Internet penetration has benefited consumers and has had a second-order impact on businesses. For every Dropbox or Facetime, there’s also a Box or Zoom using digital tools to build, test, and launch at breakneck speeds and then, in “consumer-ish ways”, brand, sell, and monetise to enterprises. While India and South East Asia have already produced some large ventures in the consumer space (Flipkart, Oyo, Byju’s, Gojek, Grab, and many others) and traditional application layer SaaS space, we are now at the cusp of building out massive generational devtools, enterprise-tech and open source businesses from here. There are several trendlines fuelling this wave that we have never seen before. The ecosystem has witnessed a huge growth in the developer community and has come a long way from merely being the back office of multinationals in the 1990s.

This trend is visible in several places: “DevOps” as a search term has seen significant growth in India specifically. Over the past five years, search interest in terms containing “DevOps” has been higher in India versus the US. In 2021, globally, around $37 billion of funding went into this space. In 2015 in SaaS, only 15 companies in India were above $1 million ARR, now there are hundreds. There are 35 startups with more than $20 million ARR, up 7x from five years ago, and nine with $100 million+ ARR. Funding for SaaS in India is expected to rise 62.5% to $6.5 billion by this year, up from $4 billion just last year. Take the case of Postman, which has raised a total of $433 million. Abhinav Asthana, the founder of Postman, talks about the growing importance of Application Programming Interfaces (APIs) in the software world today.

Postman now boasts of 20 million developers and recently started an API Lab in its founder’s alma mater BITS Pilani to promote research. On the same note, Lightspeed-funded Hasura recently became a unicorn and has raised $136.5 million.

We’re witnessing an increased pace at which developer startups can grow, increasing word-of-mouth publicity and reducing acquisition costs for the most popular developer tool startups.

Zoho formed the first generation of this cohort as purely SaaS companies. Freshworks, Postman, and BrowserStack were the second generation. Now, deeply technical companies such as Hasura, Supabase, Atlan, Acceldata, and Polygon (in the web3 space) are the youngest generation.

So what is fuelling this wave in India and South East Asia now?

While most of the activity is from India, South East Asia is witnessing the first few such businesses being built. The whole region is inflecting for the following reasons:

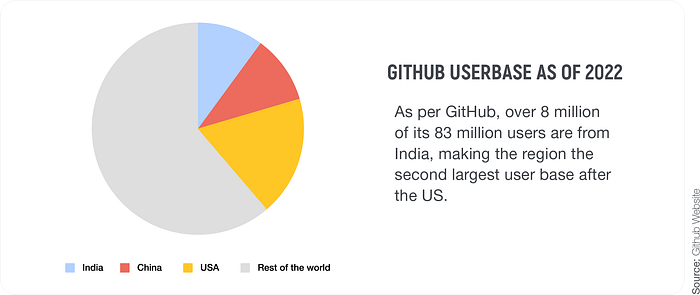

- Developers in the region have grown multifold, and India is the fastest-growing open-source contributor. As per GitHub, over 8 million of its 83 million users in 2022 were from India, making it the second-largest user base after the US. However, the Indian developer base is growing faster, ~40% in 2020–21 compared to 16% in China and 22% in the US. GitHub expects to see these numbers explode and potentially have ~10 million Indian developers on its platform by 2023. Indian talent is growing within the thriving local start-up ecosystem, which gives them an edge in areas like product management, engineering, technology, SaaS sales, etc.

- Startups have now witnessed the scale which would necessitate world-class infrastructure. Cassandra came out of Facebook’s internal need, Google open-sourced Kubernetes based on their internal container orchestrator Borg. Similarly, engineers and product managers coming out of Hortonworks, Freshworks, Flipkart, Hotstar, Ola, Capillary, InMobi, etc. are founding new infrastructure and devtools companies. In turn, startups can now build to get to product-market fit within their local market and scale to other geographies immediately after. Take the case of Atlan. It started with a problem the founders personally faced at SocialCops. Its first design partner was in India, which helped it build an MVP really quickly, get to market faster, and achieve product-market fit. Atlan founder Prukalpa talks about how it got started:

- With the sudden rise in developer salaries in India, devtools and open source which were traditionally hard to monetise are now actively being bought by engineering teams. Developers in the region prefer the trust, community support, and flexibility of no vendor lock-in that comes with open source. This is further reinforced by the shift-left paradigm where lots of tools now target developers, such as security and DevOps.

- Indian and South East Asia SaaS startups have significant cost advantages for hiring. Geographically and culturally, India and South East Asia are well-situated to serve all of Asia, being a 4-hour flight away from the major markets in the Middle East and China. Enterprises are a massive opportunity in the Asian market since even large companies move directly from no-software to SaaS. Often, there is no incumbent to displace. Given the Indian and South East Asian markets are multilingual, they become a perfect place to build products for the rest of the non-western world. It is also the perfect place for certain vertical-specific APIs such as fintech (since regulations are different), and video infrastructure (since the consumption patterns are different). There’s also a large market for verticals like videos and games.

COVID has amplified some of these conditions. With the massive increase in remote jobs, there has been a shift in salaries because of more competition for technical talent. Globally, companies are now more open to buying over Zoom calls. Successful playbooks are being built for scaling from India because of these trends.

Lightspeed has invested in several of these categories in companies, such as Supabase, Yellow, Hasura, Razorpay, Rephrase, Acceldata, Project Discovery, and many more.

India and South East Asia Opportunities

Focus on web development tools and simplifying backends

Development is becoming more frontend-heavy than backend heavy, popularised by frameworks like AMP, increase in frontend web development, and faster ways of A/B testing in the world, which has led to the rise of companies like Netlify, Vercel, Supabase and Hasura. Supabase, a Backend-as-a-Service (BaaS) company built out of Singapore and an open-source alternative to Firebase, is piggybacking on BaaS trends globally. Our view is that this space will continue to grow and we will see clear winners emerging in this arena, especially open source.

Paul Copplestone, co-founder, Supabase comments on how the shift towards open source is helping the product grow while being built out of this region.

Hasura accelerates backend development by automating the creation of data APIs powered by GraphQL. On the first day of launch, their GitHub repository gained thousands of stars and organic enterprise interest, a rare occurrence in open source.

Hasura’s founder Rajoshi Ghosh seconds the focus on developer productivity and how they simplify data access for GraphQL APIs. Developer productivity, she says, is a critical focus area for organisations today. One of the key bottlenecks for developer productivity is access to data — especially as the volume and heterogeneity of data explode.

Developer productivity tooling

Code intelligence and testing tools which help in the build-step are seeing some movement. Engineering leaders are consistently looking for ways to decrease the time that building and testing take, especially since productivity has become a big concern in this part of the world as well. Products such as Postman, BrowserStack, and LambdaTest aim to reduce the time taken to run necessary testing (like unit tests) so that feedback loops are shortened and developers can iterate faster.

Last9 is a cloud-native reliability platform for Service Level Objectives (SLOs). Piyush Verma, the founder of Last9 explains why he feels strongly about building from this region.

No-code, low-code platforms make for another recent trendline. Recently such platforms have enabled several use cases, such as app development and machine learning development, creating opportunities such as Kissflow. Retool alternatives such as Appsmith, ToolJet, and Intercom alternatives such as Chatwoot have sprung up and gained a lot of traction. Appsmith is one of the most popular open-source alternatives to Retool. With the adoption of the CI/CD paradigm, engineering teams want to codify their release automation process to make it repeatable, fast, and error-free with products such as Devtron Labs, and others.

Security

Open-source and shift-left security are a fast-growing trendline (capital flow CAGR is ~100% since 2017). Snyk in the US, a code scanning tool that caters to developers, is the largest player in this space with a valuation of $6.5 billion. While the old paradigm in security siloed the function of security teams, Snyk enables teams to “shift left” by providing code scanning to developers to identify vulnerabilities directly from the IDE and during code review, rather than waiting until code is in production. This is also critically important to ensure code security proactively, as open-source adoption increases. Lightspeed-funded Project Discovery is an open-source project originally started in Jaipur, India, that is capitalising on this trend.

Rise of Vertical APIs

India is the largest consumer of YouTube videos in the world. With Reliance Jio reducing data costs and making it ubiquitous in India, online videos have seen an explosion. New use cases have sprung up and companies are figuring out ways to solve core infrastructure problems for videos. We’ve seen 100ms, coming out of Hotstar, building audio and video SDKs for a video-first world. Similarly, Dyte also offers video and audio SDKs. More recently, Rephrase.ai uses generative AI wherein deep-learning algorithms are used to generate, from scratch, entirely new video content with just text, audio, or photos as inputs.

Here’s how Ashray Malhotra, the founder of Rephrase.ai, describes it:

This space has already seen several fast-growing startups being built. We expect consolidation in the near future, and the emergence of category leaders.

Similarly, fintech is one of the most exciting spaces in India and South East Asia today and has attracted the most capital in recent years. Razorpay is building the financial infrastructure for India, similar to Stripe in the US, and was last valued at $7.5 billion. The open banking model and its equivalent in India, India Stack, has also gained popularity. Companies like M2P (valued at over $600 million) and Setu in India and Finantier in South East Asia are building the next-generation infrastructure for fintechs and banks.

Here’s what Shashank Kumar from Razorpay had to say about building a fintech company for the emerging economies of the world:

Infrastructure & Data Management stack

The movement towards containerisation has led us to a whole new generation of startups to solve the problems related to managing the scale and dynamism of containers. Common problems such as monitoring, security, logging, tracing, and many more require a completely new product to solve the same problem. We are seeing a lot of activity in this category.

Last9 is building a cloud-native reliability platform for SLOs and SigNoz is developing an open-source APM, Zipy is building a session replay, frontend and network monitoring layer over logs, and Hasura is simplifying data access. Druva started in a smaller city in India, Pune, and has a valuation of more than $2 billion. The company initially focused on providing management software to financial companies before shifting to general enterprise data management.

We believe data infrastructure is ripe for disruption. Although there are many well-funded companies in several key emerging categories, including business intelligence and operational analytics, feature store, metrics store, ETL and reverse ETL tools, data warehouse, PLG CRMs, managed data stack-as-a-service, and many others, the overall space is still very fragmented and does not yet have clear winners.

Rohit Choudhary, founder of Acceldata, a modern data infrastructure player that helps get visibility into modern data systems, confirms this hypothesis.

The number of sources from which data is analysed and collated continues to rise, making the stack more complex. Hevo Data is an example of a modern data infrastructure pipeline pulling data from various sources for faster analytics.

Manish, founder of Hevo Data, reaffirms the no-code wave for data infrastructure.

The recent PLG wave has fuelled the growth of companies such as Toplyne, Outplay, and RevenueHero. 5x data simplifies getting started with the modern data stack and takes advantage of the cost arbitrage in this region. Meanwhile, other categories such as the metrics layer (where Transform and Supergrain operate) have seen the likes of DataBrain spring up.

Conclusion

Despite the current environment, there are very strong fundamental shifts supporting the next generation of infrastructure, devtools, and open source companies coming out of this region, with India leading the charge and South East Asia showing early signs. The startups in this region are quickly catching up with global trends in several areas. We’re seeing early breakouts within developer productivity and data infrastructure as well as the emergence of the first few start-ups in newer categories like security. We expect great companies to continue to be built and great founders to attract the right capital, and teams to build generational companies. Thanks to all our contributors, GitHub and Google. If you’re building in this space, please contact us at manjot@lsip.com, thakurniharika@google.com, achamaria@google.com.

About Lightspeed India SaaS team

Lightspeed India’s SaaS and enterprise team brings together decades of experience in prior founding journeys, business and product building, and investing across India and US markets. We have built hardware and software products across application and infrastructure SaaS and developer tools for global companies, including Google, Flipkart, AMD, Stripe, and more, and

invested in companies such as Darwinbox, Hubilo, Acceldata, Yellow.ai, Pixxel, Rattle, Supabase, and many more.

About Lightspeed

Lightspeed Venture Partners is a multi-stage venture capital firm focused on accelerating disruptive innovations and trends in the Enterprise, Consumer, Health, and Fintech sectors. Over the past two decades, the Lightspeed team has backed hundreds of entrepreneurs and helped build more than 500 companies globally including Affirm, Carta, Cato Networks, Epic Games,

Faire, Forty Seven, FTX, Guardant Health, Mulesoft, Netskope, Nutanix, Rubrik, Sharechat, Snap, TripActions, Udaan, Ultima Genomics and more. Lightspeed and its global team currently manage $18 billion across the Lightspeed platform, with investment professionals and advisors in the U.S., China, Europe, India, Israel, and South East Asia. www.lsip.com.

About Google

Google’s mission is to organise the world’s information and make it universally accessible and useful. Through products and platforms like Search, Maps, Gmail, Android, Google Play, Chrome, and YouTube, Google plays a meaningful role in the daily lives of billions of people and has become

one of the most widely known companies in the world. Google is a subsidiary of Alphabet Inc.

About GitHub

GitHub is the developer company. We make it easier for developers to be developers: to work together, to solve challenging problems, to create the world’s most important technologies. We foster a collaborative community that can come together — as individuals and in teams — to create the future of software and make a difference in the world.

Authors