03/06/2025

AI

Fintech

Billing Infrastructure in the Age of Co-pilots and AI Agents

The dawn of intelligent systems, from “selling the software” to “selling the work,” is redefining economic value. These changes don’t just affect pricing—they ripple across every facet of business operations.

As we move toward co-pilots and autonomous AI agents, pricing models must evolve. We have continued to shift further away from predominately human usage, priced on a per-seat license, to a world with an increasing number of human-to-machine and/or machine-to-machine-based interactions. The rise of AI agents performing tasks autonomously will require a re-evaluation of economic value derived from underlying services.

AI software could be priced based on compute, similar to databases. It could also be priced on an outcome-based approach, with closer value alignment. This will necessitate a new billing infrastructure. The seat based model once disrupted the perpetual license model, so too will usage/performance pricing disrupt SaaS. In a decade, we may look back at the era of subscription pricing as an anomaly.

This shift to usage or performance-based pricing requires a data infrastructure-first approach to align with process flow.

Shifting to usage-based pricing means that billing can no longer be an afterthought—it must be built on a robust data infrastructure from the ground up. Every billable action (API call, computation, transaction, etc.) needs to be metered, rated, and invoiced. This requires robust handling of high volumes of event data, applying agile monetization rules, and integrating with finance systems in near-real-time. We will see the emergence of data observability for agile monetization.

There is a clear analogy with that of telco usage-based billing that had to re-design its infrastructure to accommodate large volumes of data usage, complex billing systems (e.g., tiered rates, discounts, promotional offers, bundled services), real-time processing, regulatory compliance, and reliability, etc.

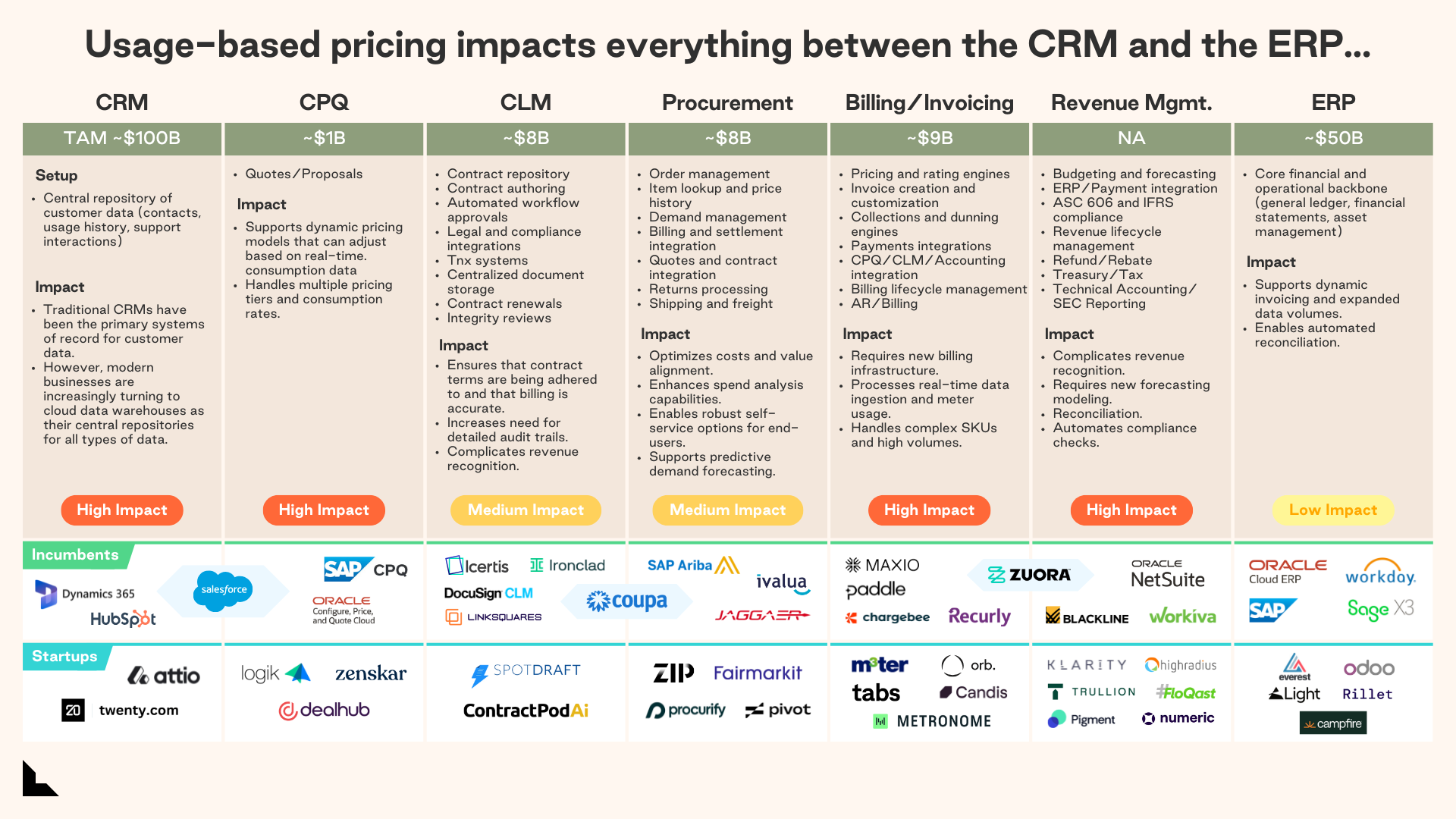

Usage-based pricing’s ripple effects across the billing infrastructure stack

Monetization is now an all-encompassing process that spans the entire organization, impacting product development, marketing, sales, finance, billing, and customer support—extending from the back office to the front office and into the customer and supplier ecosystem. Indeed, usage-based pricing impacts everything between the CRM and the ERP:

CRM

- Traditional CRM systems (e.g., Salesforce, Microsoft Dynamics) are designed around human sales reps managing relationships with customers. However, these interactions are no longer purely human-driven.

- In the old model, a salesperson’s goal was to sign a big annual contract (e.g., $X for Y seats), and they’d earn a commission on that contract value. In a consumption model, however, value unfolds over time as the customer uses the product.

- In essence, the CRM now also tracks telemetry about how customers use the product (since that ties directly to billing and renewal conversations).

CPQ

- CPQ systems help sales teams generate complex quotes for configurable products. Pricing changes for each SKU product are typically hard-coded and can take 3-6 months to implement.

- In this new paradigm, pricing and packaging need to be agile to support a wide array of models (per-use, tiered plans, volume discounts, overage pricing, prepaid credits, outcome-based charges, etc.) via configuration rather than code; for example, software licensing, cloud services, and enterprise solutions.

CLM

- CLM systems manage legal contracts manually, requiring human review for terms, compliance, and risk assessment.

- We’re seeing a shift to more autonomous contract review systems, clause extraction, and dynamic contract negotiation.

- These systems will need to be better integrated with AI-driven procurement, billing, and revenue recognition systems

Procurement

- We are moving away from rule-based approval workflows to intelligent systems negotiating autonomously, albeit with supervision or pre-determined utility curves.

- Spend analytics, supplier risk assessment, and demand forecasting will all up-level.

Billing/Invoicing

- Moving towards dynamic billing based on real-time consumption. However, this will require a greater focus on the end-customer experience of billing. Rather than a customer being surprised by a bill at month’s end, these systems enable real-time visibility of usage and spend.

Revenue Management

- Traditional revenue management systems (e.g., NetSuite, Zuora, SAP BRIM) are built around predefined pricing models and predictable revenue recognition rules.

- From an accounting perspective, usage-based revenue introduces new complexities. Finance teams can no longer recognize revenue evenly based on a straightforward annual subscription.

- Systems will need to automate complex revenue recognition for AI-driven and usage-based billing models, and ensure compliance with ASC 606, IFRS 15, and other financial regulations in real-time.

- We’ll see more autonomous financial operations, including accounting close management, business planning, revenue reconciliation, etc. Multi-dimensional modeling may finally enable revenue and cost matching at a micro-level.

ERP

- The evolution in billing and monetization opens a window to rethink legacy ERP systems as well. These tools were not built with agile pricing in mind. They assumed relatively static pricing, simple contract terms, and minimal mid-stream changes. Usage-based pricing exposes their inflexibility.

- We often see finance teams exporting data out of an ERP to spreadsheets for adjustments, or building ancillary databases to handle usage ratings because the core system can’t do it.

- AI disrupts static planning, financial reporting, procurement, and supply chain management/inventory control by enabling real-time, autonomous decision-making.

The Big So What: Billing Infrastructure Is the New Strategic Battleground

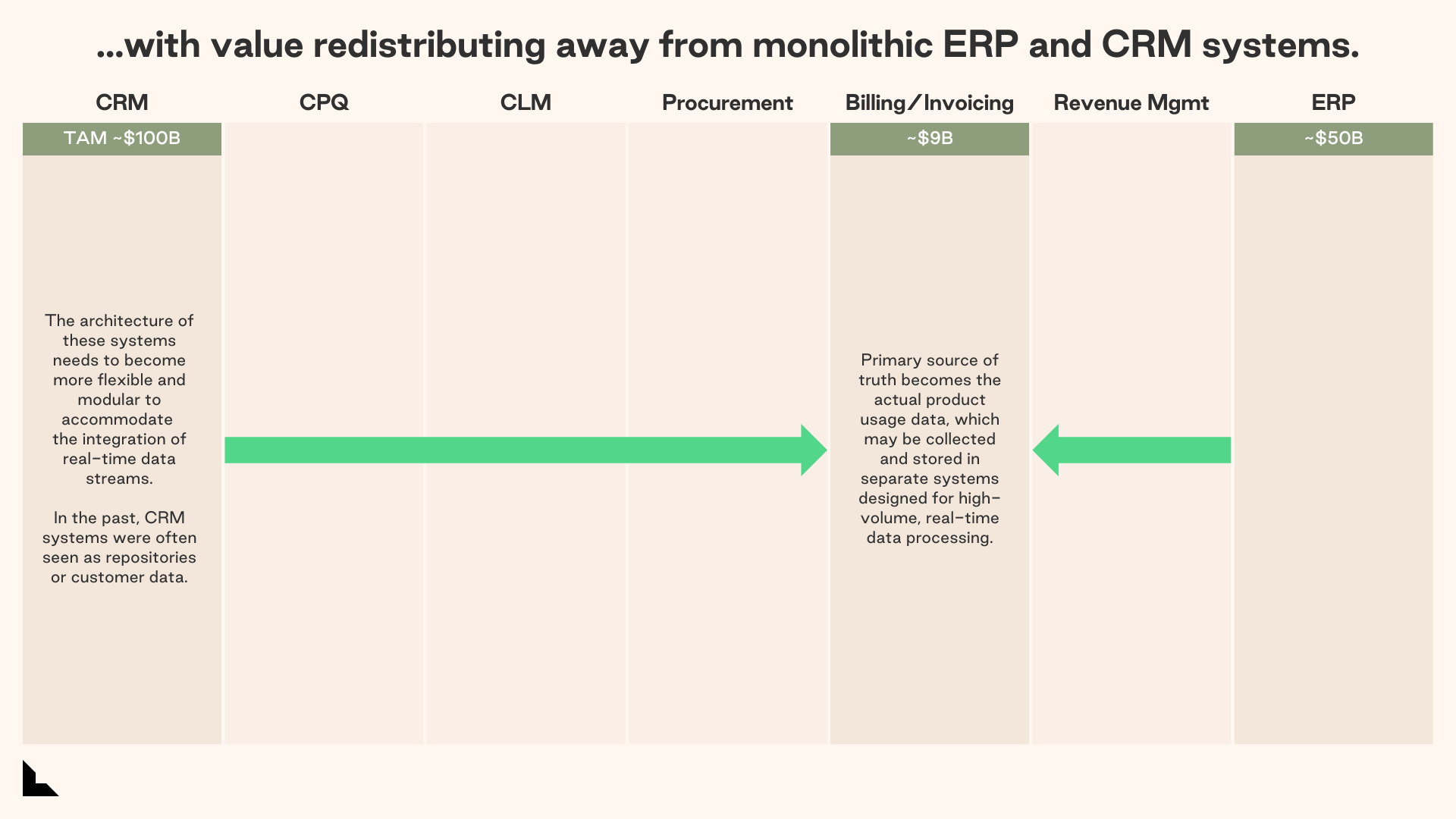

Why does this matter right now? Because as AI-based co-pilots and agents take over not just knowledge work but decision-making in finance, procurement, sales, and more, we believe value will be re-distributed in the billing infrastructure stack.

Implication #1: The Rise of Data Observability for Billing / Monetization

In a usage-based model, the most accurate and up-to-date source of customer value isn’t a static contract in a CRM—it’s real-time product usage data. As such, the billing infrastructure becomes the data observability for the broader organization.

This creates a new category of solutions that help finance and product teams see real-time cost, revenue, and performance data, enabling smarter product decisions and pricing experiments.

Implication #2: Billing infrastructure becomes the new revenue and cost intelligence layer.

Usage-based billing means costs are also dynamic—they depend on factors like compute usage, API calls, etc. As a result, companies with flexible billing can experiment with new pricing strategies faster, be it tiered usage, per-event billing, or surge pricing, unlocking new economic value and agility.

As such, your revenue and cost alignment is only as good as your underlying billing infrastructure. This elevates the role of billing infrastructure, and boards should scrutinize “BillingOps” or “FinOps” as a vital capability, not a mere back-office function.

Implication #3: CRM and ERP are not going away, but they must adapt

As AI makes unstructured data (e.g., product usage logs, emails, call transcripts, and customer interactions) more accessible and actionable in real-time, the need for static, monolithic depositories—like traditional CRMs or ERPs–diminishes. Instead of storing data in rigid, predefined structures, modern systems are moving toward ephemeral, event-driven architectures.

Opportunities for Startups & Investors

The shift to usage-based or AI-driven billing models isn’t just a pricing tweak—it’s a tectonic realignment of how revenue is generated, recognized, and optimized. As discussed above, it ripples across the billing infrastructure, impacting revenue reconciliation, changing sales compensation plans and product development, requiring servicing engineers with robust backend systems, providing intuitive frontend interfaces for sub-function beneficiaries, and revenue visibility for finance.

This is an inflection point ripe with opportunity. The companies that master usage-based monetization stand to capture outsized market share; those that ignore it may get outmaneuvered on product and pricing innovation. Investors will have to look more closely at the “FinOps” function to handle usage-based complexity while scaling, along with the implications around revenue predictability, product and pricing agility, revenue accounting and compliance, and beyond.

Table Information Sources:

- Jefferies Zuora Initiating Coverage May 7, 2018

- Gartner, Customer Experience and Relationship Management, Worldwide, 2023

- MGI MarketView, CPQ Market Summary (Sep 18, 2024)

- Precedence Research, CLM Software Market Size (Jan 27, 2025)

- Fortune Business Insights, Procurement Software Market Size (Feb 3, 2025)

- Straits, Subscription and Billing Management Software (Jun 26, 2024)

- Gartner, Enterprise Resource Planning, Worldwide, 2023

Writing Archive:

- The Official SMB Software Benchmarking Guide

- Welcome to the Hypersonic Innovation Cycle: How Scale Factors are Redefining Innovation

- New York Tech Keeps Rolling: 2024 Insights

The content here should not be viewed as investment advice, nor does it constitute an offer to sell, or a solicitation of an offer to buy, any securities. Certain statements herein are the opinions and beliefs of Lightspeed; other market participants could take different views.

Authors