12/12/2024

AI

Welcome to the Hypersonic Innovation Cycle: How scale factors are redefining innovation

Each shift in tech delivery models has reshaped speed and value—with AI, we’re propelling into the hypersonic era of innovation, ushering in exponential scaling, faster time-to-market, and a shift in competitive advantages.

From the shift to packaged software in the 1990s to the SaaS revolution in the early 2000s, every leap in a tech delivery model has compressed timelines and multiplied value—redefining speed, efficiency, and scale.

Consider SaaS: its growth was unprecedented, from just $1B in 2004 to approximately $250B in 2024E. With AI, the scale factors of IT evolution have never been steeper, creating growth curves unlike anything we’ve ever seen.

AI, scaling at twice the speed of SaaS*, marks the dawn of a hypersonic innovation cycle—one that redefines delivery models. The question isn’t if AI will disrupt IT services and SaaS but how fast it will dominate them.

The evolution of technology delivery systems

The technology industry has undergone several major shifts in delivery models over the past 40 years, each bringing faster growth rates and larger scale factors.

Phase one: IT services → packaged software

The first major transition began with labor-intensive IT services to standardized, packaged software.

1980s–1990s: The era of IT services

The 1980s and 1990s marked the rise of IT services, dominated by custom-built solutions from giants like IBM, Accenture, and TCS. This labor-intensive phase saw businesses relying on tailored systems. In 1981, when IBM selected Microsoft to supply the Disk Operating System (DOS) for its personal computers, total software product spend totaled less than $3B.

1990s: The rise of packaged software

The 1990s ushered in the early software era with the introduction of standardized, packaged software sold as perpetual licenses. Reusable code significantly reduced development effort compared to bespoke IT services. Startups no longer needed large teams for custom implementation, lowering the barriers to entry.

Microsoft in OS and SAP established themselves as the de facto standard in business planning and Oracle as the standard in databases.

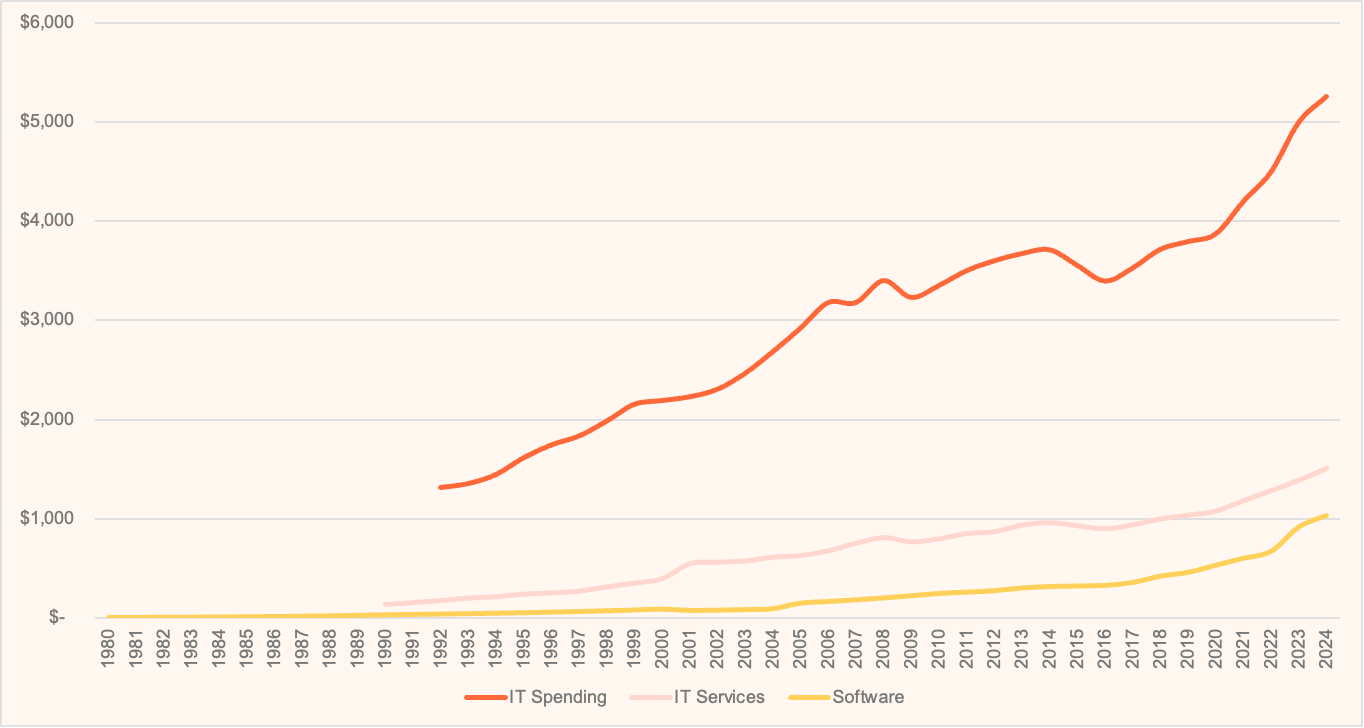

Worldwide IT spending vs. IT services vs. software ($B)

Total IT spending grew from ~$1T in 1990 to ~$5T in 2024 (5x in that timeframe). It has experienced a significant expansion since 2020, impacted by several factors, including cloud adoption and digital transformation initiatives, resulting in CAGR accelerating from ~6% to closer to ~10%.

In comparison, the IT services segment scaled from ~$130B to ~$1.5T (11x growth), and the software segment scaled from $30B to $1T (33x growth) in the same period.

Phase two: Software → SaaS

The next major shift was from on-premise software to cloud-delivered SaaS.

2004: The SaaS breakthrough

In 2004, when Salesforce went public, SaaS started to present itself as a viable delivery model. SaaS enabled startups to deploy faster, reducing upfront IT infrastructure needs. Competitive advantages shifted usability and user experience, and the shift from license to recurring revenue expanded the market opportunity set.

During this phase, key players like Salesforce, Workday, and ServiceNow achieved unprecedented growth rates. SaaS spend grew from $1B in 2004 (less than 5% of software) to circa $250B by 2024 (over 25% of software).

The modern cloud stack

The rise of the SaaS delivery model also accelerated demand for Platform-as-a-Service (PaaS) and Infrastructure-as-a-Service (IaaS); PaaS for application development and integration, and IaaS for scalable infrastructure. This created a feedback loop that drove the vertical integration of cloud hyperscalers like Microsoft Azure, Google Cloud Platform (GCP), and Amazon Web Services (AWS), ultimately forming the foundation of the modern cloud stack. Together, SaaS, PaaS, and IaaS have come to define the cloud computing ecosystem as we know it today. Startups like Snowflake were able to leverage AWS infrastructure to scale faster.

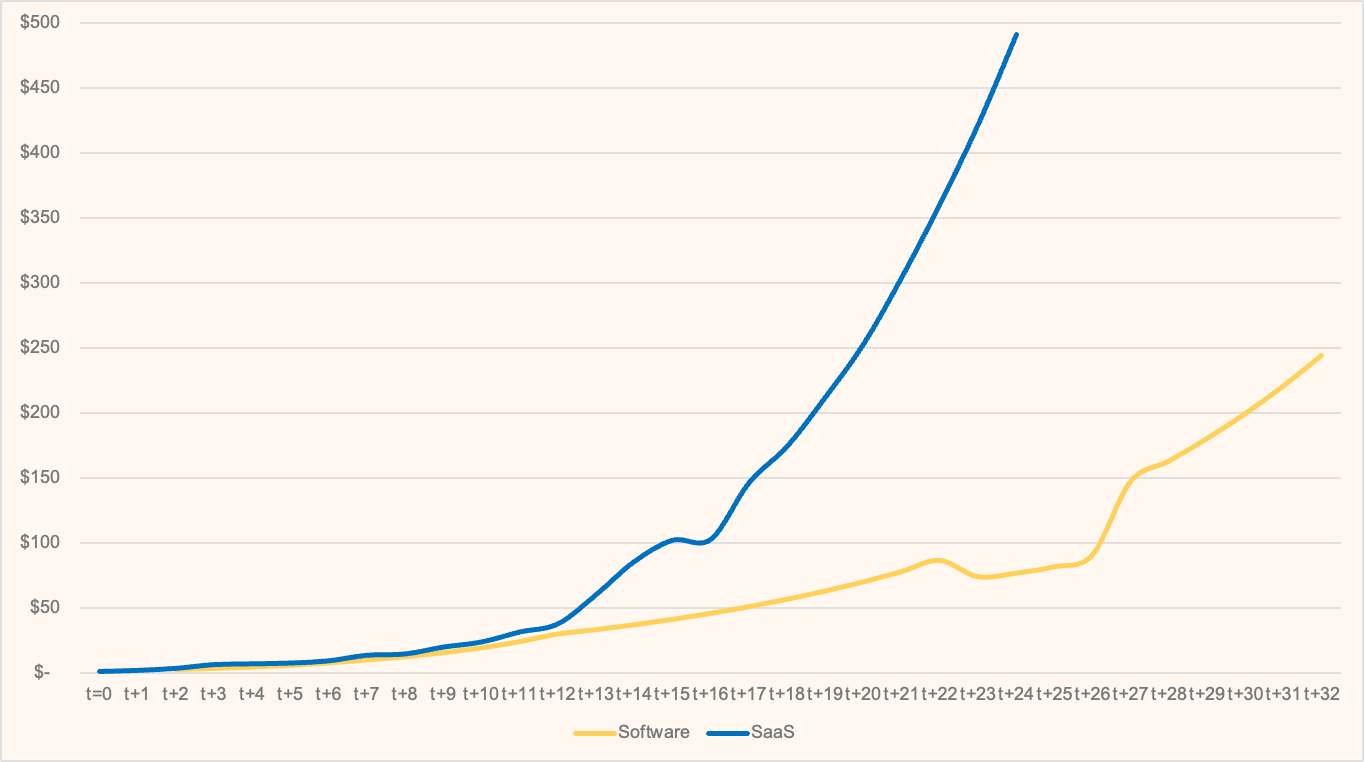

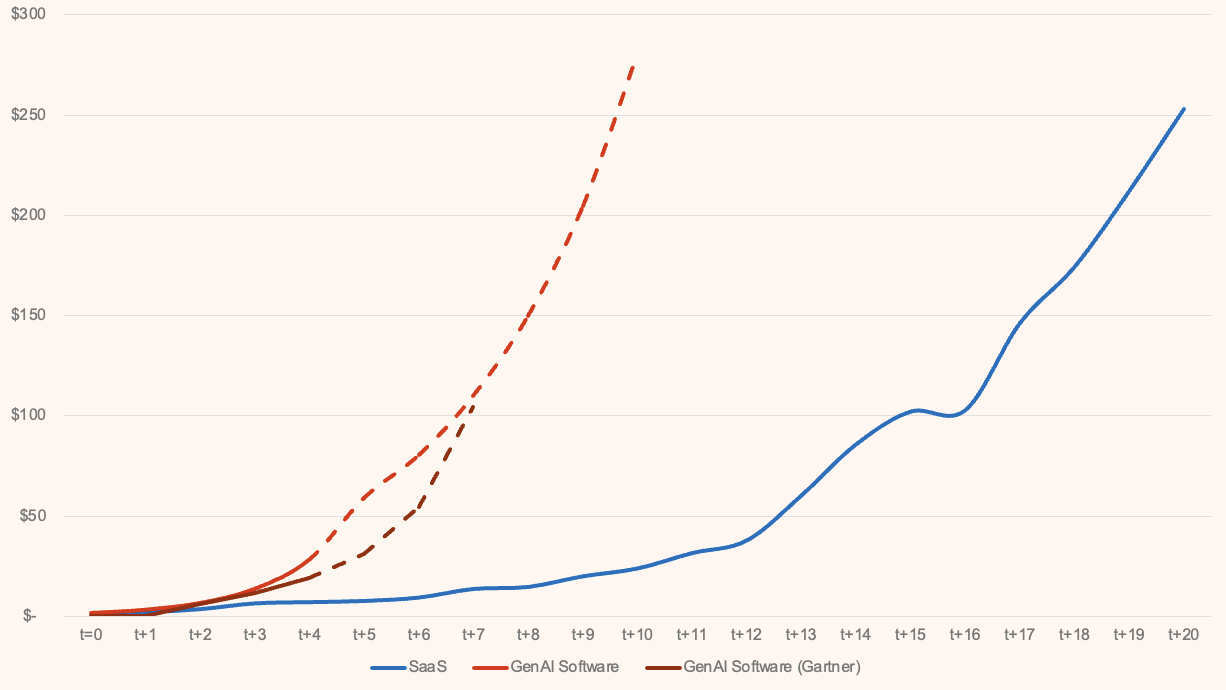

Worldwide software spend vs. SaaS spend ($B)

Software scaled to $200B after 30 years and SaaS in 20 years, roughly 2/3rds of the timeframe.

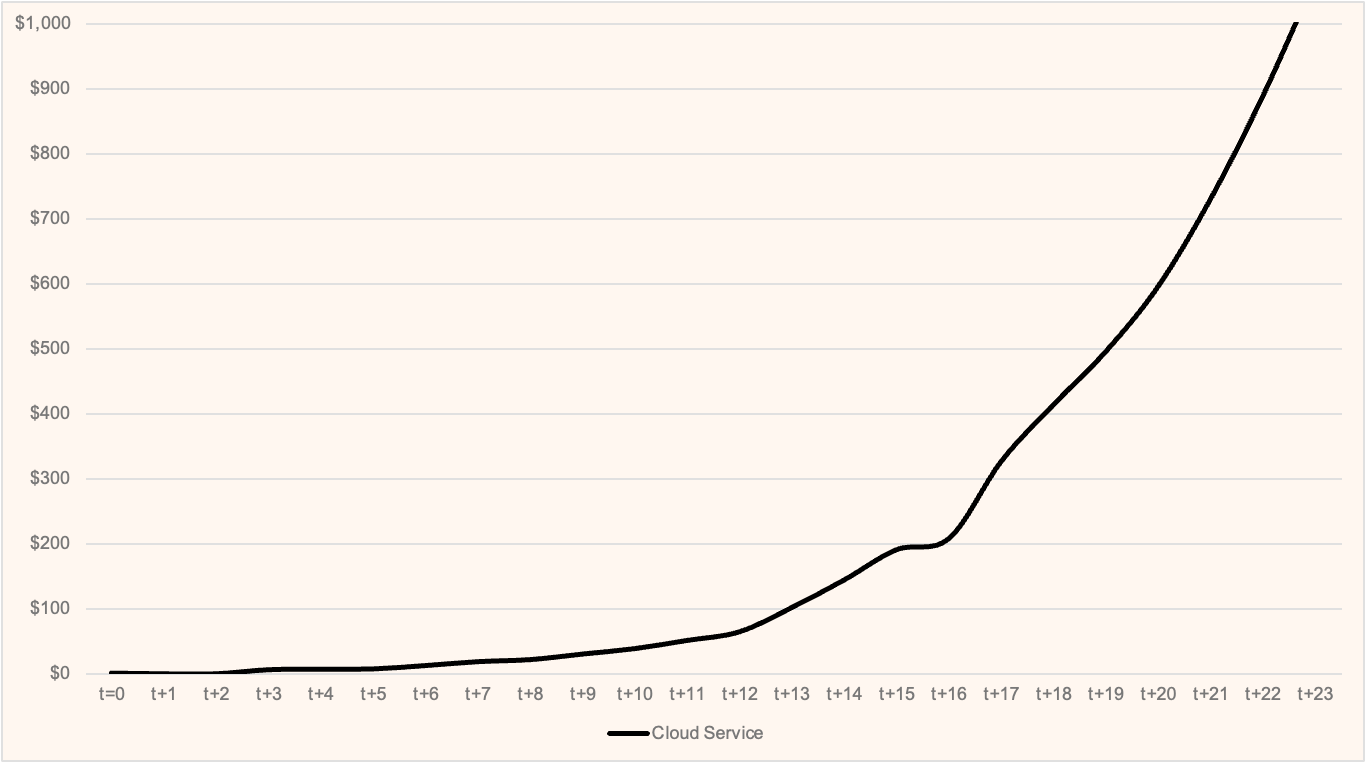

Worldwide public cloud spend ($B)

Total public cloud (IaaS, PaaS, and SaaS) spend scaled from $1B in 2004 to $1T in 2027 per forecasts.

Phase three: SaaS → AI (SaaS+Services 2.0)

We are now entering a new phase marked by intelligent systems. This period marks the systems shift from “selling the software” to “selling the work”.

Now: AI-embedded workflows

AI intelligence will be embedded into workflows, enabling systems to “do the work” instead of just supporting it. These solutions offer customization in real-time, operational efficiency gains by automating repetitive tasks and delivering non-linear value delivery (i.e. systems that improve over time).

The accelerating pace of innovation in technology delivery models is the result of several structural forces: advances in computing power, data availability, scalability of cloud infrastructure, and deep learning architectures. What will sustain this level of adoption? On the demand side, accessibility and a tight coupling between return on investment (ROI) and perceived value are crucial. On the supply side, the key to mass adoption is cost-effective computing power.

Faster innovation

Startups can leverage pre-trained models (like OpenAI or Anthropic) or tools (such as Hugging Face) to more rapidly prototype and launch products, compressing feedback cycles. The ability to leverage intelligence systems shifts the moat from product features to outcomes. Niche use cases that would have been previously unfeasible have been unlocked (for example, Pika for creative tools and Suno for music creation).

Worldwide SaaS spend vs. AI software spend ($B)

AI software is forecast to scale at a 2x factor compared to SaaS, reaching $200B within 10 years of scaling (t=0 rebased for $1B) compared to 20 years for SaaS. Examples of this accelerated adoption include OpenAI’s ChatGPT, which reached 100M users in just two months, setting a record for user growth.

What is the GenAI revenue pool today? Based on bottom-up LSVP GenAI software and services, revenue crossed $20B in 2024. This excludes hardware (devices and infrastructure), gaming, and ad spending.

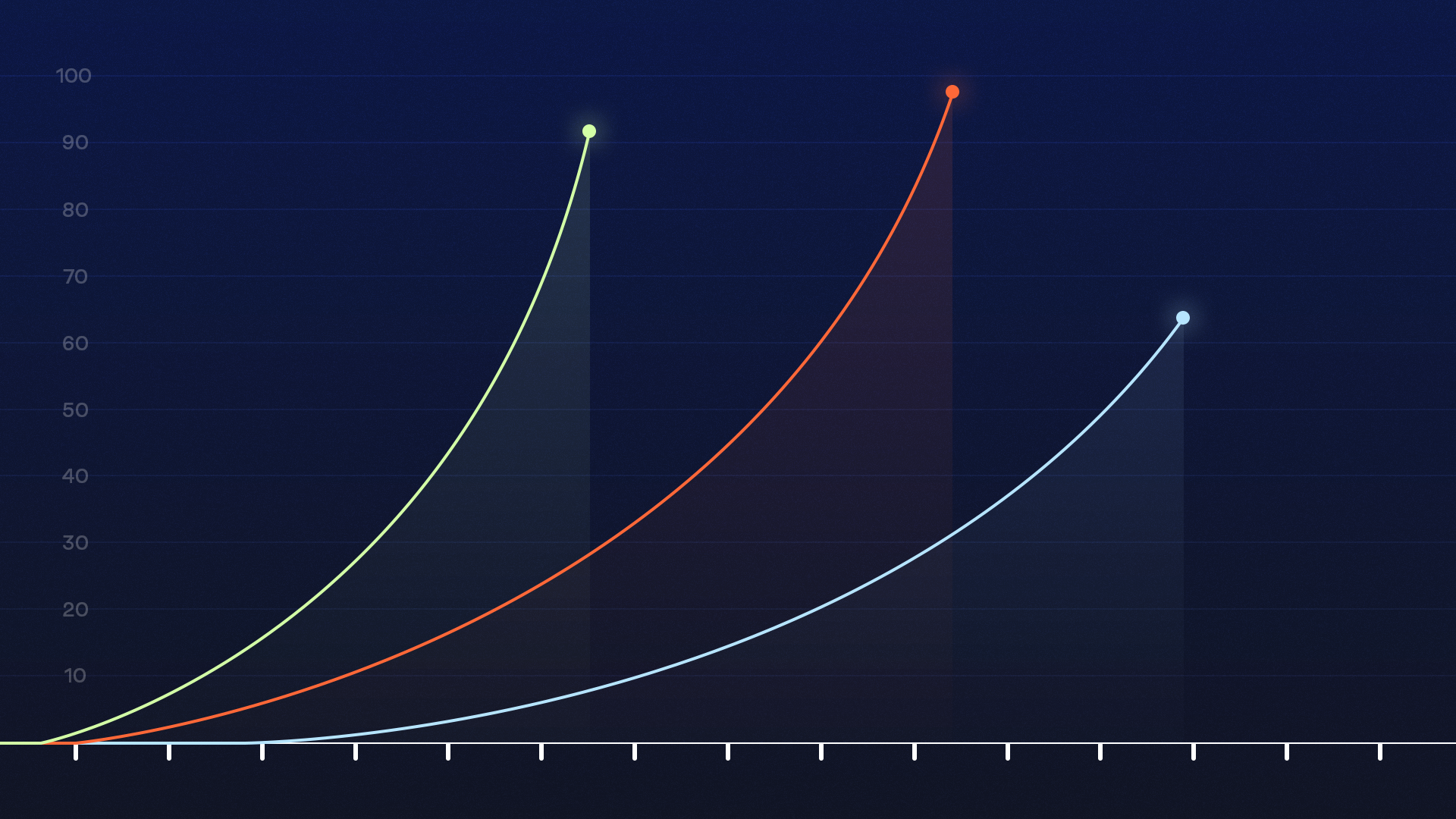

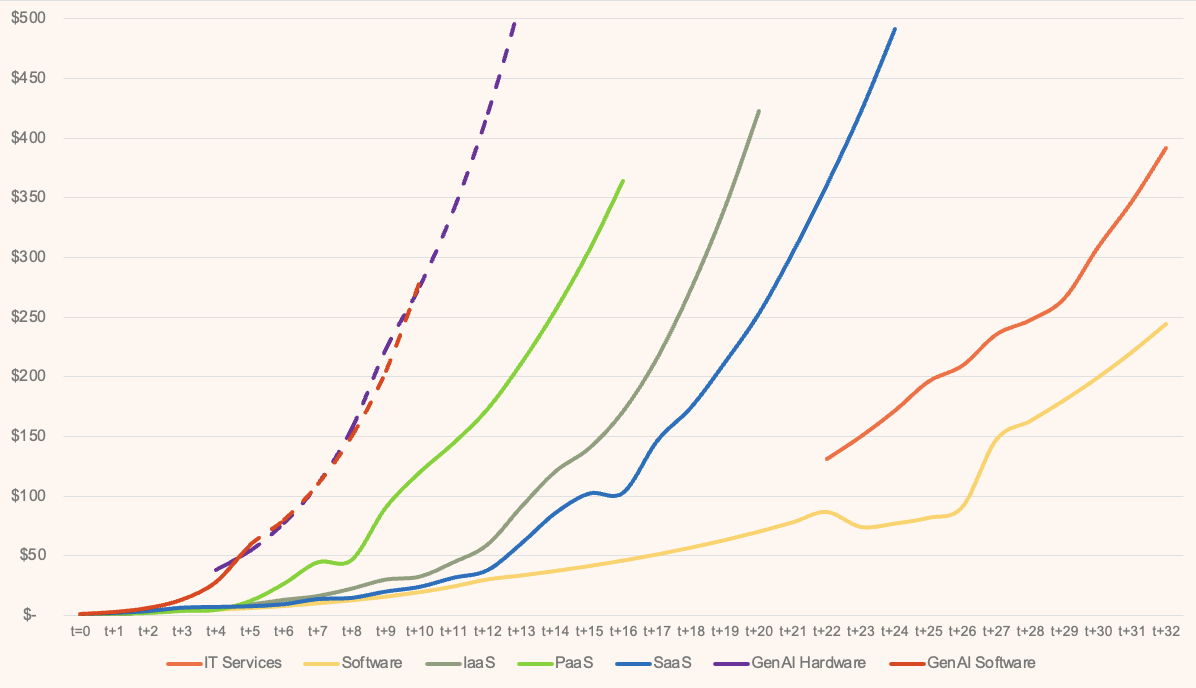

The scale factor acceleration

Each new delivery model has enabled faster scaling:

- IT Services: Took 49 years to reach $1T (1970-2019).

- Software: Reached $200B in 29 years and $1T in approximately 44 years (1980-2024) = 1.1x scaling factor.

- SaaS: Scaled to $200B in 20 years and was forecast to hit $1T milestone in about 31 years (2004-2035) = 1.2-1.3x scaling factor vs. prior delivery method.

- AI Software: Projected to reach $200B in 8-10 years = 2-2.5x scaling factor. ** ***

Technology delivery model revenue ($B)

What are the “shift left” implications of scale factors on startups?

- Faster time-to-market: Feedback cycles accelerate and startups will validate their ideas more quickly. This results in more net new company formations, but also more failures; the fail-fast mentality becomes more prominent.

- Improved capital efficiency: Each new delivery method reduces upfront capital expenditures and shortens product development phases.

- Competitive advantage shifts: Lower barriers to entry. Increased product development requires faster product iteration and responsiveness to user feedback. Product <> Feedback becomes more embedded.

- Expanded market opportunity set: Each delivery method broadens the aperture of what is possible across markets and niches. SaaS startups could rely on cloud services and AI on pre-trained models.

- Value vs. growth equation alters: Land grab opportunity puts a premium on high-growth.

- Company size narrows: The average company size decreases and continues to become more specialized. With every foundational technology transition, the size delta between large and small widens. What if LLMs are hyper-localized and individual to the agent or end user in nature?

- Acceleration of subsequent innovations: Foundational technologies serve as platforms for further innovation and become enablers in their own right. The value chain becomes more integrated and condensed.

We believe, AI is not just another phase in the evolution of technology delivery–it’s a paradigm shift, compressing decades of innovation into years. The challenge for businesses today is not to keep up with this pace but to position themselves as leaders in the era of hypersonic growth.

Would love to hear your thoughts and comments. I’m at adrian@lsvp.com.

* LSVP internal data and Financial Times article, AI start-ups generate money faster than past hyped tech companies.

** Patrick Collison’s post on Stripe research also indicated AI startups are scaling at accelerated rates, growing from zero to $1M in 11 months vs. 15 months for equivalent SaaS companies. The path from $1M to $30M is 5x faster.

*** This analysis includes a limited sample set, focusing on the top 100 highest-grossing privately held AI companies using Stripe’s payments platform as of July 31, 2024, compared with a similar cohort of high-potential SaaS start-ups from July 2018.

Authors