11/20/2024

Enterprise

Lightspeed’s 2024 Sales Benchmark Report: Key Takeaways for Startup Founders and Sales Leaders

In a year marked by economic uncertainty and shifting market dynamics, Lightspeed’s second annual Sales Benchmark Report dives deep into the data to uncover how startups are navigating sales challenges in 2024.

Surveying 154 companies across our portfolio and network, we identified critical trends from rising revenue attainment and the rebound in sales quotas to the challenges of deal slippage and AI adoption. This year’s report provides actionable takeaways for startup founders and sales leaders looking to refine their strategies and stay competitive.

Check out the full report here.

Below is a summary of our key findings.

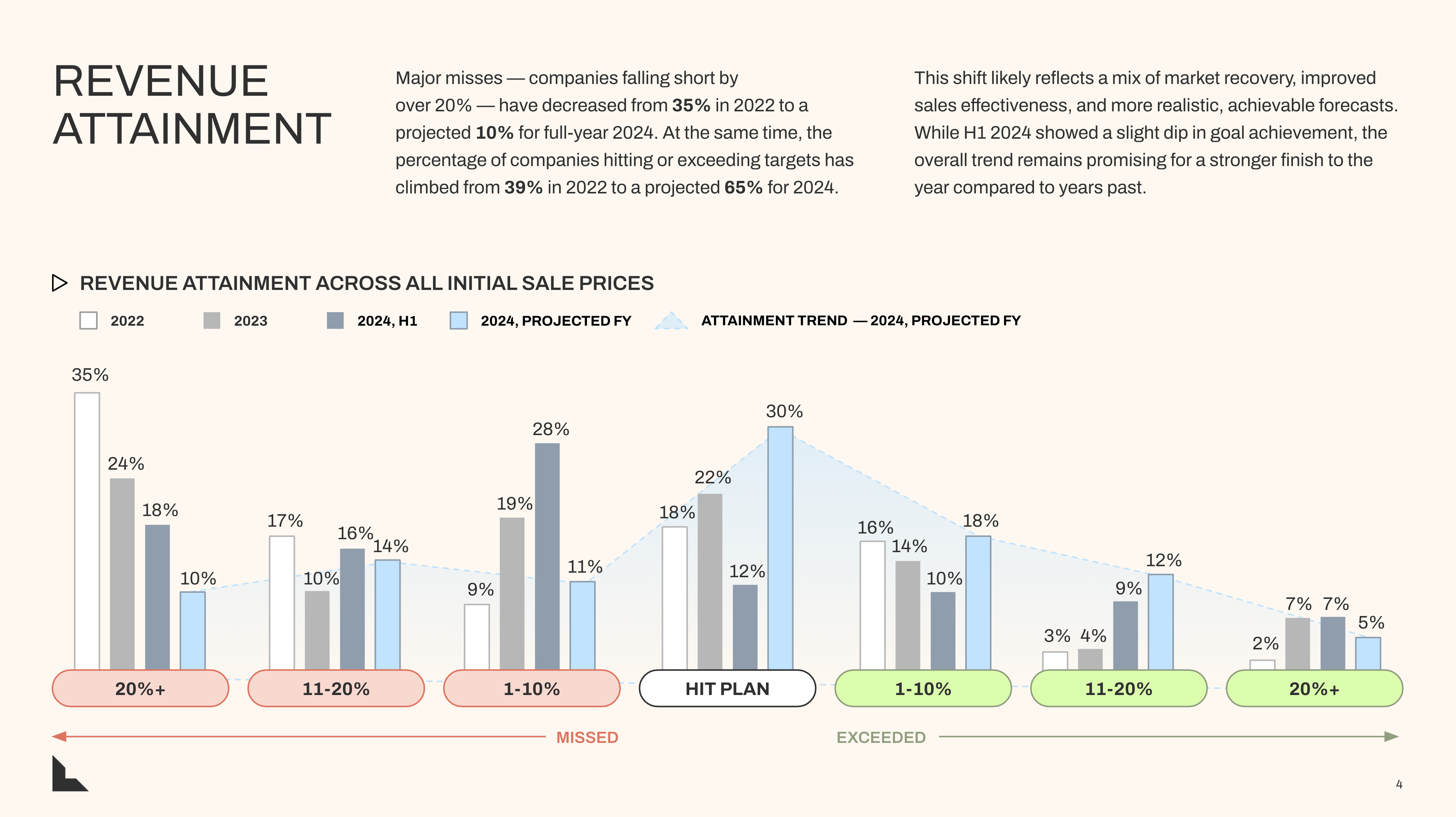

Revenue attainment is on the rise

The percentage of companies missing revenue targets by over 20% is projected to decrease from 35% in 2022 to just 10% in 2024, with 65% expected to meet or exceed their targets this year. This improved performance suggests that companies are getting better at realistic goal-setting and sales execution.

Takeaway: Accurate forecasting and realistic goal-setting are essential for sustainable growth–use these as foundations to drive reliable revenue.

Sales performance is rebounding

While only 33% of sales reps met their quota by mid-2023, this rose to 51% by year-end, and the trend has continued into 2024. This rebound emphasizes the importance of an effective second-half strategy, which can make a significant difference for teams facing early shortfalls.

Takeaway: Struggling in H1? A focused, high-energy push in H2 can turn things around.

Deal slippage persists, particularly for new deals

New deals face the highest risk of delay, with a 41% slippage rate and delays of 2-3 months being common. Only 62% of delayed deals eventually close, indicating the importance of careful management of new deals. Renewals remain more stable, with an 85% close rate.

Takeaway: Prioritize early momentum for new deals, steady follow-through on upsells, and leverage renewal stability to stay on track with revenue goals.

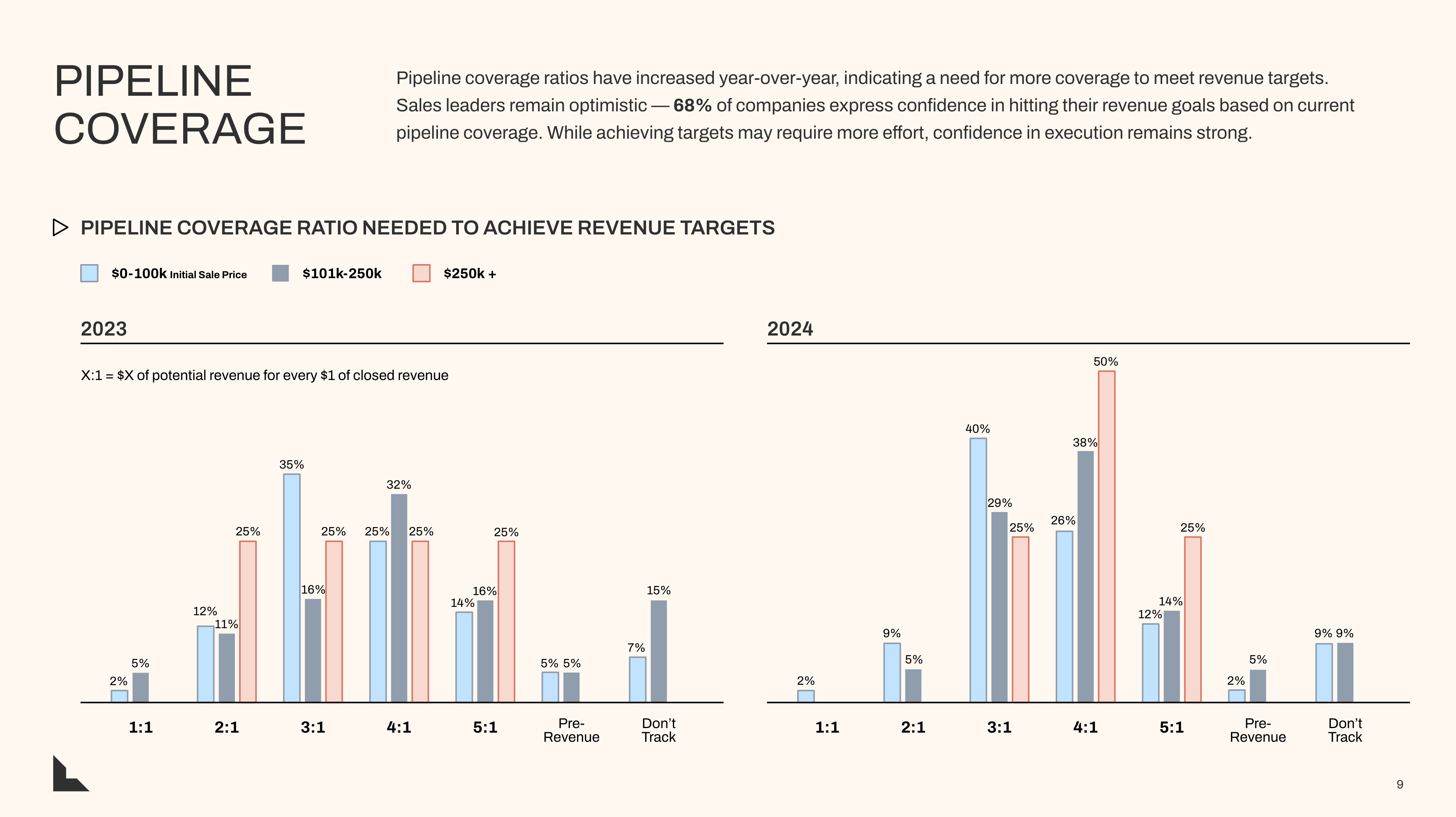

Pipeline to revenue ratios increased year-over-year

Companies are targeting higher pipeline-to-revenue ratios, with 3:1 and 4:1 coverage becoming more common, up year-over-year. Despite higher coverage targets, 68% of sales leaders remain confident in meeting revenue goals, reflecting faith in execution.

Takeaway: Maintaining robust pipeline coverage provides a cushion against deal slippage.

Remote teams are thriving

Remote work is now the dominant model, with 92% of sales teams fully or partially remote. High-performing teams are particularly embracing this model, with 88% of those meeting revenue goals operating remotely, challenging traditional views on productivity.

Takeaway: Remote setups can work well for sales teams, especially if the right support and accountability structures are in place. Embrace flexibility if it aligns with your team’s needs.

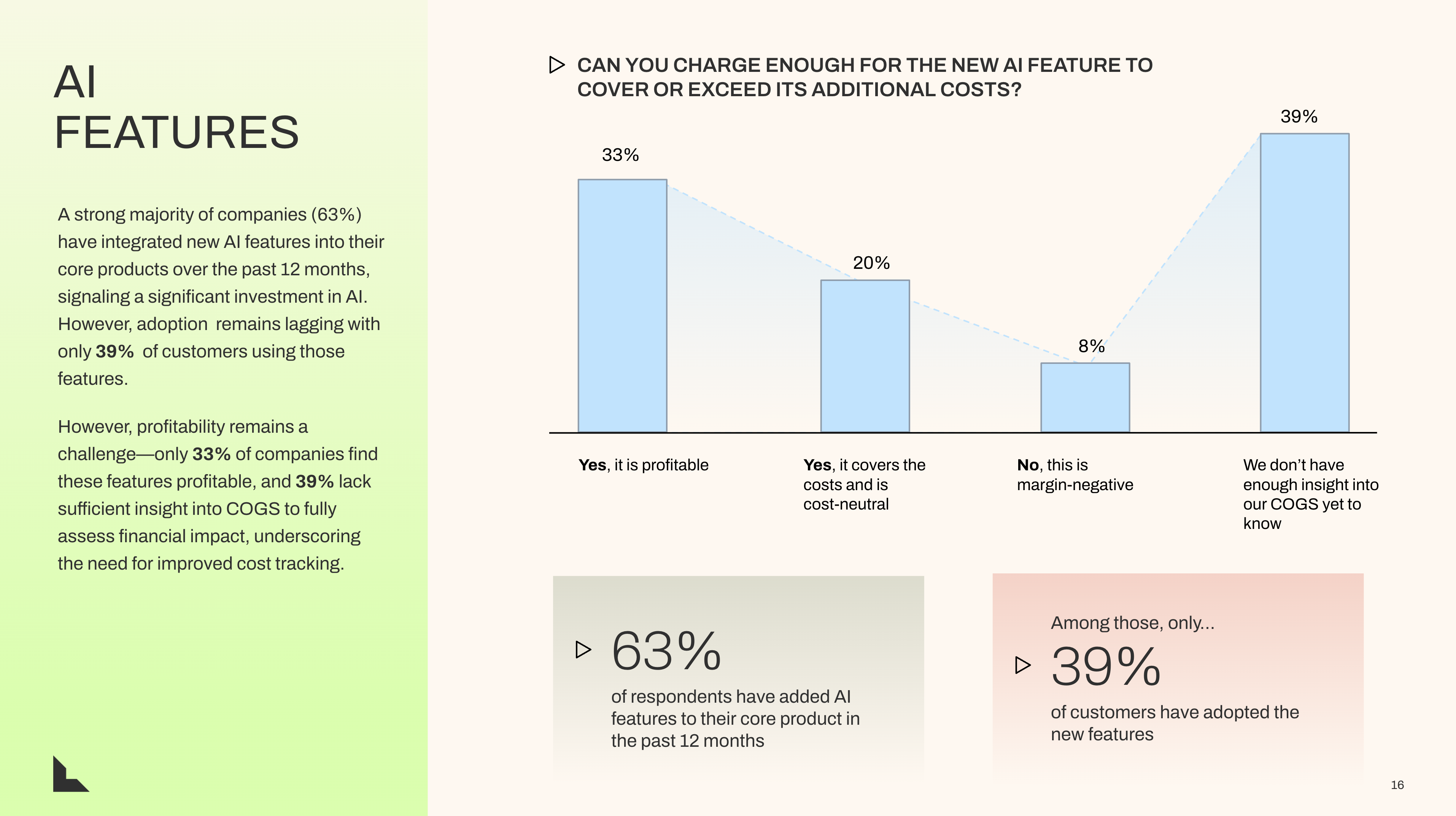

AI is gaining traction, but adoption & profitability remain challenges

A strong majority (63%) of companies added new AI features in 2023, reflecting significant investment. However, only 39% of customers actively use these features, and profitability remains limited, with just 33% of companies reporting AI features as margin-positive.

Takeaway: While AI can drive innovation and revenue, focus on adoption strategies and cost visibility to optimize its financial impact.

As you plan for the year ahead, we hope these benchmarks serve as a guide for setting realistic targets, optimizing sales processes, and navigating challenges unique to early-stage companies. Whether focusing on effective H2 strategies, setting ambitious yet achievable quotas, or leveraging AI and remote teams, these insights highlight where adjustments can drive real impact in this evolving sales landscape.

Here’s to a great year of growth in 2025!

Authors