The world has shrunk over the past decade. Technology has made borders and time zones less relevant. Remote and hybrid teams made up of talent from all around a country or the world have become increasingly normal.

Until recently, going global was a path slightly mature companies took. But now, with web-based access to global markets, international markets are accessible earlier in a company’s lifecycle. Younger and younger companies are targeting the US and other markets, either to access a vast and high-ticket size market, or to recruit high-powered talent.

Globally distributed innovation is a trend that we, at Lightspeed, spotted over fifteen years ago. We’ve seen this pattern emerge and accelerate in real-time from our portfolio of companies. From Innovaccer to Byju’s, Hubilo to Darwinbox, Zetwerk to Zolve, all have discovered the value of global expansion.

Hello, World

I did a rough analysis (spreadsheet here) of all the unicorns in India (as of Jan’22), based on data from Venture Intelligence.

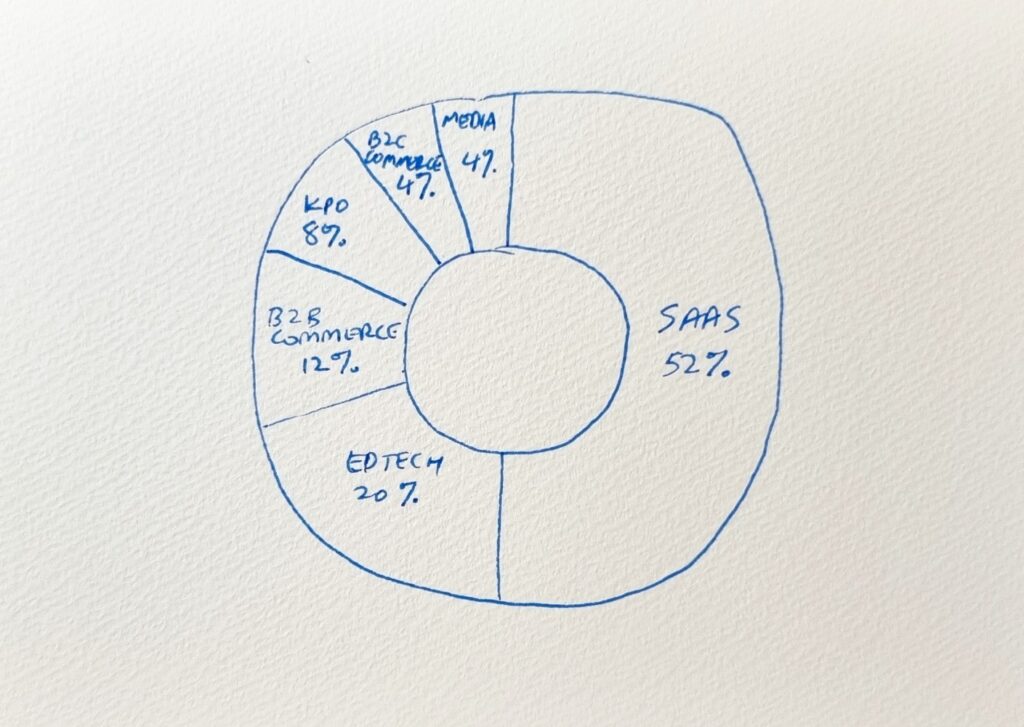

Based on my rough math, about ~30% of India’s 80 unicorns have gone or are going international with the bet that the international market is going to be their main impact opportunity. Predictably, many of these are in the SaaS space, but a surprising number of edtech and B2B commerce companies have also made the move. A further 20% have gone international as a smaller extension of their business, mainly in consumer services. I suspect crypto/web3 will move up these ranks fairly quickly.

Case in point:

—

SaaS is the early adopter of this trend. Indian SaaS firms are expected to reach $30 billion in revenue, capturing an 8% to 9% share of the global SaaS market by 2025, according to Bain & Company.

In Phase 1, SaaS companies from India leveraged business model innovation — in part, offering self-serve affordable solutions in mature categories.

We have now clearly entered Phase 2 where category creation using tech and product innovation is the main wedge.

SaaS founders have banded together. They set playbooks for each other and communities such as SaaSBoomi are on hand to help. This allows even early-stage startups to increase their odds of success when going overseas.

—

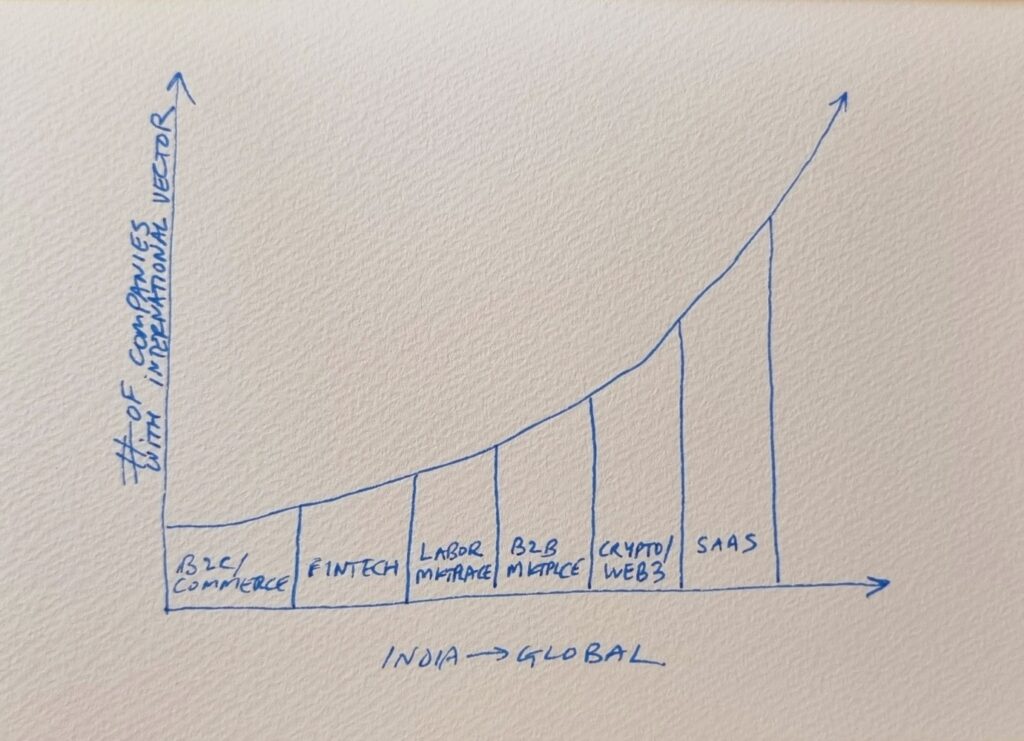

I see a world where Indian companies across the business spectrum — be it SaaS, edtech, crypto, fintech, or B2B marketplaces — will become globally recognizable brands in the US and global markets. Perhaps the progression goes somewhat like the drawing below:

The foundation is in place

No surprises here: India accelerated over the past decade like a Tesla going from 0 to 60.

- From just 50 million Internet users in 2011, India now has 850 million.

- The Indian economy, too, has transformed over the past decade. GDP nearly doubled from $1.8 trillion in 2011 to $3 trillion in 2021.

- Venture funding has also seen a huge jump in the past decade, from $1billion of venture funding in 2011 to $63 billion in 2021.

- Deals are also at an all-time high, from 182 in 2011 to a near tenfold increase to 1,202 at the end of 2021.

- From having a single unicorn in 2011 to 79 unicorns at the end of 2021 with a valuation of around $260 billion, India has come a long way.

Indian companies have an edge globally because of support from the deepening founder community, their ability to build world-class products with deep technical talent pools, access to a large domestic market, and innovative business models that are much more durable in a volatile and heterogeneous world.

The founder community has broadened, deepened, and grown in confidence in a manner that is unrecognizable compared to a decade ago. In addition, the ability of Indian founders to support and learn from each other as well as invest in each other has been super encouraging.

A big competitive advantage Indian firms have is the developer talent pool. This is how the Indian IT services industry expanded to global markets in the late ‘80s and early ‘90s and continues to thrive even today. And now, this talent is hard at work at software product companies, conglomerates, consumer startups, and open-source software (OSS) projects.

But it is not just developer talent that the country has. India also has other large talent pools such as consultants, teachers, accountants, writers, auditors, farmers, and factory workers. Consider the edtech boom in India. Teachers and educators adapted quickly and innovated with live learning, and built short and crisp capsules for young learners at home in India and globally.

In addition, India’s local markets help companies reach scale as well as fine-tune their products before going international. The market in India helped Byju’s scale in its home country and then in the US and globally. Similarly, corporate customers in India have enabled the likes of Zetwerk to fine tune their offerings before taking on large US and European customers.

- When Byju’s wanted to go overseas, it used two things at its disposal. The large talent pool of teachers and trainers to acquire local knowledge and acquisitions to access newer markets. These have helped it scale. In fact, it expects these acquisitions to be large revenue drivers this year.

- Zetwerk has built a “virtual factory” that provides customers with a B2B marketplace for manufacturing goods and components. It used its experience of working with large customers such as L&T and the Government of India to mirror its working with Airbus and GE.

- Pepper Content, the marketplace that connects writers, translators, and artists to enterprises that require content, took a mix of learnings from SaaS companies and the creator economy to the US to drive more than a third (and growing) of its revenue from there. Indians’ comfort with English and the rise of creators made rapid revenue growth achievable.

- Hubilo, the virtual event hosting platform, born out of India but now headquartered in the Bay Area, has found trust among large global customers such as SAP, Amazon Web Services, Coca-Cola, Infosys, and Deloitte.

- Acceldata understood the importance of strategic, data-driven decision-making for businesses, and built a platform that lets them optimize data operations, solving a major pain point for data scientists. From Bengaluru to Bangkok to San Jose, Acceldata has managed to get clients such as Oracle, PhonePe, and Pratt & Whitney on board.

- Darwinbox has built out Asia’s leading human capital management suite for enterprises, leveraging a large corporate customer base in India to expand to Southeast Asia and beyond. Customers include large Indian corporates such as Adani Wilmar, Tata, and Bharti AXA as well as large Southeast Asian conglomerates such as the JG Group in the Philippines.

- Zolve wants to simplify financial services for consumers crossing international boundaries by acting as a bridge between people moving from one country to another.

- Sharechat, meanwhile, has been using markets outside India, such as the US, to get access to AI and machine learning talent, which are in shorter supply in India.

The road ahead

We are going to see a growing wave of Indian technology startups going global for impact. Starting with SaaS, this trend is now extending to edtech, B2B marketplaces, labor marketplaces, crypto/web3 and fintech. While India’s talent edge and the domestic market are undeniable, the US and other countries offer sometimes larger opportunities for revenue growth, technological innovation, access to talent, and building around new trends and knowledge.

As more of you set out to access these large, vibrant markets internationally, I would love to hear from you. Please DM me on Twitter.

Authors