carbon offset? Isn’t all of this just greenwashing? Is it voluntary? Is there enough supply of CDR to have a meaningful impact? These are some of the questions we’ve been asking ourselves as we dug deeper into the market.

First, let’s start by looking back at the history of the voluntary carbon market. The concept of the voluntary carbon markets emerged in the late 1980s and early 1990s alongside international discussions about mitigating climate change. These early markets were rudimentary, with little standardization or regulation. The Kyoto Protocol in 1997 marked a turning point, introducing the Clean Development Mechanism (CDM) and Joint Implementation (JI) projects, which created a framework for generating and trading carbon credits.

However, not all countries had emission reduction commitments under Kyoto, leading to the rise of voluntary markets for businesses and individuals wanting to offset their emissions. Over the past few decades, these markets have significantly evolved, with several standards emerging to verify and certify the credits, such as the Verified Carbon Standard (VCS) and the Gold Standard.

Despite enduring criticisms around additionality, permanence, and leakage, the voluntary carbon markets have grown in response to increased corporate sustainability commitments and public awareness of climate change.

The market is based on a principle of supply and demand. On the supply side, carbon credits are generated by a range of projects worldwide. These projects are supposed to undergo some form of validation and verification processes by independent third-party organizations to ensure their integrity. Once these credits are certified, they can be sold on the market. On the demand side, companies and individuals who are looking to offset their carbon emissions can buy these credits. This not only helps them meet their sustainability goals but also provides vital funding for carbon reduction projects.

However, the voluntary carbon markets have been subject to criticisms and challenges, and for good reasons. Critics point to issues like the lack of standardization in project verification, potential for double counting of carbon credits, and risk of creating a ‘license to pollute’. Just recently, Delta Air Lines was sued over their purchase of carbon offsets to claim they were carbon neutral. The class action lawsuit alleges that the carbon offsets did not achieve what they claimed, and therefore it’s not possible for Delta to claim any relief for their emissions.

A widely cited, and heavily debated, article from the Guardian earlier this year reported that more than 90% of the rainforest projects certified by the world’s largest verification service, Verra, are worthless, and could even contribute more to global warming. Although the idea of investing in a carbon offset sounds good, it’s become increasingly clear that the market turned into a commodity trading and arbitrage industry, which unfortunately had little to no positive impact on the environment. Many now refer to purchase of these offsets as a form of greenwashing, and governments around the world are quickly moving to remove any form of net-neutral credit a business might be able to achieve through this method.

Given all the debate around the carbon market, why would we make an investment in a CDR marketplace? Carbon offset credits, the market focus for the past twenty years, and carbon removal credits are two types of instruments used within carbon markets, but they operate in fundamentally different ways.

A carbon offset credit is generated by projects that reduce, avoid, or sequester emissions. This can include a wide range of activities like the construction of renewable energy plants, the improvement of energy efficiency, or the protection of forests that would otherwise be destroyed. The key concept behind carbon offsetting is that one tonne of CO2 (or equivalent gasses) reduced in one place can compensate for one tonne emitted somewhere else. The fundamental goal is to balance out emissions. But, as described earlier, this has not historically worked.

On the other hand, a carbon removal credit pertains to the active removal of carbon dioxide from the atmosphere through processes such as direct air capture, enhanced weathering, or bioenergy with carbon capture and storage (BECCS). Carbon removal credits are not only more robust because they don’t just prevent or reduce emissions, but they actively reduce the amount of CO2 in the atmosphere. Carbon removal credits involve actively drawing down and sequestering CO2 from the atmosphere.

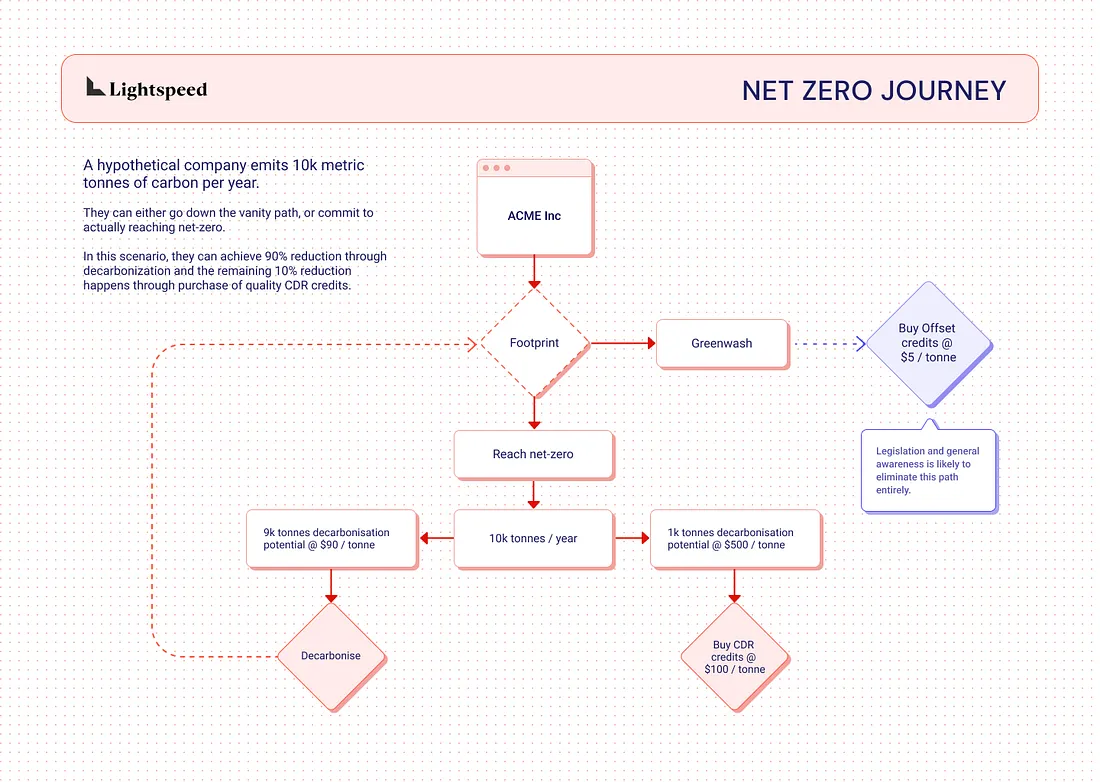

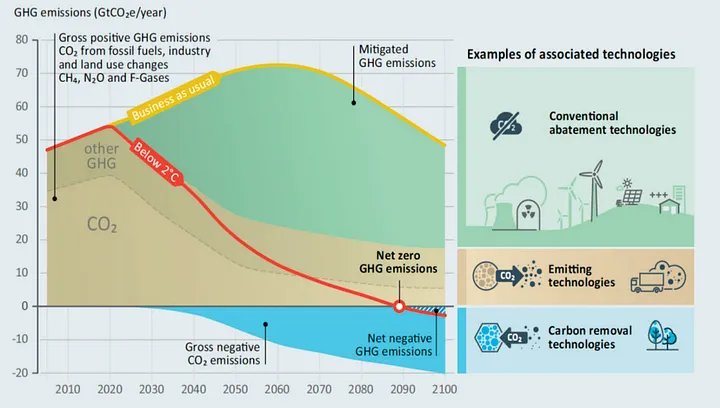

We’re deeply excited about our investment in Supercritical and the business they’re building, but we don’t believe CDR is the sole answer to getting ourselves out of the climate disaster. Tackling the climate crisis will require a multifaceted approach. CDR must be scaled alongside rapid decarbonisation strategies. We need to rebuild nearly every facet of the industrial economy over the next 20 years in order to fully decarbonise.

In practice, it will not be feasible for every company to hit net-zero solely through decarbonisation. They may be able to achieve 70%, 80%, even 90% carbon reduction through new technologies and processes but it will take time to get there. Also, there is going to be some percentage of carbon dioxide emissions that many businesses simply can’t achieve economically through decarbonisation. This (finally) leads us to the quite simple investment thesis for Supercritical: we feel it’s important to have an immediate solution available to start reducing net carbon emissions while businesses decarbonise, and a longer term solution to remove the 10, 20, 30% of emissions that companies can’t achieve through decarbonisation efforts alone.

A few of Supercritical’s attributes stood out to us in particular:

Innovative Business Model: Supercritical presents a novel approach to combating climate change. Instead of merely focusing on reducing future emissions, it tackles the pressing issue of the excess carbon dioxide already present in our atmosphere. Their marketplace bridges the gap between CDR solution providers and buyers, facilitating transactions and fostering collaboration on a global scale. They also allow businesses to invest into the future, to help high-impact removal projects with the investment they need to get off the ground.

Scalable Solution: Supercritical’s platform brings scalability to the CDR industry. It provides a platform where enterprises can aggregate demand and purchase carbon dioxide removal services from various providers, ensuring that the carbon dioxide removed is verifiable and permanent. By aggregating supply from multiple removal service providers, the platform scales up carbon removal efforts, accelerating the pace at which we can achieve global climate goals.

Driving a Green Economy: Supercritical is not just a technological platform; it is a key player in the emerging green economy. It creates a new market for carbon dioxide removal, incentivising innovation and stimulating economic growth in the environmental sector. This creates a virtuous cycle, where economic incentives and environmental protection work in synergy.

Technological Leadership: Supercritical is leading the charge in CDR technologies, supporting a range of techniques from direct air capture to enhanced weathering. The company’s dedication to continuous evaluation to find and fund new technology with the biggest potential underpin its mission. We’ve known the founders, Michelle and Aaron, since they exited their prior startup, and believe their mission-driven approach to building the business will allow them to attract the industry’s best talent and partner with the most climate-forward companies.

Transparency and Accountability: Supercritical’s marketplace offers a high degree of transparency and accountability, with robust tracking and verification protocols. This instills confidence in buyers, ensuring that their investments are genuinely contributing to carbon dioxide removal.

Policy Alignment: Our investment in Supercritical aligns with global policy trends. Governments worldwide are increasingly recognising the importance of CDR in their climate strategies, and the demand for verifiable carbon dioxide removal services is set to skyrocket. Supercritical’s business model fits perfectly into this evolving landscape.

The climate crisis requires urgent, decisive action, and Supercritical is at the forefront of this fight. By bringing together businesses, innovators, and investors in the CDR sector, it fuels the collaborative effort we need to turn the tide against climate change.

Our investment in Supercritical is not just an investment in a promising start-up; it’s an investment in our planet’s future. We are thrilled to join them in their journey towards a net-zero world, and we invite others to explore the tremendous potential of the carbon dioxide removal marketplace. Supercritical offers an exciting, scalable, and necessary solution to a global problem, and we are proud to support their mission.

Authors