India’s focus on local manufacturing with its Make in India initiative has coincided with a focus on self-reliance or Aatmanirbhar Bharat over the past few years. It’s an important conversation in today’s world of digital borders and fraught digital supply chains.

As an example, think of the OS running your smartphone. Google-owned Android is the OS of choice for over 95% of Indians, and Apple’s iOS is for about 4%. The two dominant operating systems in India and globally are owned by US companies. Another area where US-based companies hold a duopoly is digital advertising (Meta and Google).

But India is moving toward more self-reliance in technology products.

From a public policy perspective, the “India Stack” has given over a billion Indians access to ubiquitous identity (Aadhar), easy payments (unified payment interface — UPI), consent-based sharing of financial data (Account Aggregators) and persistent document storage (Digilocker). New capabilities are emerging in frictionless commerce (open network for digital commerce — ONDC), frictionless credit (open credit enablement network — OCEN) and better access to health information (unified health interface — UHI).

The private sector is also doing its part. We are now at an inflection point where there are a lot of homegrown technology products for corporates and startups in India to choose from.

I asked founders in India last year what Indian products their companies were using. The responses were enlightening and extremely encouraging.

There is adoption across the board for products from Indian startups. To put things in perspective, just look up these lists from G2 and SaaSBOOMi.

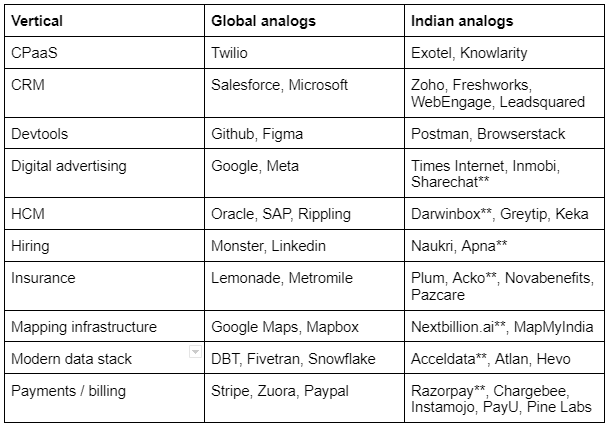

Here’re some of the B2B segments served by local Indian companies:

What makes Indian software for Indian firms a compelling proposition?

High quality

Products from India in SaaS, fintech, infrastructure and devtools have come a long way in terms of quality. Indian products compete with the best globally and are global leaders is many categories.

Context is king

The reason behind using India-made products goes way beyond just making a statement. Indian firms are solving unique Indian problems. Businesses, like end-consumers today, expect personalisation, whether paying for a product or a service. And unlike before, they are willing to pay.

Let’s look at Darwinbox**. Large global firms that offer human resource management software often have workflows that do not make as much sense in the Indian context. So customers often end up paying for over five different software solutions to solve the needs of their organisations.

Darwinbox knew that every geography has its own unique needs and challenges. So, it entered India and Southeast Asia with a mobile-first approach, making its HR system accessible to everyone.

Cost advantage

Zoho replaced the traditional CRM for many startups. Zoho products were easy to integrate with existing solutions customers were using, and it didn’t push smaller businesses to adopt an all-in approach with its offerings. Along with this, an important aspect was the cost advantage it came with. It offered better pricing options, which made Zoho a good solution for startups.

This is a common theme for most startups. They are more likely to understand why an early business is unwilling to spend big money on features it won’t use. Once businesses see the value, they come back for upgrades and more.

Unique business models

India has many problems that remain unsolved which can be solved through technology. A great example of such an area is manufacturing, which was always thought of as being impossible to digitise. Until Zetwerk** stepped in to help its customers adapt to the post-pandemic digital shift with its tech-based contract manufacturing solution. Not only has it done well, but is also adding newer categories continually. It is also eyeing expansion beyond the Indian market.

Better responsiveness

Another reason for Indian companies to work with Indian startups is the hustle mindset. Large MNC products and services, however well-intentioned, want to tap into Indian demand, but rarely have flexibility in how they serve Indian customers

Indian fintech companies, such as Razorpay**, respond to customer issues faster because the teams understand local issues, local regulations and are based locally. They are making simple, clean interfaces that are ideal for use by small businesses, and easy to manage across larger ones too.

Many investors believe that the total addressable market for B2B products and services in India is small or “capped.” We think this is a short-term view and markets in India, the third largest economy in the world by 2030, are set to be very large. It is an encouraging time, when self-reliance in the digital economy is on the rise. We’re optimistic, the future is bright.

** Lightspeed portfolio companies.

Authors